The big story first, then the real story.

This morning from the AFR:

‘Two Chinese hackers infiltrated an Australian defence contractor’s web server and stole a vast trove of documents including source code for the company’s products, according to an explosive indictment unveiled by the US Justice Department…The Australian defence contractor, which wasn’t identified in the indictment, fell victim between April and June of last year when the hackers deployed a so-called China Chopper web shell, which enables remote access to web servers and uploading of credential-stealing software.’

The headlines just keeping coming.

Cybersecurity is back on the agenda in this country, and the federal government is rolling out a big fund worth $1.35 billion to boost Australia’s capabilities.

Check out these four innovative Aussie small-cap stocks before lockdown ends. Download your free report now.

If you check the 52-week highs, you might have caught a glimpse of this bolter soon after the fund was announced:

|

|

|

Source: tradingview.com |

This is the share price chart of Tesserent Ltd [ASX:TNT], a Box Hill based cybersecurity small-cap.

Betting on funding from political sources is a potentially dangerous game, but what is the broader market telling us?

Well, there is the performance of the BetaShares Global Cybersecurity ETF [ASX:HACK], which bounced strongly off the March lows:

|

|

|

Source: tradingview.com |

Point is, interest in the cybersecurity industry is growing.

A lot of this has to do with the state-run, or at least state-sanctioned…or at the very, very least state-tolerated hacking organisations.

Read: China.

US Secretary of State Mike Pompeo recently levelled a number of charges at China, labelling their behaviour as ‘disgraceful’.

A lot of this could be bombastic rhetorical manoeuvring prior to a trade deal.

Or there could be a major shift going on under the hood.

What are the second order effects of a bad Australia/China relationship?

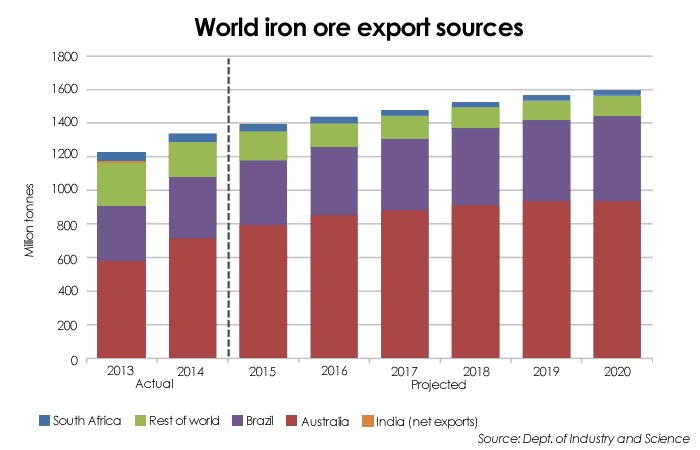

The obvious one that most people will think of is, what will happen to the big iron ore miners?

The Fortescue Metals Group Ltd [ASX:FMG] share price is on a tear on the back of improving iron ore prices.

And BHP Group Ltd [ASX:BHP] just announced some strong quarterly results.

A lot of this has to do with difficulties with Brazilian supply, with COVID-19 cases going through the roof.

Will this mean that China will pivot its iron ore imports to Brazil once things are under control?

Perhaps, it depends on how much the China/Australia relationship sours.

Given that Australia is the dominant exporter, this may not change too dramatically:

|

|

|

Source: ABC |

The more interesting second order effect centres on something called reshoring.

This is a fancy way of saying bringing back jobs that were lost to a competitor with cheaper labour.

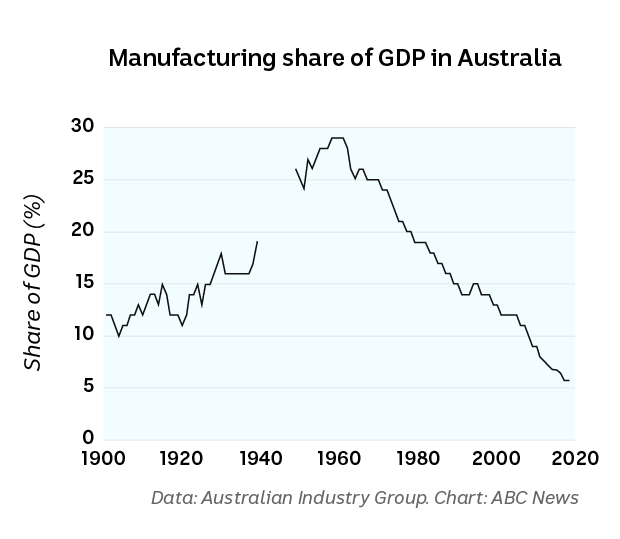

You can see that through to today manufacturing as a percentage of GDP declined from the 1960s peak:

|

|

|

Source: ABC |

Australia recently set up a manufacturing taskforce, which is headed by former Dow Chemical Company executive Andrew Liveris.

While only an advisory panel, it is looking at food, defence, mining, medical, and engineering — and yes — space.

Tech-manufacturing supply chain shift on the cards

So, whether the iron ore miners get battered or not, the real story is what happens to supply chains.

I don’t think Australia will be able to compete with India, let alone China on the steel front.

But where we could get an edge in this new environment is where tech meets manufacturing.

We have a skilled, highly educated workforce, and the nexus of these two things could be a big win for this country down the track.

Imagine if we could build our own lithium-ion batteries here?

I generally favour free trade, but a shift to local manufacturing doesn’t always result in lost efficiencies.

For instance, one manufacturing expert said the following about what we currently do:

‘How incredibly stupid it is for us as a nation to dig the lithium out of the ground, send it overseas and buy the batteries back at 50-times the price.’

We have the raw material, why can’t we make the value-added product?

It’s a legitimate question to ask.

A China-Australia divorce fuelled by cybersecurity issues (and a litany of other things) leading to an Australian manufacturing renaissance?

It’s looking like a very real possibility.

You will hear more from us in the coming days about China’s relationship with Australia, and on the weekend, I’ll take a deeper dive into what’s happening right now with Australian lithium companies.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.