In today’s Money Morning…we’ve seen this script play out before…a commodity boom for the West…why the commodity price boom is here to stay, and what it means for Australia…the race to net zero…and more…

Today I want to talk to you about commodities.

In particular, the frankly incredible prices and demand we’re seeing for some key minerals. With iron ore and copper the two most front and centre of mind.

Because if we connect some of the dots, I believe we may be about to see a new mining boom…

I know, I know, that might seem like a redundant claim given the state of the aforementioned minerals.

Iron ore recently peaked at a new all-time high of US$233.1 in Australia. Likely one of the main reasons our economy isn’t completely in the toilet right now.

While copper has done much the same, peaking at US$10,747.5 per tonne just a few weeks ago. With ongoing concerns about South American suppliers continuing to prop up prices.

So, with that in mind, it may seem like any sort of mining boom is already at its zenith.

Especially now that China has come out this week to issue a ‘zero tolerance’ crackdown on commodity speculators. An indication that perhaps the world’s preeminent source of commodity demand is about to put an end to the party.

After all, we’ve seen this script play out before.

But what if I told you there may be a major twist to the tale this time around…

A commodity boom for the West

See, at this point in history, commodities have become so China-centric that most of us take it for granted.

Everyone just expects the Middle Kingdom to be the one to soak up most of the world’s mineral output. Using it to fuel their massive manufacturing sector and churn out the goods that the rest of the world then pays for.

It’s been this way for decades now — starting around the 1980s and peaking in the 2010s.

A defining part of the modern global economy. Something that many of us have grown accustomed to, and never really paid much heed toward.

But, like any macroeconomic trend, it can’t go on forever.

At some point change is practically inevitable. After all, we’ve seen it happen time and again. With the last century perfectly encapsulating these massive economic shifts.

There was, of course, the early dominance of Europe at the outset of the industrial revolution. Followed by the post-war rise of the US. And then most recently, the dawn of modern China.

And while the rise and fall of these eras was certainly defined by much more than just commodity demand and manufacturing, it is still one of the most integral aspects of it. Which is why, today, China demands so much attention from a macroeconomic perspective.

But it looks as though that may be changing…

As Goldman’s head of commodities, Jeffrey Currie, has recently concluded:

‘[The] bullish commodity thesis is neither about Chinese speculators nor Chinese demand growth.’

Arguing that China is no longer the primary driver of commodity demand or supply. Having lost their dominance in the wake of the trade war and pandemic. Key drivers that have reversed the globalisation paradigm and forced a rethink on local manufacturing.

Which is why demand for crucial minerals like copper are surging. Because nations that once relied on Chinese goods are now being forced to manufacture it themselves. Increasing the demand for the raw materials.

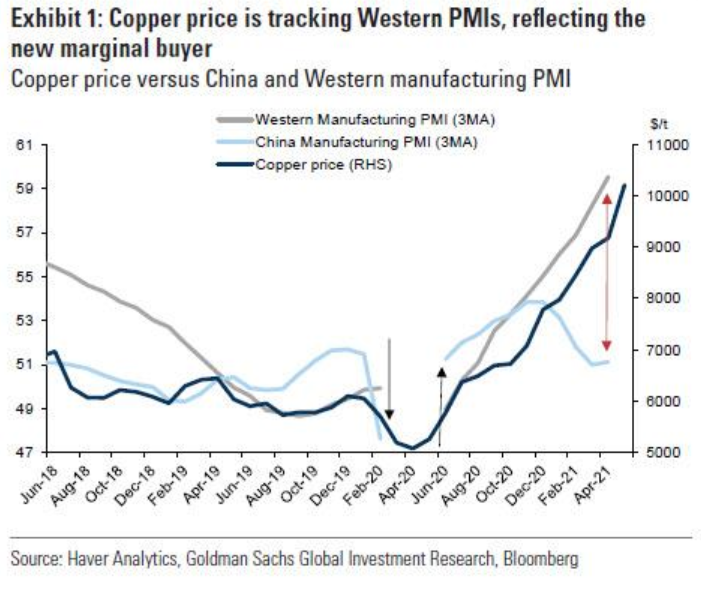

Just look at this comparison of the copper price and manufacturing purchasing managers’ indices (PMI):

|

|

| Source: Zero Hedge |

There is clear correlation between Western demand and the price of copper. Which makes perfect sense as copper is an instrumental material for a plethora of rapidly growing industries. Semiconductors, electric cars, and renewable energy are just some that immediately come to mind.

And it is for these reasons that Currie concludes that Chinese buyers are being priced out.

Why the commodity price boom is here to stay, and what it means for Australia

Yes, despite their years of dominance, Chinese commodity buyers may be in for a shock. With the simple laws of supply and demand turning against them.

As Currie states:

‘The Chinese consumer is crowded out. Today, a similar event is happening, but in reverse. 1) China is losing its derived demand as supply chains — exposed as fragile after two years of trade wars and a global pandemic — begin to turn local; 2) China is now focused on reducing environmental costs of production; and 3) not only are Chinese labor costs rising towards the West, labor’s share of costs is declining sharply with a global surge in automation.’

Factors which are all part of a much broader macroeconomic shift. Especially when it comes to his final point on automation.

Because as we’ve seen over the past 14 months, the dynamics of the labour market have changed. With seemingly distant notions of widespread remote working now common practice. Paving the way for a greater need for automation.

But that’s another trend for another day.

Because right now the focus is purely on these commodities. A trend that, like I said, may appear to already be at its cyclical peak.

But if Currie’s outlook is correct, and the long-term drivers of commodity demand come from the West and not China, then this trend may only just be getting started. A sign that could signal a much deeper and longer mining boom for Australia.

A theme that any investor can’t afford to ignore.

As for when or even if it will play out, though, only time will tell.

So, no matter what outlook you may have, keep an eye on the mining sector. The boom may only just be getting started.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Profit from the Imminent Commodity Boom — Discover why copper and nickel stocks are primed for a resurgence in 2021 and how best to capitalise. Click here to learn more.