[ASX:CXO] has officially opened its Finniss lithium mine, the first lithium mine in production in the Northern Territory.

CXO also announced it awarded Primero a five-year operations and maintenance contract.

Primero is a wholly-owned subsidiary of fellow ASX-lister NRW Holdings [ASX:NWH].

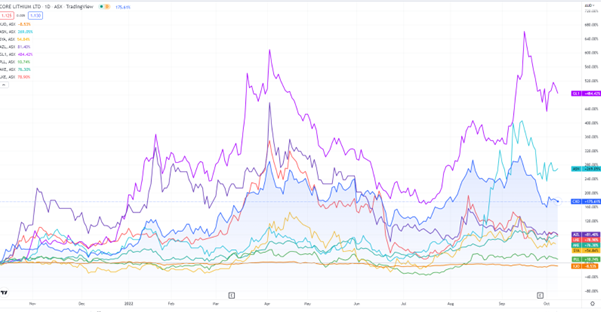

CXO shares were flat on the news, but are up 80% year-to-date:

www.TradingView.com

New contracts for Finniss’ DMS plant

Core Lithium’s new contract awarded to Primero comes in the shape of a five-year Operations and Maintenance (O&M) contract with an estimated value of $60 million.

The contract enables the companies to begin execution of Finniss project activities immediately.

Core also stated that the contract was devised in such a way as to cover the company’s Tailing Storage Facilities (TSF) for infrastructure at the Finniss site, as well as the DMS processing facilities.

Now commissioning of the DMS plant can begin, with a forecasted lithium concentrate first production date to commence in H1 2023.

Primero has personnel ready to get to work this month, with recruitment and operational activities to officially begin in December.

The companies are looking forward to reaching first production of the lithium spodumene concentrate in the new year.

Core CEO Gareth Manderson said:

‘The O & M contract award to Primero extends the relationship Core has with Primero from beyond the Engineering, Procurement & Construction (EPC) contract. Significantly Primero are not only building the projects DMS facility, they now back their workmanship through the O & M.’

CXO officially opens Finniss lithium mine

Today, CXO officially opened its Finniss lithium mine.

CXO said Finniss is set to become the first Australian lithium mine in production outside Western Australia.

Core will employ about 300 staff directly and indirectly. More than 80% of its contractors and direct employees live in Darwin and work at Finniss.

Manderson continued:

‘Core is bringing production online at a time of high lithium prices, strong global demand and constrained supply. The Core team has done a fantastic job quickly transitioning from discovery and exploration to construction and shortly supply of high-grade lithium concentrate to a global market in just six years.

‘The first four years of production from the Finniss Lithium project is already secured with approximately 80% sold to offtake partners, including Ganfeng Lithium and Sichuan Yahua who have provided tremendous support during our development phase.’

Last Monday, Core also made its first spodumene direct shipping ore tender on a digital exchange auctioning platform.

It sold 15,000 dmt (dry metric tonnes) of the lithium spodumene product for US$951/dmt, a result which had Manderson claiming was an indication of ‘strong demand for lithium’.

The lithium developer is set for nearer-term realisation of its lithium development goals, securing buyers, and working painstakingly with partners to fast-track its development and profitable targets.

To this end, Core has been raising further funds, hoping to fast-track its efforts through the recent completion of a $100 million placement.

Overlooked ASX lithium stocks

Junior lithium stocks have enjoyed a strong run in recent years…but as 2023 approaches, it’s worth asking whether the easy money has now been made in the sector.

Have the easy gains been exhausted? And, if so, where should investors turn?

Are there any lithium stocks the market is overlooking?

Yes, according to Money Morning’s recent research report on the local lithium sector.

In fact, the research report profiles three neglected ASX lithium stocks. Read further here.

Regards,

Kiryll Prakapenka

For Money Morning