The Andromeda Metals Ltd [ASX:ADN] secures binding offtake agreement with large Chinese commodity trading house for 70,000tpa of kaolin.

Having flagged the news in yesterday’s trading halt request, Andromeda Metals resumed trading on the ASX today by shooting up as high as 20.9% in early trade.

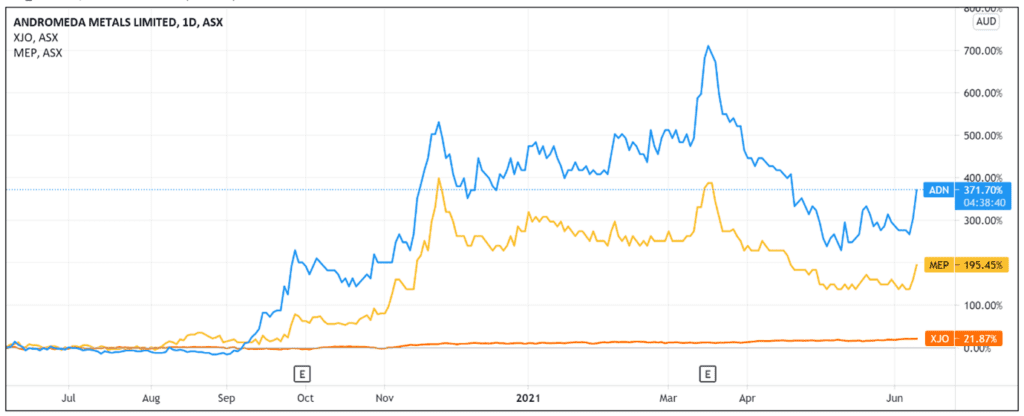

At the time of writing, Andromeda Metals Ltd [ASX:ADN] share price was up 16%, exchanging hands for 25 cents a share.

Today’s spike somewhat offset the explorer’s year-to-date losses, with the Andromeda share price down 9% in the period.

However, Andromeda is still up a significant 300% over the last 12 months.

‘Substantial’ binding offtake agreement

Andromeda signed a ‘substantial’ legally-binding offtake agreement with Jiangsu Mineral Sources International Trading Co (MSI), a leading Chinese commodity trading house, for the coatings and polymers market.

Trading houses are intermediaries used by local manufacturers to secure products from foreign locations, smoothing the process for manufacturers who want foreign products but don’t want to deal with import costs.

The agreement between ADN and MSI is for 70,000tpa (+/- 10%) of ultra-bright, high-purity kaolin product for an initial term of five years at a fixed price for the first three.

There is an option to extend the contract upon mutual agreement, with a revised price to be struck prior to the commencement of the fourth contract year.

The fixed price is ‘significantly higher’ than the $700 a tonne for ceramic grade material used in the pre-feasibility study.

Interestingly, the fixed contract price was not disclosed at MSI’s request, considered to be ‘commercially sensitive information’.

Likely, MSI doesn’t want local clients figuring out the upsell margin at which it resells the kaolin for.

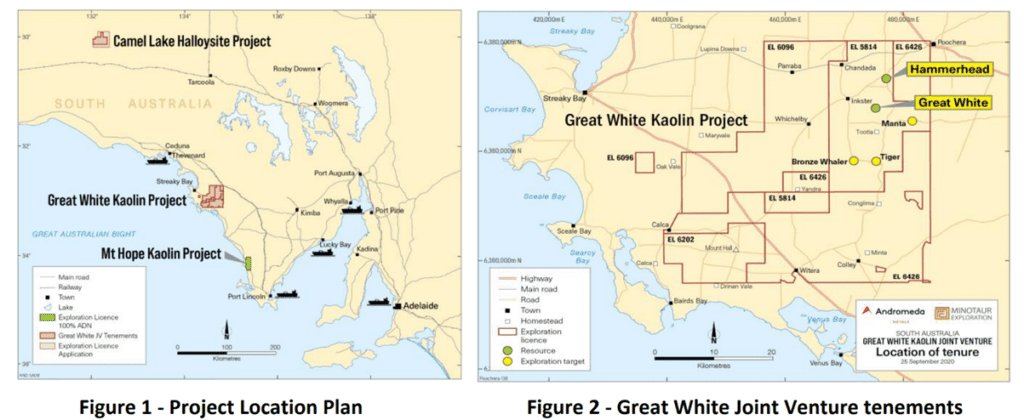

Andromeda manages the South Australian Great White Kaolin Project as a joint venture with Minotaur Exploration Ltd [ASX:MEP], in which Andromeda holds a 75% equity interest.

MEP shares were up 15% at the time of writing.

As our earlier profile of Andromeda discussed, halloysite is a rare derivative of kaolin where the mineral occurs as nanotubes.

Currently, halloysite-kaolin’s main applications are in ceramics, where it’s used to manufacture high-quality porcelain.

Andromeda also noted that halloysite-kaolin is an attractive feed material for producing high-purity alumina (HPA). HPA is, in turn, a key ingredient for lithium-ion batteries.

ADN Share Price ASX outlook

Back-of-the-napkin calculations imply a minimum windfall of $49 million per year for the first three years at a price floor of $700 a tonne.

According to ADN’s June 2020 PFS, Andromeda’s total life of mine revenues are expected to reach $4,136 million at $700 a tonne.

The Great White Kaolin Project has a mine life of 26 years. That averages out to about $159 million a year in revenues.

So this new offtake with MSI will certainly contribute a large chunk to projected revenue.

Indeed, Andromeda reported the agreement represents a ‘substantial proportion’ of the planned 116,000tpa of refined halloysite-kaolin product to be manufactured from the initial 250,00tpa feed rate capacity.

The offtake agreement has a non-binding clause whereby MSI and ADN intend to increase transacted volumes of refined kaolin from 70,000tpa to an aspirational quantum of 150,000tpa two years after first production.

Andromeda’s gains over the last year reflect the recent commodities resurgence, with ASX iron ore and lithium stocks leading the way.

But commodities like halloysite-kaolin are also starting to receive more attention.

And since halloysite-kaolin is part of the supply chain for HPA — a key ingredient in lithium-ion batteries — it may yet play a bigger role in the coming renewables revolution.

That’s why I recommend reading our free report on the future of renewables, where energy expert Selva Freigedo discusses three ways you can capitalise on the $95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report