Public-owned asset managing company BKI Investment Company [ASX:BKI] today put out an update on its quarterly activities and results for the March quarter, along with an investor presentation for a share purchase plan (SPP).

The group has launched the SPP for investors to subscribe for up to 30,000 worth of new BKI shares at a maximum issue price of $1.67 each to fund further opportunities.

BKI stated the latest reporting season had been a success, with expectations of more than $67 million in investment revenue — not including special dividends.

The investment group was worth $1.70 a share at the time of writing. BKI’s stock has been performing slightly down in the month and is more than 5% down so far in 2023:

www.tradingview.com

BKI’s March quarter highlights

Early Monday, asset management corporation BKI released the latest highlights for its investment returns and portfolio movement for the March quarter ending 31 March 2023.

BKI said it experienced a successful reporting season, and the company now expects to receive more than $67 million in ordinary investment revenue — not including special dividends, which is up from the $63.4 million earned at the same time last year.

Counting income brought in through special dividends, BKI says it should receive an extra $3.7 million for the financial year, with main contributors being the likes of Telstra, Washington H Soul Pattinson, Amol, Smart Group, and New Hope.

BKI itself expects that — so long as no unforeseen circumstances get in the way of its intentions — it is confident in declaring a fully franked final dividend of 3.70 cents a share to demonstrate its favourable trading year FY2023.

BKI maintains that it follows its ‘sensible, low cost’ investing strategy focused on quality assets, of which it holds $1,322 million worth.

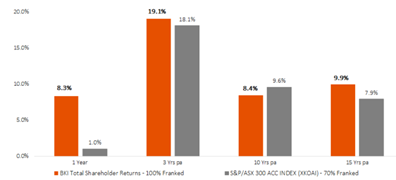

Its historical grossed dividend yield has risen 7.4%, and its one-year total shareholder return (TSR) has also moved up 8.3%, a result which outperformed the S&P by 7.3%. TSR has now multiplied 19.1% a year for the past three years.

The group expects ordinary investment revenue to increase by 6% for the 2023 financial year.

Source: BKI

BKI’s 2023 SPP

The asset managers also outlined the 2023 share purchase plan launched last month, which allows investors to subscribe for up to $30,000 worth of new shares in the company.

The shares will be eligible for the fully franked final dividend for the full financial year, and will set investors back $1.67 each, which was offered at a 3% discount to a five-day VWAP (volume weighted average price).

This also represents a 7.2% discount to BKI’s Pre-tax NTA (net tangible asset) as calculated last Friday.

BKI explained that proceeds from the SPP will be used to back its investment strategy of investing long term in ‘profitable high income and well managed companies’.

It will look to snap up opportunities with corporations that have growing dividends, attractive yield, good growth prospects and other financial and management-related green flags.

Australia faces big changes — are you prepared?

Australia has serviced 30 years of abundant, robust trade…but that’s now broken, and it’s unlikely to be pieced together the way it once was.

The global supply chain has been twisted — that’s why there’s less on our supermarket shelves, inflation is running rampant, and banks are closing branches.

The change is all around us, and the clues and signs are everywhere.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has — certainly not the mainstream media.

He says no one is talking about how this could end the Australian economy as we know it as soon as within the next 12 months.

If you want to know more about the biggest geoeconomic shift of our lifetime, click here for more.

Regards,

Mahlia Stewart,

For Money Morning