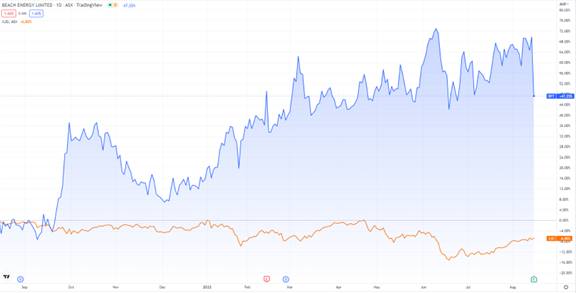

Oil and gas producer Beach Energy [ASX:BPT] fell more than 12% on Monday after FY22 production disappointed.

BPT did record higher revenue and net profit for the year on strong oil and gas prices.

BPT shares are up 30% over the past 12 months.

Source: www.tradingview.com

Beach Energy’s FY22 highlights

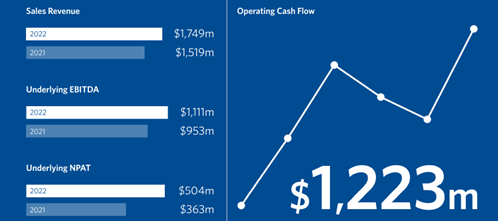

Beach Energy presented its full-year operational and financial results for 2022.

Here are the highlights:

- ‘Total revenue up 13% to $1.8 billion, underlying EBITDA up 17% to $1.1 billion and underlying NPAT up 39% to $504 million

- ‘Operating cash flow up 61% to $1.2 billion with $752 million free cash flow pre-growth expenditure

- ‘Net cash position and total liquidity of $765 million at year-end’

The company reported lower production for the year, offsetting the production slump with rising prices.

Beach Energy’s Chief Executive, Morne Engelbrecht, commented:

‘The 2022 financial year brought into sharp focus the important role natural gas currently plays in providing energy security, and will continue to do so for decades to come. Beach continues to play its part by investing in new gas supply for domestic users.

‘Despite lower production, increased demand and pricing for our products saw a rise in earnings and cash flows.’

Source: BPT

BPT also drew attention to its operational milestones during the year:

- Offshore Otway Basin drilling completion (a gas discovery and six wells built)

- Geographe connections to Otway Gas Plant made, production up 47% (4.1 MMboe)

- Final Investment Decision complete for Enterprise and Otway Gas Plant

- Waitsia Stage 2 under construction

- BP to acquire all 3.75 mt for Waitsia Stage 2 (200 million MMBtu of LNG) over five years

- Kupe and Yolla wireline projects delivered

- Final Investment Decision complete for Moomba Carbon Capture (CCS) project

The company reported lower production for the year, however, BPT managed to offset this with increased pricing for its product — boosting company cash and earnings.

Outlook for BPT

Engelbrecht noted Beach Energy’s production outlook was lower than expected, resulting in today’s sell-off:

‘The production outlook for the financial year 2023 is significantly lower than consensus and even our financial year 2024 (FY24) numbers are too high compared to the company’s production target.

‘We expect the market will not react well to this news despite the potential for even higher prices in FY24 as contracts reset and spot LNG sales commence.’

Engelbrecht believes that despite the lower production volumes in FY22, Beach Energy is well positioned for the future:

‘The 2022 financial year brought into sharp focus the important role natural gas currently plays in providing energy security, and will continue to do so for decades to come. Beach continues to play its part by investing in new gas supply for domestic users.

‘Beach’s multi-basin strategy is to develop the assets within our portfolio, keep our plants processing at higher rates for longer, and in doing so maximise gas supply. The benefits of this strategy were clearly evident in our financial results this year.

‘We have a busy schedule in FY23 completing the major projects that will deliver material free cash flow from FY24.’

Many businesses have had a tough time during the current economic environment.

Due to this, it can be tricky to determine next steps.

However, help is at hand.

Our Editorial Director Greg Canavan has seen a bear market or two.

And thanks to these experiences, he has put together a new report on how to play a bear market.

If you’d like to read Greg’s ‘The Stocks You Should Own in a Bear Market’ report, click here.

Regards,

Kiryll Prakapenka