Oil and gas exploration company Beach Energy [ASX:BPT] reported its latest activities summary and highlights for the third quarter 2023.

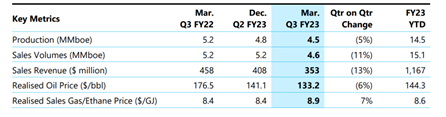

The energy group admitted to a 5% quarterly drop in production by reporting the total of 4.5 MMboe (million metric barrels of oil equivalent), and revenue was 13% below the prior quarter.

BPT dropped very lightly in share price following the update and was trading around $1.52 a share at the time of writing.

In the past month, BPT’s share price has improved by more than 8%, but it’s still down nearly 5% in the year so far:

www.TradingView.com

Beach posts lower production and sales

In its third quarter report, the energy company has revealed 5% less production than the previous quarter, down to 4.5 MMboe.

Gas production was reportedly hit by impact of 10 days’ worth of downtime at the Otway Basin, while this period was planned, it still had a negative effect on the group’s production in the quarter. It might not have been quite so bad if it weren’t for further (unplanned) events that also played a part.

The company also revealed that there were lower submissions, in part, due to surplus gas after the LNG outage in Queensland, and then there were some unforeseen outages at the Cooper Basin JV.

Beside the lower productions at working sites, Beach also provided updates on its active drilling campaigns across its gas assets in the Perth Basin. Its exploration is also continuing as planned.

Beach says that overall, it has managed 89% drilling success rate from 36 wells.

The Perth Basin gas exploration campaign has begun, with spudding of Trig 1, while in New Zealand, Valaris 107 rig is secured for the Kupe South developments, also targeting spud in the first quarter of FY24.

Cooper Basin has been tracking along with 33 wells now underway, with an overall success rate of 87%.

Moomba CCS is now 55% complete, yet some complications with flowlines have delayed Otway Thylacine until repairs can be done.

Beach has also completed a Webuild agreement for Stage 2 of the Waitsia project, which has been slated to reach first gas production by the end of the year.

Source: BPT

Beach financials

Beach’s total sales volumes of 4,585 kboe (kilobarrel of oil equivalent) were 11% below the prior quarter, mainly due to lower production and timing.

Total sales revenue was 13% below the prior quarter, totalling $353 million, also due to lower sales volumes and realised oil pricing, even if it was partially offset by higher gas pricing.

Average realised sales prices across products were reportedly $76.9 per boe, 3% below the prior quarter. The average realised oil price had decreased 6%, at $133.2 per bbl while the realised gas price increased 7% to $8.9 per GJ.

The company has earned $1.16 billion in total sales year-to-date.

Beach now says it’s targeting a payout ratio of 40–50% of pre-growth free cash flow.

Morné Engelbrecht, Beach’s CEO said the group has ‘made a number of positive strides in the recent quarter’ acknowledging the progress made on its diverse projects, especially Moomba CCS, which is now more than half complete with the first CO2 injection targeted for 2024.

Source: BPT

The drilling boom Australia

There’s an industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

In fact, the drilling business is booming…or will be.

More booms are marked to happen for every single metal on the period table.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our experts definitely say so, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart

For The Daily Reckoning