Today’s Daily Reckoning makes no apologies for beginning today’s note with a giant ‘FU’ to Twitter, Google and Facebook.

All are complicit in limiting free speech and expression of thought.

Likely you know that Donald Trump is banned from the two social media platforms above plus YouTube.

But events lately are even more insidious than that.

My colleague Jeff Brown points out that both Google and Apple just removed a social media application called Parler.

Parler is designed to protect free speech and is gaining traction because of the very censorship the Big Tech firms are showing now.

You may not have time for Donald Trump.

But if they can censor a former US president, you can guarantee any dissident or alternative viewpoints to what’s considered ‘acceptable’ are hopelessly lost too.

Here’s another example: ‘Trend’ guru Gerald Celente is putting his business at risk by loudly criticising the government response to COVID-19 and absurd mainstream fear mongering over the virus.

LinkedIn and YouTube are threatening to close off or limit his accounts unless he tones it down.

His ability to attract new subscribers would become less if so. Don’t you get the message? Just shut up and toe the line!

This is one reason why I don’t pay attention to the ‘news’ about what happened in Washington DC and that dude with the Viking helmet carrying on. I gather the narrative is he and his crones were Trump supporters.

Maybe. Maybe they were paid stooges too. I don’t know and I don’t care. I don’t trust any of it.

After all, we are here to make money right?

Paying attention to the mainstream news is an utter waste of time anyway.

All they can tell you is what has already happened. There’s no money in that.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Watching the Stock Market for Opportunities

Personally, I’m a touch cautious right now. I take my tee of the stock market action daily. It seems the bar to get a stock rising has gone up a notch.

There have been some solid quarterly reports come out this week and the stocks have either held steady or sold down in several cases. That suggests buyers are a little more wary right now.

That could change. But there are no extra points for doing something for the sake of doing something only.

Take gold stocks. Many of them have fallen 30–40% since the top in August 2020. It’s tempting to start nibbling at them: the margins for the producers are still high.

And yet instinct has told me lately to hold off. So I have.

I haven’t paid a penalty for that yet. That doesn’t mean I’m not interested at all. But I just keep watching for some stronger signs. Gold stocks may consolidate for another six weeks or six months.

In general, I’m impatient. I don’t like tying up my money for too long without a demonstrable trend or catalyst in front of the stock to get it moving.

Right now the upside pressure is in an unlikely place: natural gas. We touched on this yesterday.

The price of LNG in North Asia has gone from $3GJ to $30GJ in the last six months or so. That’s an astonishing rise, and totally — as is the way in markets — unexpected.

This is a heady price for gas producers that can ship into this market. But it’s likely to pressure east coast gas prices for consumers back up again too.

It was the weak export market that helped bring down domestic gas prices over 2020.

Some gas originally destined for China and Japan made its way to Sydney and Melbourne instead.

That will now go into reverse again. We can expect the debate over Australia’s energy policy to flair up again.

Likely lost among this discussion is the notion that gas as an energy source is in terminal decline.

The march of battery and solar technology means the energy market is going to go through extraordinary upheaval in the next five years.

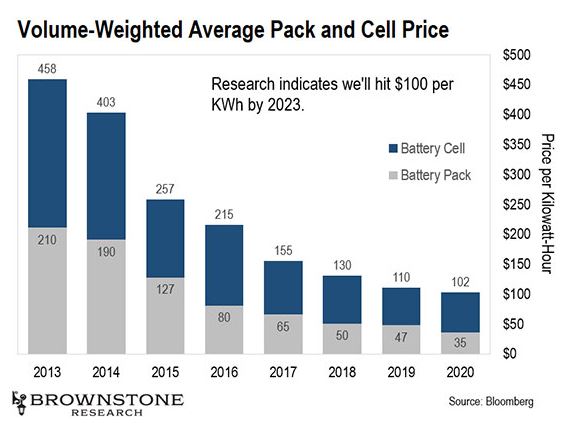

Look at the decline in battery costs since 2013…and they are going lower.

|

|

|

Source: Bloomberg |

Any oil and gas stock needs to be approached with a trader’s mindset. You ride them while the going is good.

At the first sign of trouble, cut it loose. That’s my game plan, anyway.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.