In today’s Money Morning…insane property market entirely predictable…commodities skyrocket too…plus, the secret of wealth creation…and much more…

Check this out…

The Australian reported yesterday that…

‘Australian households are on average almost four years ahead on their mortgage payments, with a record $50bn funnelled into offset accounts over the past two years as homeowners used the pandemic to pay down their loans.’

All that money that might have gone to travel or eating out is building up into a monster national war chest of cash.

It’s also making the property market more secure. No wonder it’s booming!

You see signs of it everywhere you look.

And once you see it, you can’t ‘unsee’ it.

‘I just don’t believe how much prices have jumped. These prices are far exceeding what I think is a fair and reasonable market price.’

That’s a buyer’s agent in the Sydney property market.

‘It is definitely the hottest market I’ve ever seen with the low supply, the lower interest rates and the cost of borrowing, money being so cheap.’

That one’s from Brisbane.

‘We thought it would stop for a pandemic, but it hasn’t. I think it’s gone against all the experts and predictors out there; it just keeps going.’

Those are the words of an auctioneer right here in Melbourne.

The property market is in a ‘frenzy’, according to the ABC.

And it’s not just Australia either. The UK property market is ‘frankly obscene’, according to one estate agent in London (and estate agents are — by a long way — the last people you’d expect to talk the market down).

In fact, in the year to June 2021, the average UK home ‘earned’ more than the average worker.

Then you have the US…

‘Will Real Estate Ever Be Normal Again?’ asks The New York Times.

The market in many parts of the US has gone berserk. Here’s one story the Times quoted that shows you how things stand. It involves a property in Austin, Texas:

‘It was listed on Dec. 30, 2020, for $370,000, and it seemed like mere minutes until buyers and agents began lining up in the bitter rain to tour the house one by one, a process that took hours.

‘Agents texted Google Maps screenshots to one another, noting the red traffic jams around the property.

‘By the 11 a.m. deadline on New Year’s Day, the house had received 96 offers, with the winning bid clocking in at $541,000 — a mind-boggling 46 percent above asking.’

If that isn’t a frenzy, I don’t know what is.

But what if I told you that this is all part of a bigger pattern?

One that extends far beyond property…and far beyond Australia.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The Grand Cycle

See, though the real estate market tends to garner more coverage than the wider financial markets, it’s not just property prices displaying this kind of behaviour.

The ASX 200 made a new all-time high in August 2021.

The Nasdaq has gone near-vertical in 2021, making new highs all the way. The most recent was in mid-November.

