At time of writing, the share price of the big three iron ore miners are all up, with BHP Group Ltd [ASX:BHP], Rio Tinto Ltd [ASX:RIO] and Fortescue Metals Group Ltd [ASX:FMG] all tacking on 2–3% today.

The chart below makes for interesting reading with the FMG share price (blue line) giving way to the Rio Tinto share price (orange line) in the race up the charts in the last 12 months:

So today, we ask, should you invest in the iron ore miners? What’s the outlook for BHP, Rio and FMG?

We breakdown recent movements in the iron ore price.

Iron ore defies expectations again — why is iron ore up?

The answer lies in firm Chinese demand, despite their best efforts.

As per coverage in the Australian Financial Review:

‘Benchmark iron ore surged back above the $US200 a tonne mark, based on pricing by Fastmarkets MB and S&P Global Platts, challenging bets by some market strategists that the steel making material is poised to drop sharply.

‘Fastmarkets said iron ore rose $US9.84 or 4.9 per cent to $US208.67 a tonne on Tuesday; extending Monday’s 4.3 per cent rise.

‘S&P Global Platts said its key index rose $US10.35 or 5.2 to $US209.10 a tonne.

‘“As long as demand globally remains strong (including China) and markets are tight, we think it is unlikely China’s authorities will be able to push prices down on a sustained basis,” Bank of America said in a note.

‘Bank of America forecasts iron ore will average $US172.2 a tonne this year; then $US143.8 a tonne in 2022; it sees a slow grind lower through 2025 when it will end below the $US100 mark.’

US$172.2 a tonne on average this year should provide the big three iron ore miners plenty of ‘cream’, or margin on their operations.

I’d even venture out on a limb and say the major three iron ore miners are due for an earnings beat.

You can see analyst forecasts of their earnings below via Market Screener:

