BHP Group [ASX:BHP] shares were flat on Tuesday following the release of its operational review for the year ended 30 June 2022.

Last week it was Rio Tinto [ASX:RIO] with its June quarter update, and today it was BHP.

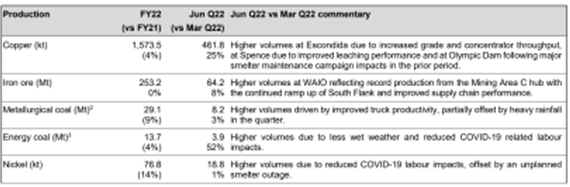

The mining giant reported that it achieved full year production guidance for iron ore and energy coal.

Full-year nickel production was lower than guided after a smelter outage in the June quarter.

BHP also addressed ‘broader market volatility’, expecting inflationary pressures to weigh on commodity markets next year.

BHP is flat YTD, and down 18% over the past 12 months.

BHP’s 2022 operations

On Tuesday, BHP released an operational overview of its FY22 performance.

BHP reported ‘record’ sales volumes from its WA iron ore subsidiary, capitalising on high iron ore prices during the reporting period.

Full-year production guidance goals were achieved for iron ore, energy coal, copper and metallurgical coal.

However, nickel production was lower than guidance, which BHP explained was due to a smelter outage last month.

The company’s full-year unit cost guidance is expected to be a success for WA iron and Escondida.

Although, NSW coal unit costs dove to bottom guidance despite anticipated increases in higher-quality energy coal prices.

The company has expressed that it will be keeping NSWEC and extending mining approval beyond 2026.

BHP’s Jansen shaft project has just been completed, with the company looking to fast track Stage one production to 2026 and then begin focusing on Stage two.

Source: BHP

BHP’s CEO, Mike Henry, commented:

‘We delivered record full-year sales volumes at our iron ore business in Western Australia as a result of reliable operational performance and the South Flank project which continued to ramp up. In copper, Escondida in Chile had record material mined and near-record concentrator throughput, while Olympic Dam in South Australia performed strongly in the fourth quarter after planned smelter maintenance.

‘Queensland metallurgical coal delivered strong underlying performance for the quarter in the face of significant wet weather. BHP is assessing the impacts on BMA economic reserves and mine lives as a result of the increase in coal royalties by the Queensland Government. The near tripling of top end royalties has worsened what was already one of the world’s highest coal royalty regimes, threatening investment and jobs in the state.

‘Our US$5.7 billion Jansen potash project in Canada is tracking to plan and we are working to bring first production forward to 2026. Also during the year, we merged our petroleum business with Woodside, completed the sales of BMC and Cerrejón, and decided to retain New South Wales Energy Coal until the cessation of mining in 2030 subject to relevant approvals. We also unified our corporate structure, and added to our global options in copper and nickel.’

BHP comments on market outlook

BHP also noted weakened Australian dollars and Chilean pesos have impacted operations, yet another side-effect of the tightly squeezed economy stretching all areas of businesses.

Mr Henry also commented:

‘Broader market volatility continues and we expect the lag effect of inflationary pressures to continue through the 2023 financial year, along with labour market tightness and supply chain constraints.

‘Over the year ahead, China is expected to contribute positively to growth as stimulus policies take effect, however, the continuing conflict in the Ukraine, the unfolding energy crisis in Europe and policy tightening globally is expected to result in an overall slowing of global growth. Our strong focus on safety, operational reliability, cost control and social value will help us navigate these challenges and continue to deliver for all of our stakeholders.’

There’s no getting around inflation…or is there?

Very few businesses can claim immunity to inflationary pressure.

So, how is it some businesses can deal with inflation better than others?

Our experts have pinpointed stocks that have the potential to be ‘inflation busters’ despite the current climate.

You can now access our research report on five inflation buster stocks — for free.

Regards,

Kiryll Prakapenka