It was the Commonwealth Bank of Australia’s [ASX:CBA] turn to release its FY22 results today, a day after NAB announced theirs.

Cash profit rose 11%, however, net interest margin fell 18 basis points to 1.90%.

CBA shares were flat on the results and are trading flat year-to-date:

www.TradingView.com

www.TradingView.com

CBA’s FY22 stats

While the bank did highlight growth in NPAT cash, rising by 11% this year — a total of $9.6 billion — the group’s net interest margin fell 18 basis points due to ‘low yielding liquid assets’ and reduced home loan margins.

Here are CBA’s key FY22 results:

- Statutory NPAT increased 9% to $9.7 billion.

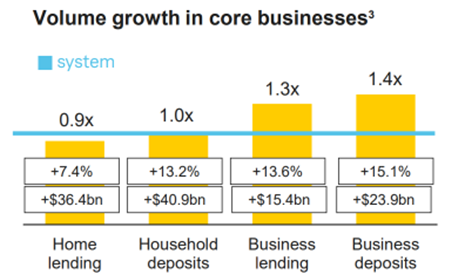

- Operating income rose 1% which CBA said was due to volume-related revenue growth in core products and included a slight offset in net interest margin.

- Net interest margin was down 18 basis points to 1.90%.

- Operating expenses declined 1.5% to $11.2 billion which CBA says was driven by ‘lower remediation costs and productivity benefits’.

- Full-year dividend of $3.85 per share fully franked, up 10% on FY21, reflecting the bank’s ‘continued capital and balance sheet strength’.

The bank attributed its 11% cash NPAT growth to core business volume, high operational performance, and loan impairment benefits.

CBA’s Common Equity Tier 1 reached a capital ratio of 11.5%, exceeding regulatory requirements.

Source: CBA

Source: CBA

CBA slashes value of Klarna stake by over $2 billion

As part of its FY22 results, CBA disclosed it had revalued its Klarna stake down from FY21’s $2.7 billion to $408 million as of 30 June 2021.

CBA first invested in Klarna — a global buy now, pay later (BNPL) firm — in 2019.

CBA said the impairment was due to Klarna’s recent private capital raise in July (in which CBA participated by investing a further $47 million), which had the implied revenue multiple of 4x.

The $2.7 billion valuation as at 30 June 2021 was based on another private capital raise (CBA didn’t participate).

That time, however, the implied revenue multiple adopted by CBA was 32x.

CBA explained the steep valuation reduction:

‘The $2,293m reduction in valuation from 30 June 2021 to 30 June 2022 was driven by changes in the valuation implied from each private equity capital raise, as well as the reduction in revenue multiples of market listed comparable companies.’

What’s the outlook for CBA and other big banks?

CBA acknowledged the tough conditions 2022 brought for Australians adjusting to COVID-19, with the added implications of natural disasters and the wave of inflation-centred interest rate rises.

CBA’s CEO Matt Comyn said:

‘Inflation is high, and we have seen a rapid increase in the cash rate which is negatively impacting consumer confidence. We expect consumer demand to moderate as cost-of-living pressures increase. It is a challenging time, but we remain optimistic that a path can be found to navigate through these economic conditions.’

Mr Comyn believes Australian households and businesses remain in a ‘strong position’ economically, due to low unemployment and solid investments outside the mining sector.

Are you prepared for the EV revolution?

Economies the world over are getting ready to decarbonise.

And EVs are a big part of the agenda.

Lithium commanded most of the attention last year, taking eight of the top-10 spots in the ASX.

But the mass adoption of EVs is also set to boost demand in lithium’s siblings: copper, nickel, cobalt, and graphite.

In fact, the lithium rush has got our team at Money Morning thinking…is there a much smarter way to play the EV boom?

According to our team, yes, there is. And it involves what you might call lithium’s ‘little brother’.

Regards,

Kiryll Prakapenka