There’s one surefire signal that tells you when markets are peaking.

It’s simply this…

Merger and Acquisition (M&A) activity ramps up big time!

Everyone wants to ‘make a deal’, splash the cash around, and show who the big dog in town is.

Of course, the predictable hangover to this game of one-upmanship comes later.

But in the frenzy, it’s hard to resist the allure of the deal.

Today’s piece will show you the warning signs to look out for. But also the opportunities in play well before we reach this inevitable end game.

Specifically, I will show you why the copper market is ripe for the picking right now.

First, let me take you back to 2011…

2011 was the year that marked the finale of history’s most euphoric commodity boom.

As a field geologist back then, I saw first-hand how this process played out in the resources sector.

The M&A hubris was in overdrive, and I was in the thick of it working for a company called Equinox Minerals.

This Australian-owned producer held copper assets in Zambia and Saudi Arabia.

My job as a project exploration geologist was to help the company find new copper targets in Africa.

But by February 2011, Equinox was also swept up in takeover fever. It jumped on the M&A bandwagon with a $4.8 billion bid for Lundin Mining.

It looked like a done deal until, out of nowhere…the predator became the prey!

The Chinese-owned MMG flipped the dial on Equinox’s growth ambitions, making a multi-billion dollar offer to the company.

The story didn’t end there…

A year of M&A mania!

With the Equinox board fishing the market for a higher bid, it cast a line for some willing contenders.

And it didn’t take long in the manic 2011 market.

Equinox quickly struck a deal with the world’s largest gold miner… Barrick.

Another company caught up in copper fever!

Barrick agreed to a US$7.2 billion offer for Equinox without much wrangling. This was just one of dozens of mega deals taking place at the time.

Media strained to keep up with the volume of deals.

Never before had the mining industry been struck with so many offers, counteroffers, and squillions of dollars spent on overpriced acquisitions.

As a geologist on the ground, it was an exciting time, if not a little unnerving.

You see, there could only be one outcome to this breathtaking corporate FOMO.

The bigger the boom, the deeper the subsequent bust must be!

And that’s exactly what happened…

A race to the bottom

Predictably enough, the hangover arrived later that year.

And the resources market fell into a deep, prolonged bear market.

In hindsight, feverish M&A activity was a clear sign of what would come…even if many industry veterans missed it at the time.

Symbolically, Barrick’s takeover took place just a few weeks after copper reached its all-time high of around US$4.48/lb in February 2011.

M&A hubris beware!

Two years later, Barrick announced a humiliating US$4.2 billion write-down on the Equinox deal.

At the shareholder meeting, Barrick’s CEO admitted that he’d grossly overpaid in the race to nab a prized copper asset.

A few months later, he was fired.

It just goes to show you that mining executives are just as prone to overpaying as the everyday investor.

And Barrick was far from alone in this race to the bottom…

In 2013, the CEO of mining giant Rio Tinto, Tom Albanese, was fired after the company wrote off more than $14 billion following several poorly timed acquisitions.

BHP, Rio Tinto, Glencore, Barrick, and many others participated in the M&A folly, which marked the peak of the last mining boom.

Undoubtedly, the next generation of mining executives is destined to repeat the same mistakes—as are the legions of investors.

Lessons from 2011

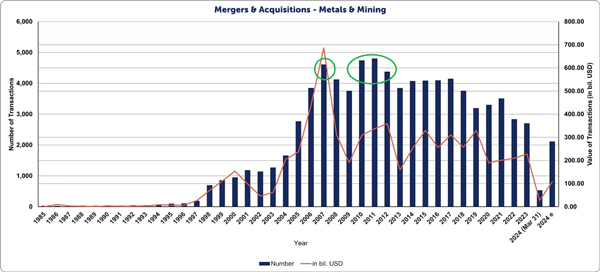

As you can see, 2007 and 2010/2011 marked a peak in the number of mining M&A deals since the mid-1980s:

| |

| Source: Mergers, Acquisitions & Alliances |

Note that blue bars represent the number of deals and the brown line measures the overall dollar value.

The first spike in 2007 pinpointed a top in commodity markets and preceded the 2008 subprime crisis.

Commodity prices fell sharply… M&A activity cooled.

But that was only temporary.

As you can see, a second green circle shows the next peak in M&A activity over 2010-11.

This was the final culmination that led to feverish deals like the Equinox offer.

But how does that relate to today’s market?

2024… More like 2004 (than 2011)

The number and overall value of M&A deals have fallen sharply since 2011.

In fact, 2023 recorded the lowest volume of M&A deals in almost 20 years.

That’s good news for mining investors.

Given the docile activity, it suggests we’re still a long way from any peak in the M&A cycle.

It’s almost the polar opposite of the 2011 frenzy.

And that’s despite BHP’s high-profile $75 billion bid on Anglo-American earlier this year.

Yet, deals like this do suggest M&A action is finally stirring back to life.

That tends to align with the long-term price action for copper, as you can see from this 5-year chart below:

| |

| Source: TradingView |

Despite a decent correction driven by weak Chinese growth, the long-term uptrend remains in place.

But here’s the question…

Why is the price of copper futures – the price of copper for delivery at some point in the future – rising while Chinese growth is slowing?

After all, China is the most important driver for global copper demand.

China stimulus?

Perhaps…

Given that China’s long-term 5% growth target is under threat, meaningful stimulus is perhaps more likely now than ever.

What I do know with more certainty is that copper supply is tighter than it’s been in years.

This leads us to the opportunity in front of you today…

Strategic opening to add copper exposure

If you’re a long-term reader, you probably know I spend a lot of time covering the copper market.

For good reason.

This commodity is a broad bellwether for resources and financial markets, hence the nickname Dr. Copper.

And despite recent falls, I believe the long-term set-up remains firmly in place.

Copper flirted with all-time new highs earlier this year despite M&A activity remaining at multi-decade lows.

To me, that signals a market with plenty of room for growth.

On the technical front, copper has maintained its long-term trend despite poor economic data flowing from China.

The copper market is perfectly positioned for strong upward momentum on the first sign of strength.

Where could that come from? We touched on the stimulus potential, the most obvious driver of price strength.

But supply remains the most critical aspect…

This is the primary tailwind that could drive copper prices higher in the future.

As a former exploration geologist working on Australian and overseas copper projects, this is where I can offer you a unique perspective.

I’ll have more to say about that next week.

But if you want a head start, you can do so here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments