Thirty years ago, China launched one of the most ambitious development projects in the world: the Three Gorges Dam on the Yangtze River.

Construction officially began in 1994.

Remarkably, just 12 years later, this giant infrastructure project was finished.

It stunned the world.

And it’s why the Three Gorges Dam project epitomises the early 2000s China growth story.

Sure, the development of apartment buildings, bridges, highways, shipyards, and railways made headlines, but the Three Gorges Dam symbolised China’s emergence.

And now, twenty years on, China is putting a new flag in the ground:

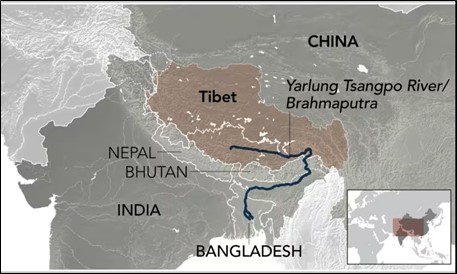

On the eastern rim of the Tibetan plateau, China is looking to harness the roaring waters of the Yarlung Tsangpo.

This river will be the site of a new mega dam — the world’s largest. A project that is set to eclipse Three Gorges.

How big is it?

The dam will be situated in the lower reaches of the Yarlung Tsangpo, along a section that drops 2000 metres over 50km, creating immense hydropower potential.

As you can see below, it will be built in the region of Tibet, close to the border with India:

| |

| Source: Nikkei Asia |

Once completed, this project will surpass the Three Gorges Dam as the world’s largest hydropower operation.

The region’s Premier Li Qiang described it as the “project of the century.”

In fact, this single dam will generate more power than Britain’s entire annual output!

The cost is estimated at around US$167 billion, about five times the Three Gorges Dam price tag.

But few have given much weight to this potentially enormous curveball China has thrown here…

The West firmly believes that China’s two-decade infrastructure build-out is gradually unwinding and that economic stagnation is inevitable.

That narrative has proven difficult to reverse.

Not that China cares! The country is pushing ahead despite all the Western doomsday economic predictions over the last ten years.

And with that, I believe it has firmly established ‘Phase II’ of its national infrastructure build-out.

So, let’s put this into context…

Iron ore miners, the great victors of the Phase I growth cycle, received a modest boost from last month’s announcement.

But so far, the news has fallen flat in the commodity arena.

There’s no acknowledgment of the potential importance and how closely it mirrors events from twenty years ago.

You see, the Phase I growth story of the early 2000s was centred on the country’s East, encapsulating wealthy city centres like Beijing and Shanghai.

However, I believe this mega dam symbolises Phase II of China’s growth plans.

A strategy of opening up the country’s Western frontier and aligning these underdeveloped regions with the wealthy provinces in the East.

Like the China Growth Phase I showed, you must first build the energy supply… Once that’s been assembled, all the associated infrastructure follows: apartment buildings, warehouses, and railways.

Today, it seems unfathomable that China could repeat anything like what it achieved in the early 2000s.

However, the global economy has a habit of underestimating the Middle Kingdom.

As an investor, you shouldn’t underrate the potential here… This could be the catalyst that drives commodity markets into a new upward cycle.

Twenty years ago, China’s economy boomed after the completion of the Three Gorges Dam.

The vast energy it created fuelled the development of new mega-cities.

And now we have a new dam under construction… But this time it is much, much bigger.

Stay tuned.

Regards,

James Cooper,

Mining: Phase One and Diggers and Drillers

Comments