In today’s Money Morning…the arrogance of power…the worm has turned…who will win the battle for money?…and more…

In 1764 the British parliament passed the Currency Act.

This law banned the fledgling US colonies from issuing their own paper money.

You see, those pesky colonists, not having much gold and silver of their own to create actual coinage, decided to invent their own form of money.

It was none other than the great Benjamin Franklin who proposed the idea of paper money in the New World.

The way he devised it, paper money would be backed not by gold or silver, but by land.

And the Americas certainly had a lot of that!

But the British didn’t want their taxes to be paid in fake ‘paper’ money.

They wanted real money of gold and silver.

And more than that, they wanted these outposts to provide The Empire with cheap goods and raw materials to grow the economy back home.

Not to become upstart competitors with their own fast-growing economy!

But London was pretty far away, and the colonials weren’t to be deterred.

You see, money in the US was already an ever-changing concept. It was whatever it needed to be at the time.

Funnily enough, the reason one dollar is still called a ‘buck’ to this day is because it once referred to deerskins. The skin of a deer — a buck — was an item in high demand by exporters; it was especially good for the cold European winters.

As was recorded at the time:

‘In yet another documented reference from 1748, Conrad Weiser, while traveling through present day Ohio, noted in his journal that someone had been “robbed of the value of 300 Bucks.”

‘At this time, a buck skin was a common medium of exchange.’

Anyway, the British banning of paper money added to the colonists’ long list of grievances with King George, which eventually led to the War of Independence.

To finance this war, in 1775 Congress issued a new form of paper money called Continentals.

They were backed by the ‘promise of future tax revenues’ but given the uncertain outcome of the rebellion at hand, this was pretty flaky backing.

The Continental Dollar lost value, however, they managed to keep printing enough of them to help George Washington beat the Brits, which in turn gave birth to the United States of America.

It was a battle over ideals and freedoms for sure, but it was also a battle over money.

And it was the first time in history such a poorly financed party had managed to beat a much richer one.

This was thanks, in part, to success in experimenting with the concept of money.

Which brings me to recent comments made by our current economic masters…

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

The arrogance of power

As reported last Friday:

|

|

The article in thewest.com.au read:

‘Assistant governor Michele Bullock said regulators still needed to grapple with privacy, consumer protections, and countering the use of Bitcoin and cryptocurrencies for money laundering and funding terrorism — and that’s not happening any time soon.

‘“There’s a lot of fuss over Bitcoin — it’s not a payment instrument and it’s not really money,” Ms Bullock said.’

There are shades of the Currency Act of 1764 here.

The powers that be are feeling threatened. And they’re decreeing they’ll decide what is money and what isn’t.

But we know how that worked out for the Brits of the 1700s.

The fact is, central bankers like the RBA need the current money system to keep going, otherwise they lose all power.

Never mind it is their actions that have brought us to our current situation.

A world with zero-bound interest rates, a world with ‘too big to fail’, a world of eternal money printing…

These actions have unforeseen consequences.

In my opinion, they’re destroying the social fabric of society with their constant meddling with money. But they either don’t see it, or they just don’t care.

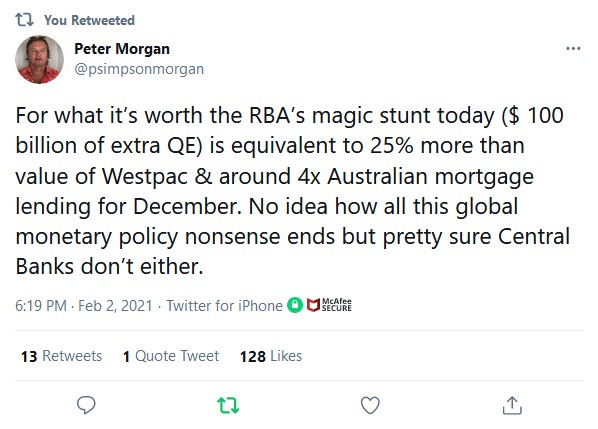

Just last week the RBA used their power of the printing press to issue $100 billion of new money.

Former fund manager Peter Morgan tweeted in response:

|

|

|

Source: Twitter |

Think about that for a second…

The problem is we’ve given fellow fallible humans this immense power over money, and they’re completely stuffing it up.

There’s no question in my mind, that they’re the ones destroying the concept of money.

I mean, why should you or I pay taxes if $100 billion dollars can be created at will?

Money without limit is money without value.

How much time and effort of human endeavour goes into trying to save a few thousand dollars?

Yet, with a magic money wand they create obscene amounts at will!

And then they have the cheek to say that bitcoin — an asset free from human meddling or centralised corruption — ‘isn’t really money’.

Of course, they want you to believe that!

Unfortunately for them though, the rebellion is already underway. And it’s now got the support of some pretty heavy hitters…

The worm has turned

For a long time, we here at Money Morning were almost a lone voice in supporting cryptocurrencies like bitcoin.

People laughed at us.

That’s fine, we can take the guffaws of the mainstream. In fact, that’s usually a good sign we’re onto something!

But it’s no longer embarrassing in the halls of finance to say you support bitcoin.

Just last week, the richest man in the world — Elon Musk — had this to say:

‘I am a supporter of bitcoin. I am late to the party but a supporter. I think bitcoin is on the verge of getting broad acceptance by conventional finance people.’

Musk is by no means a conventional billionaire.

But he proved with Tesla that he can successfully challenge mainstream thinking. And so, I’d expect some serious players to be listening to his words.

Of course, financial firms like PayPal and Square have already jumped onto the crypto bandwagon.

One analyst expects PayPal to announce this week that it earned around $2 billion in revenue from its fledgling Bitcoin business.

Real money or not, it’s adding real value for its shareholders!

As MarketWatch reported:

‘Lisa Ellis, analyst at Moffett Nathanson, predicted that PayPal’s crypto business will contribute up to $600 million to group revenue in 2021. “Over the long-term, we believe PayPal’s cryptocurrency initiatives have significant strategic value.”’

It’s no wonder Visa just announced last week that it too would be creating a crypto unit…

Who will win the battle for money?

This was a long piece today.

But it’s a big topic and understanding the history of money is essential to imagining the possibilities of what could come next.

My point today is that money has to change when it no longer fulfills its function as an equitable — without favour — store of value.

Of course, this process of change always threatens those currently wielding power. So, you’ve got to expect some pushback.

But in the end, in my opinion, better money will always beat bureaucratic meddling.

And more than that, this is about economic freedom too.

The colonists of early America recognised that without self-sovereign control over their money, they’d be economic slaves to Britain forever.

I think we’re at that stage with central banks.

We either take back control now, or forever be indentured to the whims of the powerful. Cryptocurrencies like bitcoin represent the best way to fight back.

It will be a battle, but in my opinion, history is on our side.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.