In today’s Money Morning…an exponential shift…the end of the petrodollar system…you just need to pay attention to the changes…and more…

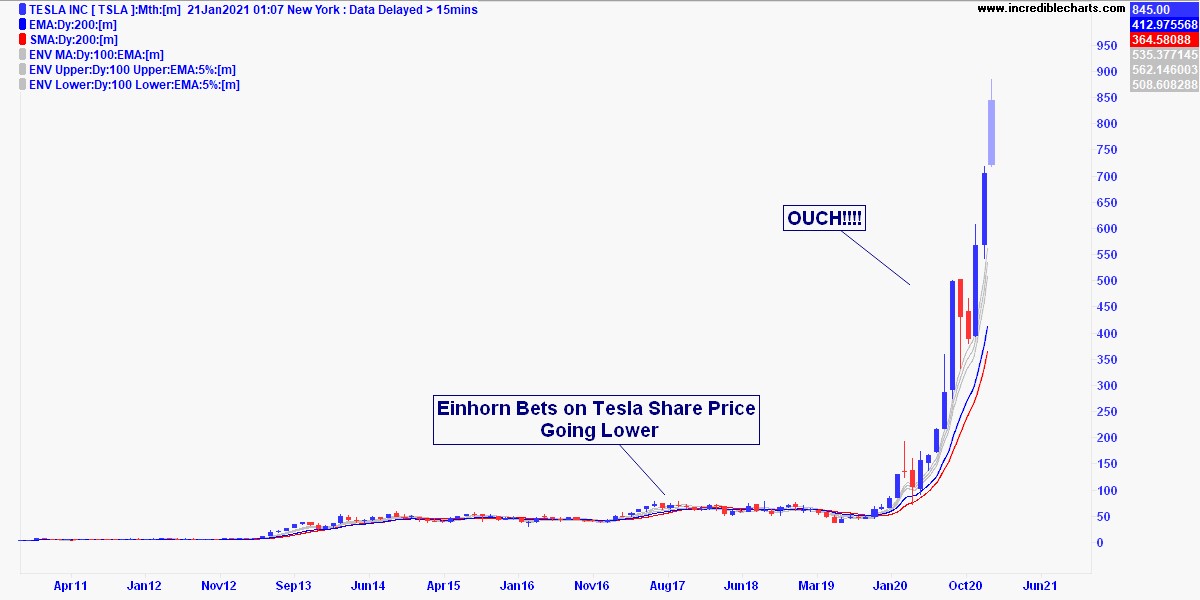

David Einhorn has been shorting Tesla Inc [NASDAQ:TSLA] — shorting means betting on the share price going down — since 2017.

Einhorn made his name by doing this kind of thing in the past.

He famously shorted Lehman Brothers in 2007 just before they went bankrupt and he describes Tesla as a similar type of ‘fraud’.

So how are things going for him?

Check out the chart:

|

|

|

Source: Incredible Charts |

To a shorter like Einhorn, this chart is a disaster!

Remember an investor ‘going short’ needs the share price to fall to make money — preferably all the way to zero like Lehman Brothers did.

But over the past three years Tesla’s share price has gone totally ballistic.

The company recently became the fifth most valuable company on Wall Street, in turn making CEO and founder Elon Musk the richest man in the world.

By all accounts Einhorn’s fund, Greenlight Capital, is still short on Tesla which means he’s in a world of hurt right now.

So how did he get it so wrong?

I’ll explain what I think in a second…

But first let’s look at another soaring asset that’s confounding the experts.

Bitcoin vs Gold — Which Should You Buy in 2021? Download your free report now

This one is Bitcoin…

Like Tesla, the parabolic growth in the Bitcoin [BTC] price has big-name investors shouting ‘bubble’ from the rooftops.

Just last week billionaire ‘Shark Tank’ investor Mark Cuban said that crypto is ‘exactly’ like the dotcom bubble of the 1990s and investors should expect steep falls ahead.

Will he be right?

Well, I think both Einhorn and Cuban are missing something very important in each of these two areas…

