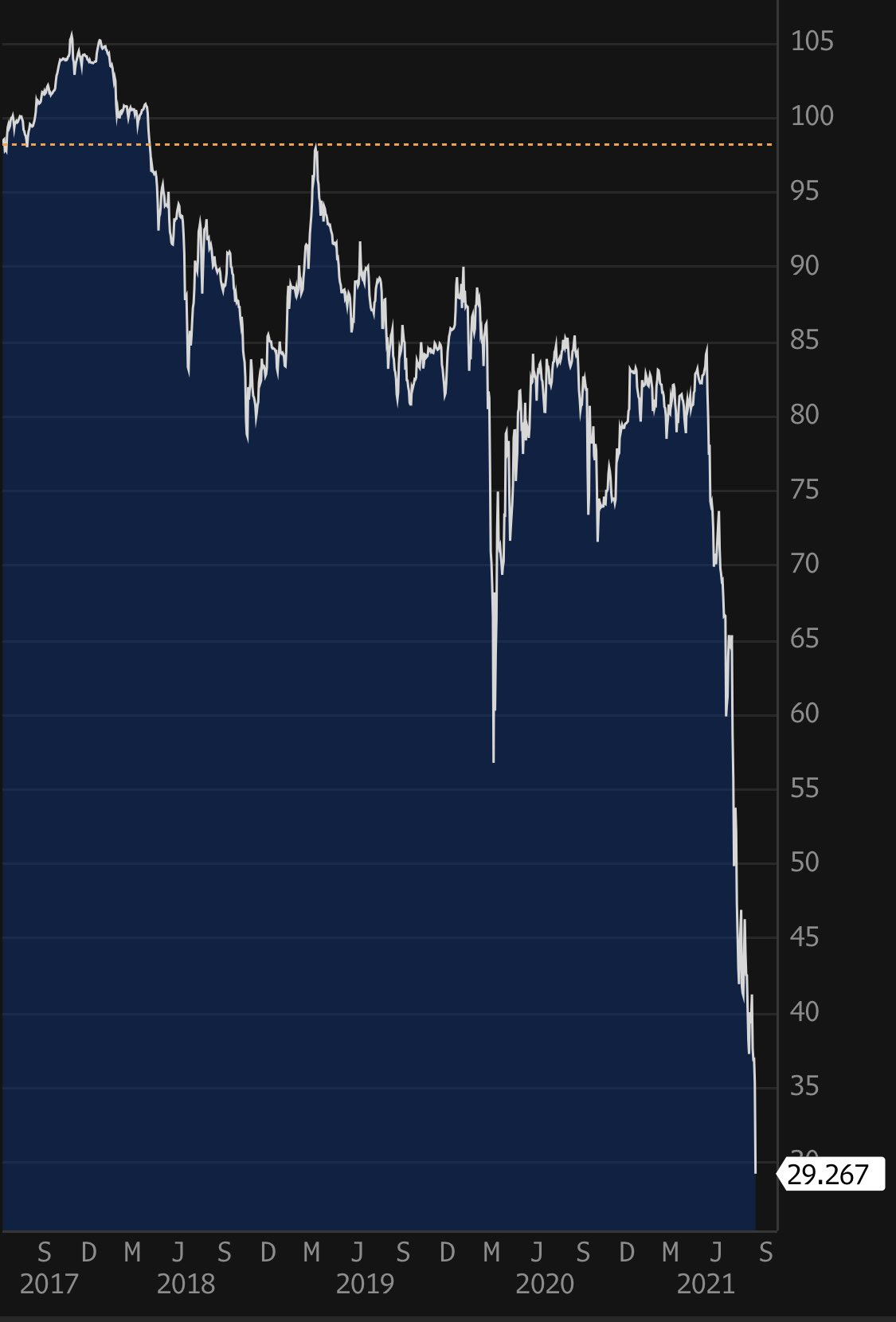

- Surely the most curious corporate story right now belongs to China’s massive — and I mean massive — property developer, Evergrande. Its bonds have been in free fall.

Check out the swan dive here…

|

|

|

Source: Twitter |

Evergrande owes more than US$300 billion in total liabilities.

The bond collapse has creditors jumping ship, thinking it might not be able to pay its debts.

More importantly, is China’s property market toast as well?

Certainly, the action here is bringing out those that like to entertain that line of thinking.

Ian Verrender of the ABC writes:

‘The only way the group can lift cash flow is to sell off its vast portfolio of apartments at heavy discounts. That is threatening to undermine prices across the country and potentially cause the collapse of rivals as the entire industry comes under pressure.’

It’s certainly possible. However, I don’t stretch quite to the apocalyptic scenario of the Chinese property bubble bursting…and taking iron ore down to US$50 or something like that.

One reason is that Evergrande’s trials and tribulations are not surprising news. This situation has been brewing for a long time.

And it’s not clear to me that the Chinese government wouldn’t step in and control the situation if it got too out of hand, either.

For example, The Economist recently reported that:

‘To shore up growth, China may try building more subsidised homes. It has ordered 40 cities to construct almost 1m low-rent housing units this year.’

I don’t pretend to be an expert on China.

But I don’t see why the Chinese government couldn’t quite easily acquire some of Evergrande’s portfolio at cheap prices, use them as subsidised housing, and inject liquidity into Evergrande.

Or just recapitalise the firm and take a stake in the business and put some government apparatchik on the board.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Here’s something else: The Economist also reported back in August that China has a grand plan to lift the productivity of its economy.

It wants to link big cities with smaller satellite towns to great giant social ‘clusters’.

How so?

‘China has approved plans for 11 megaclusters in all. The average population of the five biggest is about 100 million, nearly three times bigger than the 40 million in Greater Tokyo, the world’s biggest existing cluster.

‘Having discussed the idea for several years the government is beginning to invest in making it real. Over the next three years it has committed to double the length of its intercity commute lines.’

It won’t be immediate, but this is going to cause land values in these areas to skyrocket as productivity, infrastructure, and population boom. It’s hard to see a mega-crash with this in the works.

But that doesn’t mean we won’t see a spooky wobble or two before we get to the end of all this.

- The pricing of iron ore took a big whack to open the week. We’re back down to US$130 a tonne after seeing a brief recovery to US$150.

One of the big swords hanging over the iron ore market is the idea of the African deposit of Simandou being brought into production.

It’s a massive resource located in the nation of Guinea. Rio Tinto has a stake in it. But the main idea is that China will use Simandou to diversify its iron ore supply away from the Pilbara and Australia.

Now we have news that a coup is going on and Guinea’s constitution and government are getting the flick. Guinea is also the largest exporter of bauxite.

I have precisely no insight into the politics driving this or where it goes from here.

But we can say it’s volatile and unpredictable enough to keep out foreign investment…and Simandou undeveloped for a lot longer.

What an amazing development. It’s hard not to see this as a positive for Australia longer term. We are resource-rich but also secure.

That might attract a large premium as the geopolitical stability gets very uneven around the world in the years to come.

The debacle in Afghanistan is another case in point. It’s too early to say where this Guinea development goes…but adds another fascinating element to the iron ore dynamic currently in play.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.