When it comes to investment management firms, no one compares to BlackRock…

With a staggering US$10 trillion worth of assets under their management, this company has a big influence on markets. For that reason, whenever BlackRock decides to follow a new trend, the market pays attention.

After all, you don’t get this big without knowing your way around investment circles.

So with BlackRock now announcing a new private Bitcoin [BTC] trust for institutional investors, you know things are getting serious. Because with this new service, some of the firm’s biggest clients will now be able to gain direct exposure to the largest and most well-known cryptocurrency.

It’s a stark contrast to even a year ago when BlackRock’s CEO — Larry Fink — stated that:

‘We see very little demand for those [crypto] types of things.’

Although even this statement was an improvement over Fink’s 2017 views that bitcoin was exclusively used for money laundering.

What a difference a few years can make…

And for retail investors like yourself, whether you own crypto or not, the question now turns to what sort of difference BlackRock can make. Because more than anything else, this decision by the asset manager is a clear endorsement that they believe cryptocurrency is worth investing in.

The race for accumulation is on

Now, you may wonder why BlackRock is choosing to commit to bitcoin now, of all times.

But it makes perfect sense.

Bitcoin, along with all the major crypto coins, has been smashed in recent months. We are deep in the early stages of a ‘crypto winter’. These periods of price and investment dormancy are symptomatic of the recurring boom and bust cycle that crypto goes through every few years.

The key point, though, is that BlackRock is likely betting they’re getting in close to the bottom.

Like any experienced investor, they know that the time to start buying is when most people are selling. And their clientele likely knows this too:

‘Despite the steep downturn in the digital asset market, we are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities.’

For that reason, don’t be surprised if we start to see some serious accumulation from big players. This is why right now may be your last chance to get involved at a reasonable price.

Owning one whole bitcoin is still feasible, albeit daunting, for everyday investors currently. No one knows if we’ll be able to say that in a year or two. Because if the price reaches and exceeds six digits, then a whole bitcoin will be firmly out of reach for most people.

Now, more than ever, it is seriously worth considering the addition of just some crypto to your investment portfolio.

Because with BlackRock taking the lead, institutional money is certainly coming to the market.

Creeping capital

Keep in mind that the scenario I’m outlining isn’t going to occur overnight.

These sorts of investment management trends usually take much longer to pan out and take shape. Moving around the sums of money we’re talking about isn’t easy and isn’t a decision made lightly.

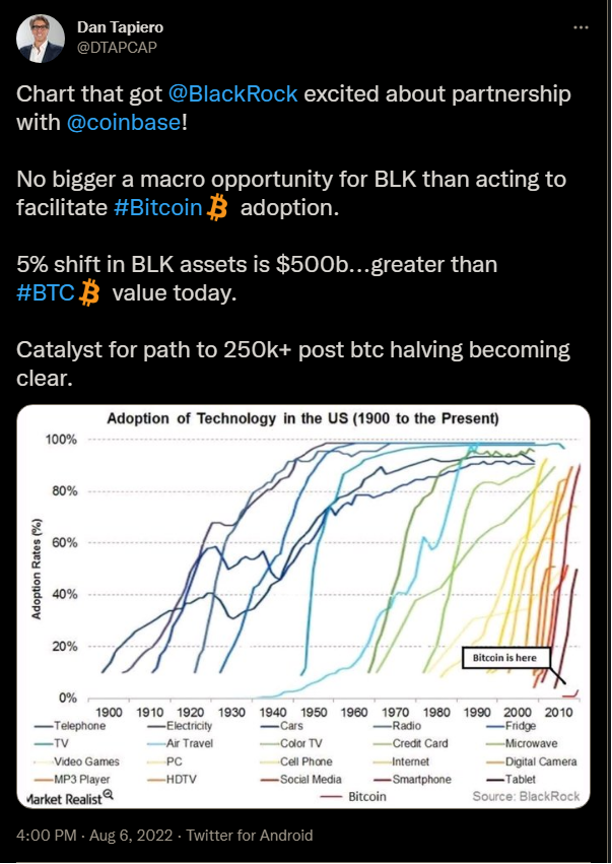

The point is that we’re potentially at the start of it. Because as one current crypto fund manager, Dan Tapiero, bluntly puts it: BlackRock could easily be the catalyst for wider adoption. Here is a tweet that concisely makes his point:

|

|

|

Source: Twitter |

In other words, we’re on the precipice of what may be the start of proper crypto adoption — a turning point that could truly open the floodgates for unprecedented growth in bitcoin.

No one really knows how big it will become or how long it will take, but the potential is massive.

The only question you need to ask yourself is, are you willing to get in before it all happens?

Because no matter which way you look at it, big money is coming to crypto with or without you…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.