Then you have copper…

|

|

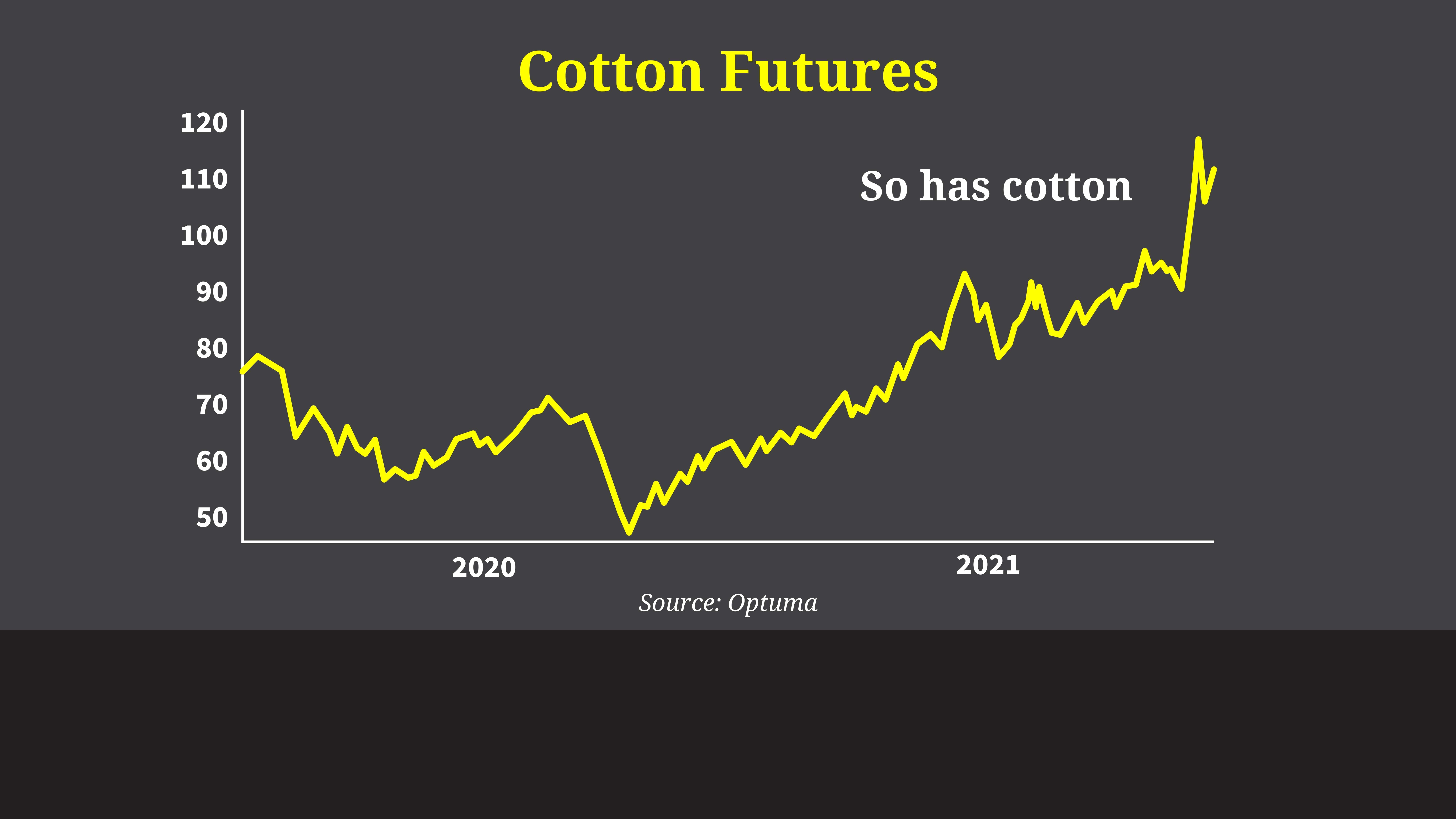

Cotton…

|

|

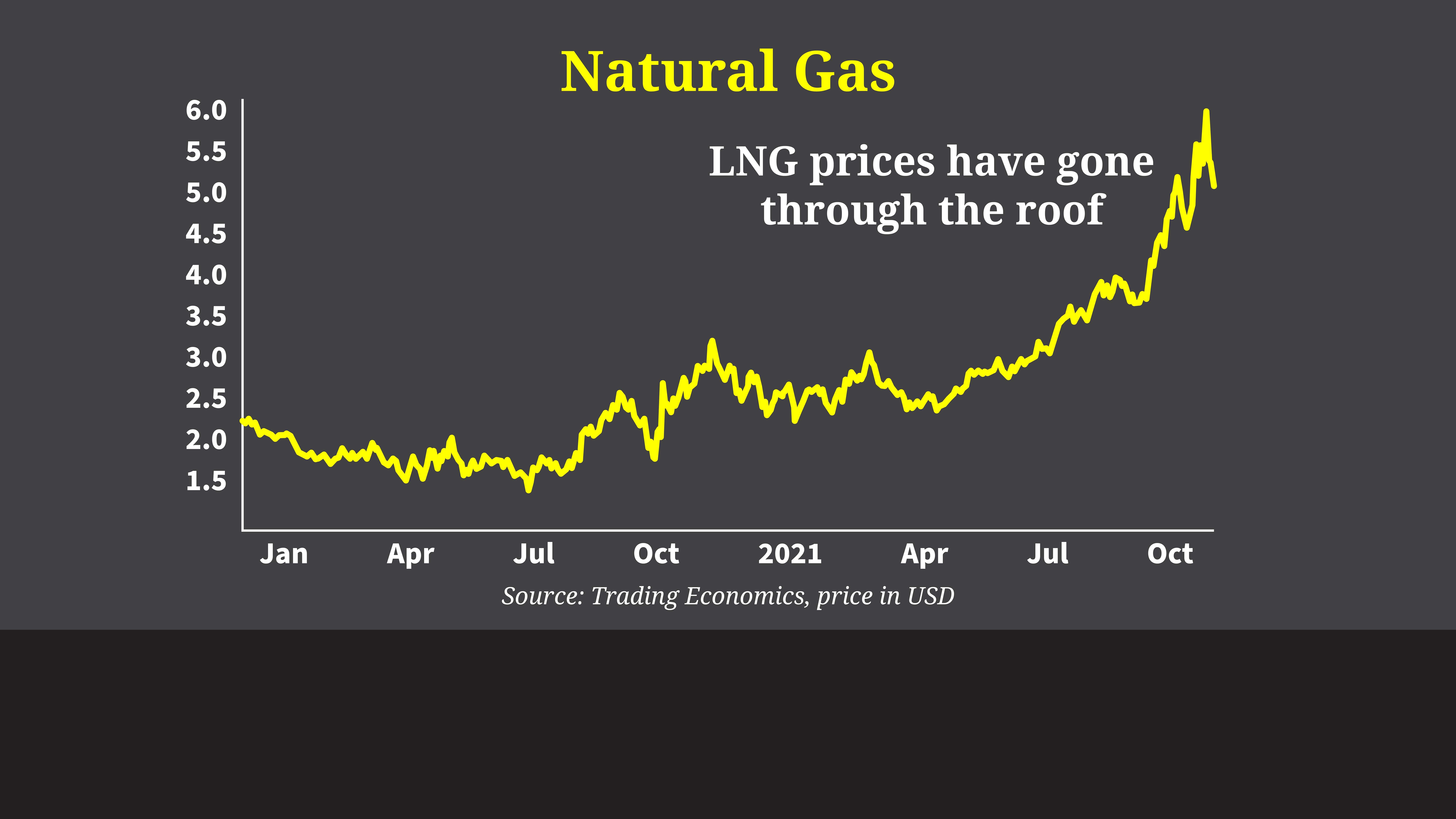

Liquid natural gas…

|

|

Even that most ‘hated’ of commodities — coal — has gone nuts…

|

|

If you’ve missed any of these moves, charts like that probably sting. When you’re on the outside, it can feel like everyone is benefitting but you.

The question is — why?

I think I know.

Now — before I go on, a quick disclaimer. I’m not here to try and convince you we’re in the middle of a bubble or markets are on the cusp of collapse.

There are plenty of doomsayers out there who’ll tell you that story.

They’re pretty good at it, by now.

After all, most of them have been telling it since 2008. Predicting that markets are about to collapse is a great way of getting people’s attention. ‘Doom porn’, you might call it.

The problem is those doomsayers have been wrong for the best part of a decade and a half. Markets have powered to new highs. Even the pandemic couldn’t hold them back for long.

Anyone who’s been out of the market in this time might have felt smug, but they’ve missed out on some of the best wealth-creating opportunities in history.

So assuming we share that goal — wealth creation — let me explain why markets are roaring higher.

It comes back to that idea I discussed yesterday: land. (Check out yesterday’s piece here if that went over your head.)

