Andromeda Metals Ltd (ASX:ADN) share price was up 16%. The Andromeda Metals Ltd [ASX:ADN] secures binding offtake agreement with large Chinese commodity trading house for 70,000tpa of kaolin…

All the Latest Iron Ore News and Developments

Australia is the largest iron ore producer in the world. Iron ore is Australia’s biggest export earner. In 2014 it contributed around $75 billion in export revenues, providing a major source of income for the country.

Should You Invest in Iron Ore Stocks? BHP, Rio and FMG

At time of writing, the share price of the big three iron ore miners are all up, with BHP Group [ASX:BHP], Rio Tinto [ASX:RIO] and Fortescue Metals Group [ASX:FMG] all tacking on 2–3% today.

Iron Ore and Property Crash? Not So Fast

A couple years back I got deep into the reeds on iron ore — I started looking at weather patterns in the Hubei province (the largest steel-producing province in China),

Iron Ore and Gold: Where The Action’s at?

Iron ore could certainly stay higher for longer. If demand holds up, there’s not going to be a rush of supply anytime soon. This makes for a compelling case to hold iron ore stocks…

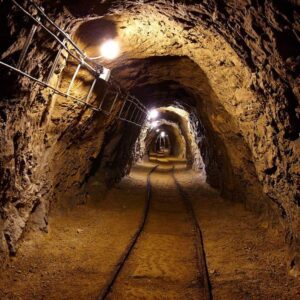

Why Australia May Be on the Cusp of a New Mining Boom

We’ve seen this script play out before…a commodity boom for the West…why the commodity price boom is here to stay, and what it means for Australia…the race to net zero…and more…

Iron Ore Boom Feeds Housing Boom — Mining Boom in Western Australia

The mining boom in Western Australia is becoming so prodigious that rents and house prices will respond as the high wages and company profits shower down on the place…