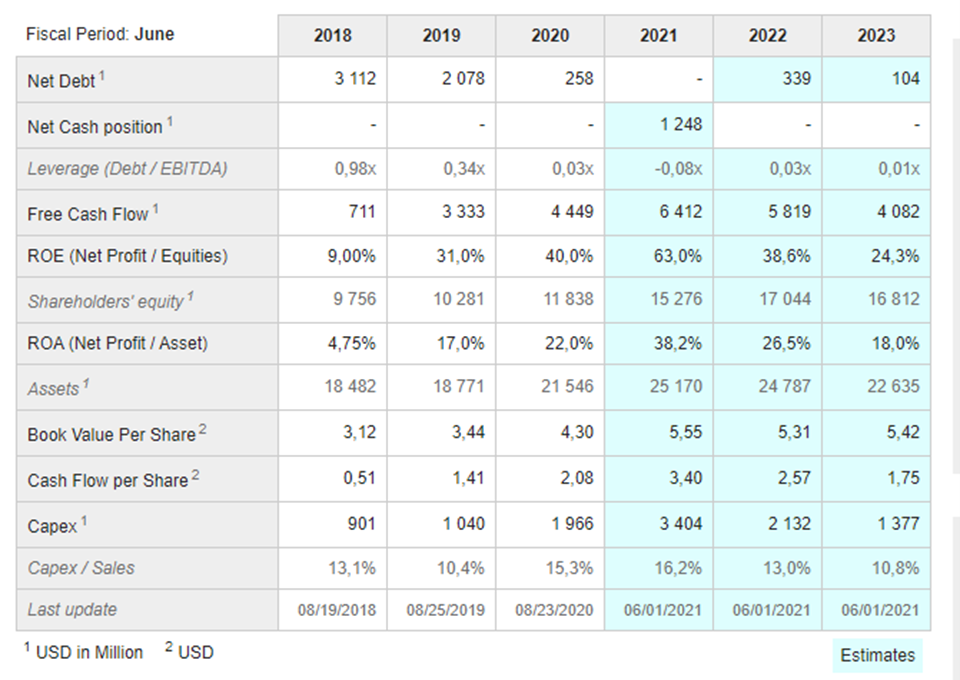

FMG forecasted financials

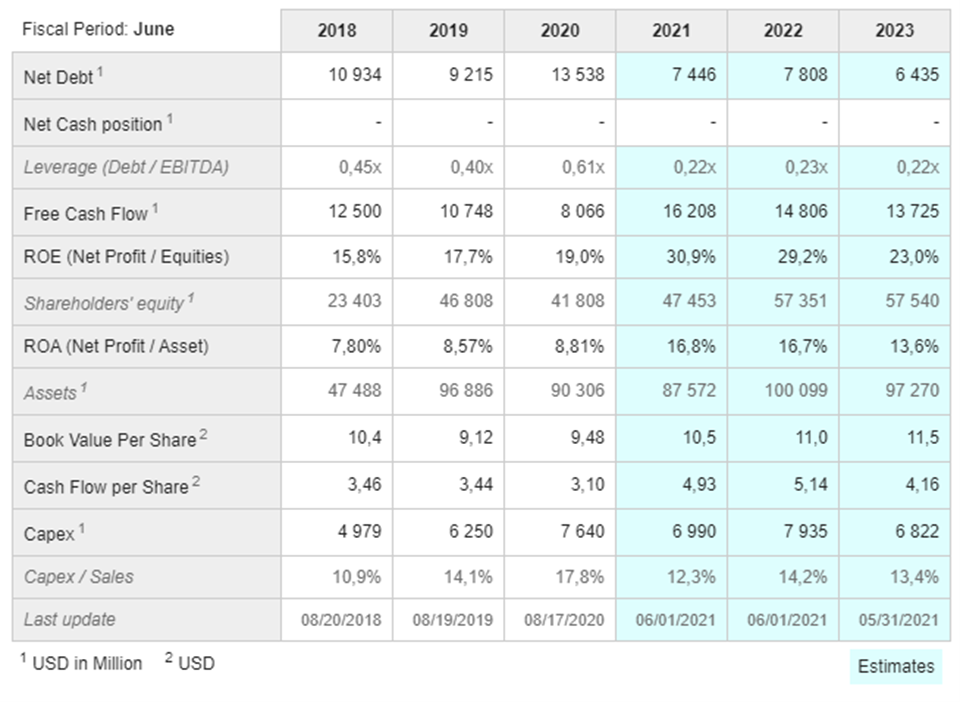

BHP forecasted financials

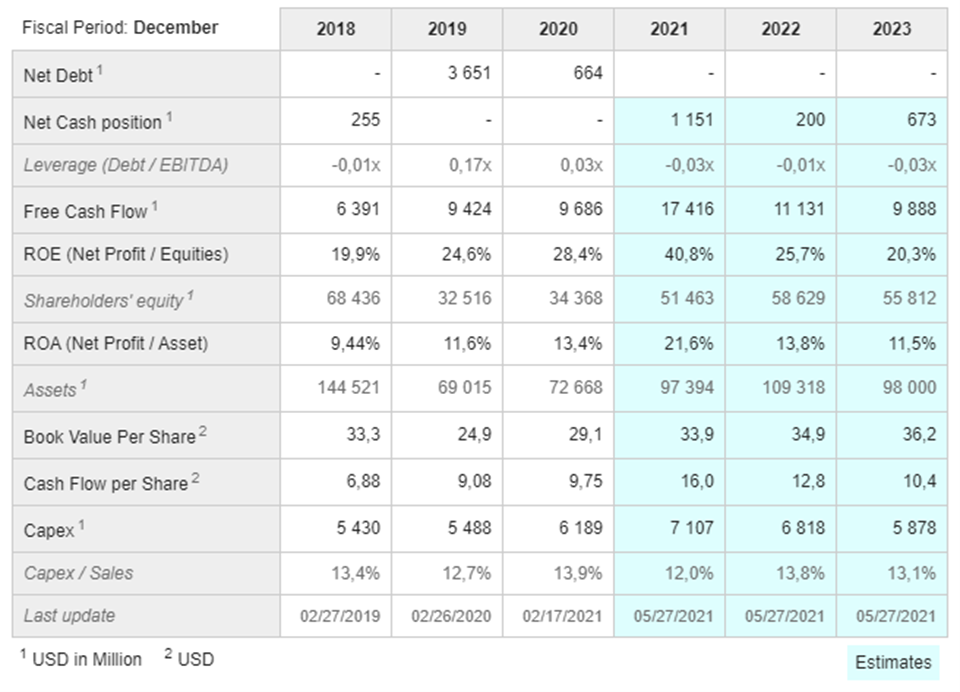

Rio forecasted financials

According to these numbers, FMG is clearly the cash cow with a mind-boggling return on equity (ROE) of 53% for 2021. Rio is no slouch either, given its size; 40.8% is massive.

The analysts are forecasting a sharp drop off of ROE for all three in 2022 and 2023.

I’m not surprised; the iron ore death knell gets sounded frequently.

Talk about broken clocks.

I’ve recently changed my tune on iron ore after being wrong so frequently.

This brings me to a critical question.

Should you invest in iron ore stocks?

I’m not saying yes or no; instead, I’d encourage you to ask yourself a few questions.

These are:

- Can China pivot quickly to Brazilian supply?

- Brazil is the second-largest exporter of iron ore, but can they dig into the Aussie market share?

- What about India’s steel-making industry? If that comes back online, does it even matter if Brazil gets back to exporting in a big way?

- Think of the infrastructure spending? Is that going to suddenly disappear?

- Will central banks aggressively taper monetary stimulus? Heck, will governments roll back fiscal stimulus and pull the carpet out?

- What about smaller iron ore players, including producers and near-term producers?

- Will the market wake up to them in time?

- Commodities like iron ore used as a hedge?

On that last point, that could be where the real ‘cream’ is for investors and traders.

Think of the questions above as an investing in iron ore checklist.

It’s by no means definitive, but answering those questions will bring you a lot closer to making a definitive decision.

Be sure to check out the chat with Callum Newman too.

Regards,

Lachlann Tierney

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here