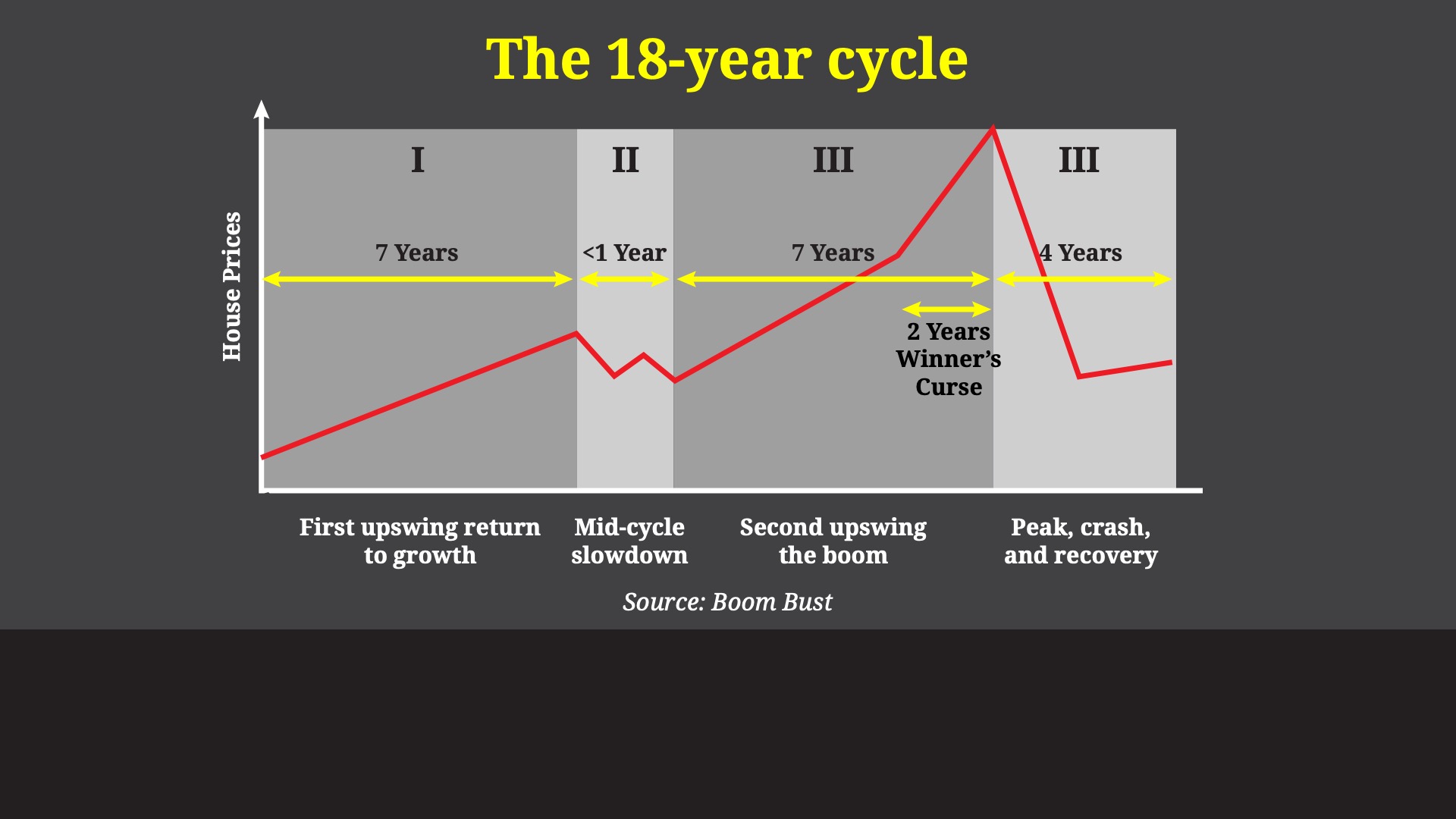

See, land prices move in a very predictable way. We call this the Grand Cycle. It works like this:

Each cycle lasts approximately 18 years. We tend to see seven years of land price growth, followed by a short recession. Then we see another — much bigger — seven-year period of booming land prices, followed by four years of decline and economic hardship. Then the cycle begins again.

That four-year period tends to be when we see housing and stock market crashes. We also tend to see banking problems, recessions, and other catastrophic events like that.

This graphic tells the story fairly well:

|

|

This is all driven by land prices, remember.

A booming land price drives everything from property to banking credit, to the wider financial markets (at least, if you’re a student of land, history, and the Grand Cycle, that’s what you believe).

Once you start looking at things this way, everything sort of clicks.

The last ‘bust’ was 2007–11. That’s when land prices globally went into reverse and the world banking sector went to the brink.

Wind the clock back 18 years from there, and where do you land? The early 1990s recession.

Another 18 years back and you hit…the global crisis of the early 1970s. Most people will tell you that was driven by OPEC. But it just happens to fit perfectly into…the Grand Cycle.

I could write pages about the past, but I’d rather focus on the future.

Why?

Because we’ve just seen the ‘mid-cycle’ recession. It was short and sharp. But land prices didn’t decline. Now we’re entering the second half of the cycle — traditionally the most profitable time.

And — right on cue — we’re seeing land, property, stock, and commodity prices go nuts.

Coincidence?

Nope.

This is all part of what you’d expect if you study the Grand Cycle.

And here’s the best part: there IS a specific playbook you can use to potentially profit from the next phase of the cycle.

In fact, tomorrow, we’ll be sharing the five specific things you can do with your money in 2022 and beyond if you want to set yourself up to capitalise.

More on that tomorrow.

Until then,

|

Callum Newman,

For Money Morning

PS: Don’t forget to check out my free podcast here. Already we’ve covered commodities, property, cannabis, day trading, and gold shares. And there’s plenty more coming up…and it’s all FREE. Give it a go!