Small home appliances brand Breville Group [ASX:BRG] was sinking in share price by a little more than 6% in the afternoon following its latest results announcement for the half year ended 31 December 2022.

Breville’s revenue moved up slightly by 1.1%, with a total of $888 million for the first half of FY2023, while EBITDA jumped by 13.1% to $141.9 million.

The small appliances machines maker is expecting 5–10% in EBIT growth, around the range of $165–172 million.

BRG shares were trading at $20.38 at the time of writing. They increased by 11% this year but are still down 27% in the past 12 months.

www.tradingview.com

Breville’s half year results fail to excite investors

The home and kitchen appliances brand Breville reported results for fiscal 2023 with revenue, though moving up very subtly by 1.1% in growth (from $878.7 million to $888 million), still a record half result.

Gross profit went up by 3.8%, from $300 million earned in the first half of FY22 to $311.3 million.

BRG reported a gross margin increase of 1% year-on-year, while EBITDA (earnings before interest, tax, depreciation, and amortization) rose at a hearty rate of 13.1%, from $125.5 million to $141.9 million.

EBIT picked up by 7.6%, and net profit after tax came to $78.7 million, a 1.3% increase of one million.

Overall, BRG has delivered marginally higher on its financials than the previous year, which takes the interim dividend to 15 cents per share, fully franked, flat on the prior corresponding period.

CEO, Jim Clayton reflected:

‘The strength of our product portfolio, coupled with the maturity and agility of our underlying Acceleration Platform, cut through the macro-economic headwinds of the 1H23.

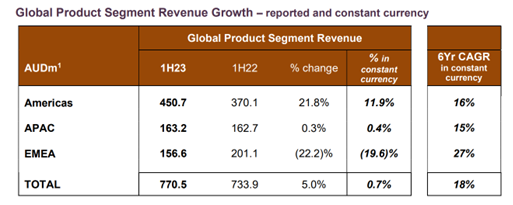

‘We grew Gross Profit by tacking into our areas of strength: we managed price to counter material input and logistics cost inflation as well as negative currency swings; we leaned on our geographic diversification to deflect the impact of EMEA retailers buying much less than they were selling; we aligned our supply chain and go-to-market to take advantage of the trending tailwinds of “air frying” and “café quality coffee at home”…

‘With Gross Profit growing 3.8%, we then grew EBIT by 7.6%. Over the last 8 years, we have typically, and intentionally, grown revenue faster than EBIT, giving the business model a forward tilt.’

Source: BRG

Breville seizes up FY23

The group acknowledged gross margin headwinds caused by FOB increases, freight rates and a strong US dollar, but its own product increases and returning promotional periods are improving.

Healthy cash inflow is forecast for 2H23 as receivables are collected, and a supply chain normalisation is expected to complement BRG’s inventory flow model.

The company stated:

‘Looking forward we appear to be entering a more benign inflationary environment for our products with recent substantial falls in freight rates, FOB reductions and a moderating USD, all of which should support ongoing healthy gross margins.’

Breville expects 5–10% in EBIT growth ($165–172 million) for FY23, assuming no further material supply chain interruptions or significant economic conditions stand in its way.

Investors may be worried about further interest rate hikes, yet BRG seems confident times are soon to change.

Five bargain stocks

The war in Ukraine, the pandemic, continually rising rates and tough cost-of-living conditions have households and businesses alike sitting in a tight spot with little room to move.

But the thing is, while money is tight for many, it’s actually in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning