It’s no secret that Australian investors love dividends.

Relying on a steady stream of income from stocks isn’t just a strategy for some, it’s a way of life. Especially for the retirees among us.

I certainly can’t refute just how cushy the dividend playbook has become. Having avoided a technical recession for 29 years, dividends have grown substantially.

Free Report: ‘Why Your Bank Dividends Could Be Under Threat’

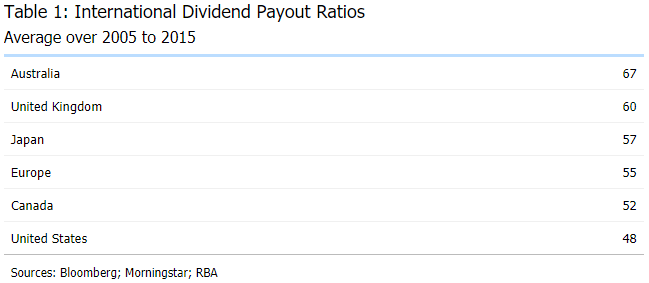

As a result, we became a world leader for dividend payouts. Take a look at the figures:

|

|

| Source: Reserve Bank of Australia |

Despite our relatively small market size, we love to give back to shareholders.

And I’m not here to declare that a bad thing. On the contrary, putting returns in the hands of shareholders is the whole point of investing.

However, it is clear that investing for dividends has become too easy. That helped us reach a new milestone last year, with the majority of retirees now classified as ‘self-funded’.

But, as impressive as that is, it also highlights my point. A lot of investors are now relying on these dividends to make ends meet.

Which begs the question, what happens when the dividends stop flowing?

Well, we’re about to find out…

NAB pulls the pin

National Australia Bank has been the first to wave the white flag this week.

They’ve had to rely on $3.5 billion in fresh capital from investors to shore up their balance sheet. Money that will be used to pay off their fine to ASIC and cover the deluge of loan defaults expected to come.

All in all, NAB is lucky to be walking away from this in one piece. They’ve been thrown a lifeline that will ensure they at least survive this downturn.

Whether this is the beginning of end for NAB, or just a blip in the road though, is unclear. It is too early to draw any conclusions as to what the long-term ramifications will be.

But, aside from the fate of the bank, the bigger news was NAB’s dividend announcement.

See, typically a capital raise would suggest that a company is in no position to be paying out money to shareholders. After all, that’s more money that could be used to solidify and strengthen their balance sheet.

So, when NAB declared their interim dividend would be just 30 cents, many were gobsmacked.

This 53-cent cut compared to last year’s payout was a huge blow for shareholders. Likely the first of more to come. At the very least, expect the other major banks to follow suit.

Here’s the thing though, investors should be horrified that NAB is paying a dividend at all.

This payout isn’t akin to some olive branch handed over in good will. It’s like a drug dealer trying to keep their clientele addicted. As the Finanical Review reports:

‘So even with the Australian Prudential Regulation Authority warning the banks to prefer capital strength to dividend payouts, McEwan and Chronican have decided that it is better to retain some level of payout to keep these retail investors sweet.’

It goes to show just how hooked on dividends we are. NAB had to raise money from investors, just so it could give money back to investors, in order to keep investors happy…

Do you see insanity in this strategy?

The public better snap out of this delusion quickly though, because things are only going to get messier from here on out.

Invest for growth, not income

As it currently stands, our banks are in for a rough couple of years.

New analysis suggests they could be facing $35 billion worth of defaults over the next three years. An insight into just how deep this virus and subsequent lockdown will bite.

Therefore, investors better brace themselves for a severe cut to ongoing dividends. Something that many probably aren’t prepared for.

It won’t be the end of investing for income, but it is going to be a massive wakeup call.

In a few years we may even look back and wonder how we reached this point. It is going to become very apparent, very quickly, that our current system is unsustainable.

The way Australians view dividends needs to change. We must rid ourselves of this addiction for our own good. I thoroughly believe it will lead to a healthier market.

Now, that doesn’t mean there won’t be pain. Like any habit, kicking it requires hardship and sacrifice. Both for investors and for companies.

But, long term it should also help bring about greater prosperity.

After all, you must remember that dividends come at an opportunity cost. It is money that could have been reinvested in the business for further growth or development.

Our government keeps talking about its ‘pro-growth’ agenda, so it’s about time businesses did too. And right now, the best way to do that is to stop paying shareholders for a while.

It’s time to start investing for growth. It’s time for some innovation.

We’ll all be better for it.

Regards,

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: FREE ‘Crisis Money Guide’ explains how a currency crisis could suddenly unfold and how to survive it. Click here to claim your copy now.

Comments