An exponential shift

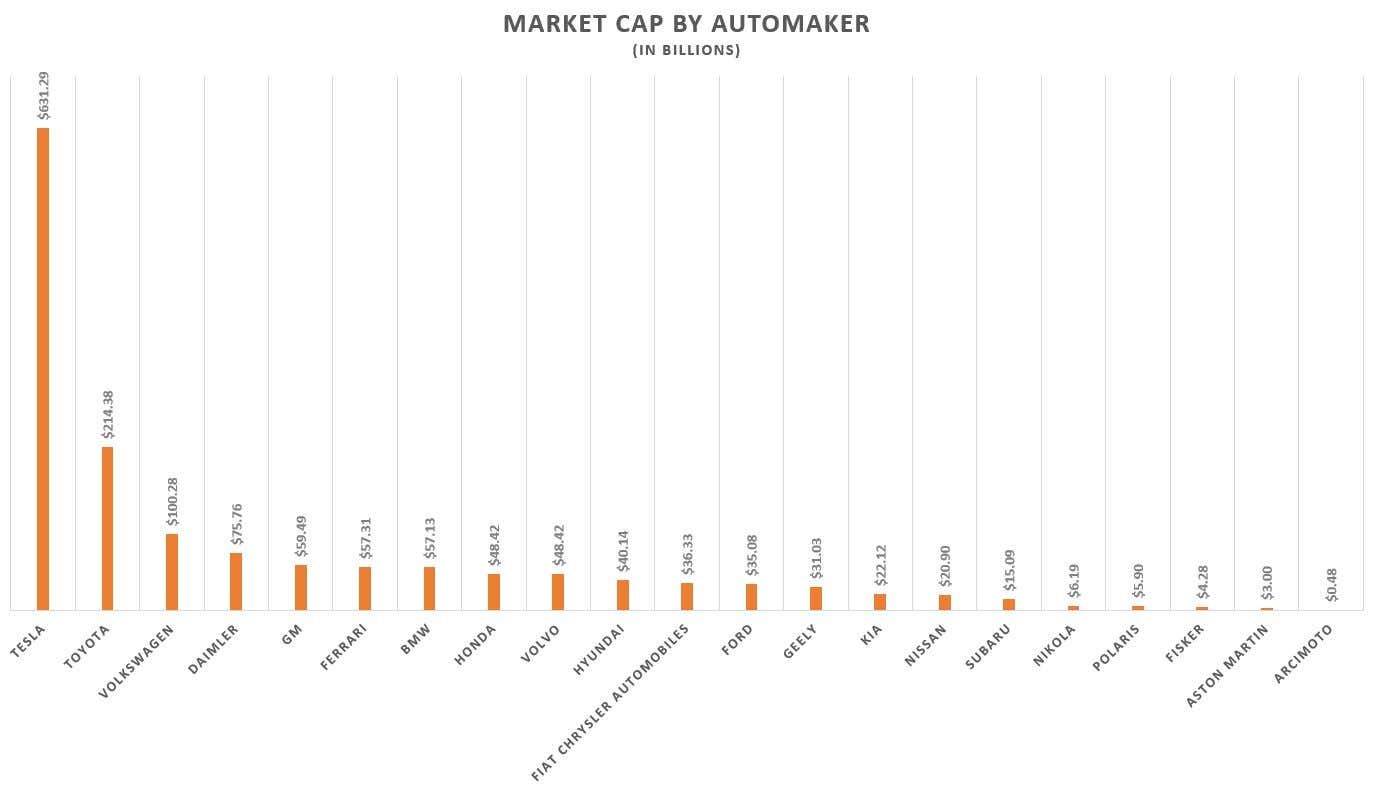

When traditional investors look at Tesla, they see things like this:

|

|

|

Source: Visual Capitalist |

This chart shows that Tesla is worth more than all the other car manufacturers in the world combined, despite the fact that a competitor like Toyota sold 20 times as many cars as them!

Now, I can understand why you might shake your head at seeing this. From an old-school ‘Ben Graham’ perspective, it doesn’t make fundamental sense.

But that’s only if you see Tesla as just ‘a car company’.

What many people miss is that it is a lot more than that.

It’s actually a technology and energy company too.

Of course, the disruptive potential and high-growth rates of electric cars is the mainstream story behind the company’s astronomical valuation.

But it’s not the only area propelling this company into the future.

For example, Tesla has its own chain of revenue-generating electric charging stations; analogous to owning a huge chain of petrol stations.

It also has unique know-how in the field of battery technology. This expertise has big crossover into the exponential trend in renewable energy too.

For example, South Australia is home to the world’s largest lithium-ion battery — a wind power plant using Tesla battery technology.

Self-driving cars are another area Tesla is in and I’m sure the software and AI tech they develop here will drive further valuation upside to Tesla. The tech behind this is compostable into many different areas.

Now, I’m not saying the short-term valuation of Tesla isn’t looking a bit frothy, I certainly wouldn’t be a buyer at these levels.

But what I am saying is that the long-term outlook might be a lot rosier than a lot of people realise. They just need to look past their conception of what Tesla actually is.

It’s a tech play riding a number of exponential trends — one of which is electric cars.

Similarly, with bitcoin, it might look like a bubble compared to just a few months ago.

But compare it to the industries it could disrupt over the next few years and you’ll see it’s far from overvalued.

|

|

|

Source: Blue Sky Capital Management |

Bitcoin is still a mere drop in the ocean of financial assets.

My deeper point is this…

Behind the extreme returns of these two assets is actually an exponential shift playing out in two of the most important industries out there…

The end of the petrodollar system

I see Tesla and Bitcoin, not as stand-alone bubbles, but as clues to huge changes taking place in the fields of money and energy.

You can’t get two more important industries to the fabric of the global economy than these two.

Indeed, the combination of oil and the US dollar — the so-called petrodollar system — was the background for most of the big geopolitical moments in the second half of the 20th century.

And yet now both are under threat. New technologies are seeking to replace them, and they are now gaining traction very, very fast.

That’s the real insight you should take from Tesla and bitcoin’s parabolic moves.

We’re witnessing a seismic shift and the implications of this shift will have major ramifications all over the world.

As an investor, understanding that reality will alert you to new opportunities well before the people who still can’t see this.

These ‘linear-sighted’ sceptics will still be shouting ‘bubble’ or ‘scam’, or whatever, while the Earth shifts below their feet.

The truth is most people can’t recognise exponential growth.

And the thing is, you don’t need to invest in Tesla or Bitcoin either to take advantage of the trends they’re symptomatic of.

You just need to pay attention to the changes in energy and money markets.

There’ll be many opportunities here, in my opinion, for forward-thinking investors.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.