In today’s Money Morning…central bankers will get their way and then some — lessons from the GFC…industrial metals are now tech metals means nickel story isn’t over…the catalyst for this move?…and more…

In this episode of The Money Morning Podcast, I discuss all things resources with Adriatic Metals Pls [ASX:ADT] Managing Director and CEO Paul Cronin. Adriatic Metals has a polymetallic project in Bosnia and Herzegovina, and we talk about the outlook for industrial metals, precious metals, and EV battery materials like nickel. If you are into mining stocks, it’s a great listen.

*

I had a great chat with a CEO of an ASX-listed resource company recently, and he expressed scepticism about new production processes putting a serious and sustained dent in the nickel price.

He said this based on decades of experience in the resources sector.

That’s one of the big things I learned in the latest episode of The Money Morning Podcast — be sure to check that out.

And today’s article is all about how I’m bullish on pretty much every resource out there. Nickel in particular — which I’ll get to in the second half of this article.

I know it could be seen as over the top to have such broad-based bullishness, but I’m unconcerned.

Here’s why I think that’s not a problem.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Central bankers will get their way and then some — lessons from the GFC

A big part of it is down to the fact I think reflation will give way to inflation.

Reflation is defined as:

‘A fiscal or monetary policy designed to expand output, stimulate spending, and curb the effects of deflation, which usually occurs after a period of economic uncertainty or a recession. The term may also be used to describe the first phase of economic recovery after a period of contraction.’

Now, we’ve seen unprecedented fiscal AND monetary policy stimulus rolled out across the globe.

However, within our editorial circle at this business there is diversity of opinion on the deflation/inflation debate.

Which is a good thing.

If we were some hive mind, we’d all be wrong at once.

But my reasoning for the inflation angle is this — central bankers generally get what they want.

Sometimes they even get more than what they want.

Cast your mind back to the GFC when the Troubled Asset Relief Program (TARP) was rolled out.

The Fed had supposedly done all it could, so the US Treasury took the lead on the fiscal front.

The Treasury bought up a swathe of toxic assets while also giving the Fed a piece as well.

As per thebalance.com:

‘Treasury loaned the Federal Reserve $20 billion in TARP funds. The Fed created the Term Asset-Backed Securities Loan Facility (TALF). The Fed lent TALF money to its member banks so they could continue offering credit to homeowners and businesses.’

Fancy that, a government loaning to a central bank?

That’s how whacky the GFC was.

But these days, with Modern Monetary Theory coursing through the veins of central bankers, the whacky meter is about to go into the red zone.

Negative rates and yield curve control (to say nothing of central bank-backed digital currencies) are part of an ever-expanding playbook.

So I think this time round, reflation will give way to inflation in a big way — in turn making commodities attractive as a hedge against runaway inflation.

That’s my broad commodities boom thesis explained.

But let’s talk about resources and especially nickel.

Resource speculation is a national pastime in this country, after all.

Industrial metals are now tech metals means nickel story isn’t over

On top of the reflation to inflation narrative, industrial metals are quickly rebranding as tech metals.

Things like copper and nickel — which were frequently thought of as boring old resources — are now essential to the EV boom.

This is the unfolding demand element to the puzzle.

I recently shared these quotes from a fund manager for Janus Henderson with subscribers of Exponential Stock Investor (emphasis added):

‘EVs and renewable energy thematics all need materials. Whether that’s battery raw materials for the lithium-ion battery and for other types of battery. There are other technologies, other chemistries, that will be applied over time. As other examples, wind power and solar power also need raw materials, such as copper, nickel, manganese and cobalt.

‘We’re seeing a structural-driven, demand-driven scenario that will last for quite a few years.’

Continuing:

‘Let’s say by 2040 40% of all new vehicles are EVs.

‘In base metals, such as copper, you have to produce an additional 3 million or 4 million tonnes of copper in a 25-, 26-million tonne market.

‘That doesn’t sound big, but it’s huge. To build that much new capacity, commodity prices need to be high enough to incentivise new exploration, new discovery and development.

‘And in nickel, which is used in lithium-ion batteries, that market could double in scale over that period. But again, it’s a significant undertaking.’

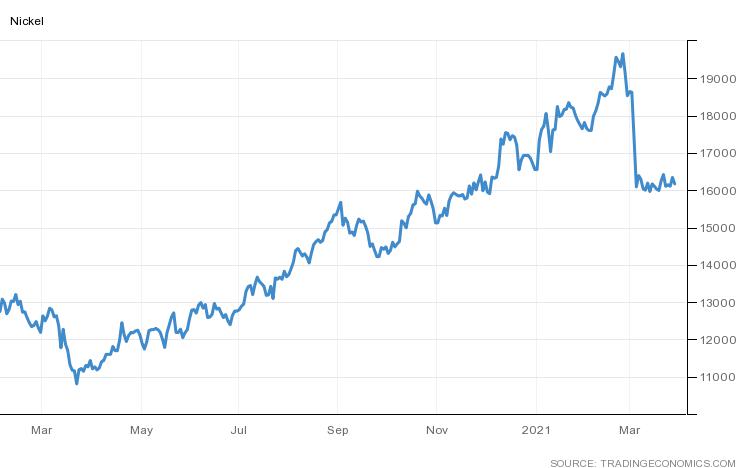

But nickel investors are likely familiar with the recent strong pullback in the nickel price:

|

|

| Source: Tradingeconomics.com |

The catalyst for this move?

As per Forbes:

‘China’s Tsingshan Holding Group announced that [they] had started producing a battery-grade form of nickel from low-grade saprolite ore, a technical breakthrough which threatens to flood the nickel market.

‘Until Tsingshan said it would be produce 75,000 tons a year of nickel-in-matte for conversion into nickel sulfate for battery-making customers the primary market for saprolite-sourced nickel was in the production of stainless steel, Tsingshan’s specialty.

‘Most battery-grade nickel comes from nickel sulphide ores mined in Canada and Australia with a sudden surge in demand from battery makers the major reason why BHP did not sell its nickel division after years of trying to offload the operation.’

The problem with this though, is that ‘by some estimates…the carbon emissions are 10-times higher than hydrometallurgical (liquid) processes.’

In my eyes, this means those high-grade Canadian and Australian deposits should survive this scare, given the need for green nickel, not just any old nickel.

So, the nickel story is far from dead.

Moreover, as part of the big commodities + inflation narrative (which we call the ‘Supercell’) it’s nowhere close to finished.

You can find a full rundown of our commodities ‘Supercell’ thesis right here.

Regards,

|

Lachlann Tierney,

For Money Morning

Comments