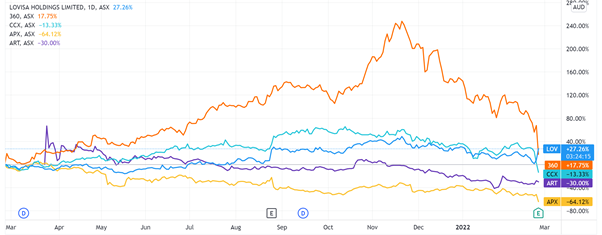

We examine the trading updates from City Chic Collective Ltd [ASX:CCX], Lovisa Holdings Ltd [ASX:LOV], and Life360 Inc [ASX:360].

Source: Tradingview.com

It was a day of big moves on the ASX.

ASX blue-chip stocks fell 2.4% by midday on Thursday, as companies released their earnings to markets preoccupied with geopolitical tensions and inflationary pressures.

Life360 and Appen Ltd [ASX:APX] registered the biggest moves.

360 shares plummeted as much as 30% on widening losses while APX shares sank 20% on lower profit in FY21.

Let’s delve into the details.

Lovisa shares rise…while rivals fall

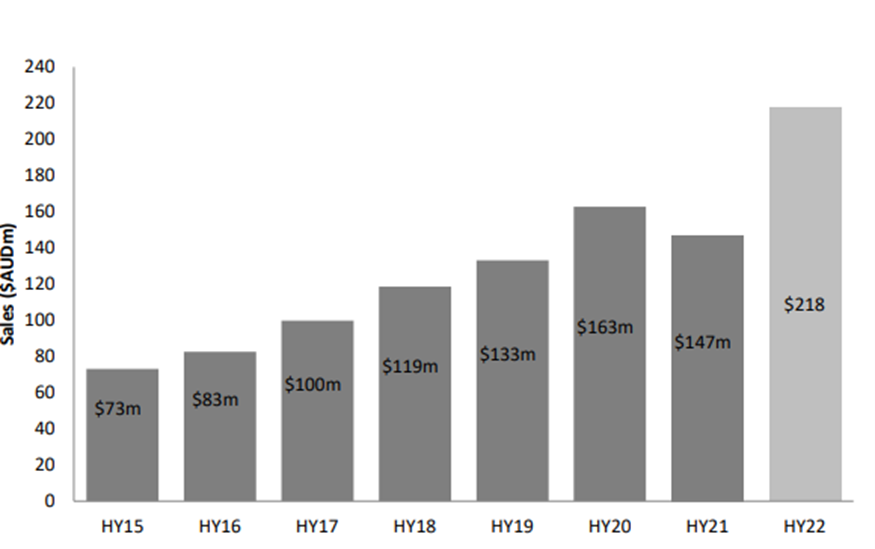

Lovisa, the jewellery retailer, released its 1H FY22 results…and saw its shares rise as high as 20% in mid-day trade.

LOV’s half-year revenue grew 48.3% to $217.8 million.

The retailer maintained gross margins of 78.3% during the reporting period, with gross profit up 50.5% to $170.7 million.

Net profit after tax came in at $36.7 million.

Lovisa’s operating cash flow hit a healthy $53.6 million, with a cash conversion rate of 93%.

Cash conversion is a handy tool to measure how much cash flow a company generates compared to its accounting profit.

The higher the rate, the more cash a business generates per dollar of accounting profit.

Source: Lovisa

The boost in profit saw LOV distribute an interim dividend of 37 cents a share, 30% franked.

The H1 FY21 interim dividend was 20 cents a share.

Despite the revenue growth, Lovisa management was unable to give clear guidance.

LOV said:

‘Our balance sheet remains strong with available cash and debt facilities supporting continued investment in growth and we have added a further 3 stores since the end of the half, taking the store network to 589.

‘As a result of the current uncertainty in the global economic environment we are not in a position to provide any further information in relation to outlook for the business.’

While Lovisa shares soared on Thursday, the shares of Lovisa’s rivals fell.

City Chic falls 30% on interim results

Fellow retailer City Chic Collective’s market cap got cut by almost a third…in one day…as investors sold off CCX shares following the FY22 interim results.

While CCX’s revenue grew 49.8% to $178.3 million, statutory net profit after tax slumped 5.9% to $12.3 million.

While CCX reported strong top line growth, the business’s bottom line may not have impressed investors.

Despite growing its customer base 64% to 1.32 million active customers, CCX also saw its cash balance reduce 46% to $38.7 million.

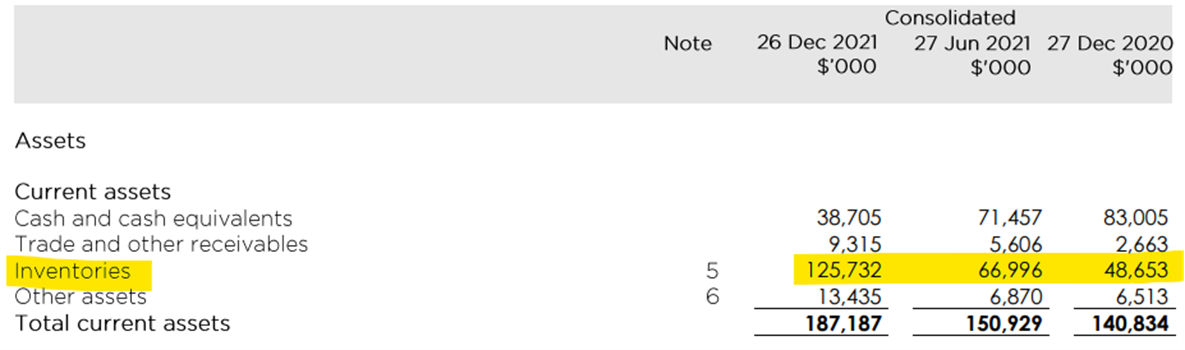

Another potential issue spooking investors is City Chic’s rising inventory:

Source: City Chic Collective

CCX’s inventories ballooned to $126 million from $49 million this time last year.

Regarding this increase, City Chic commented:

‘The increase in inventory is aligned with the growth of the business globally, including the acquisitions of Navabi and Evans in the prior year and current reporting period respectively. The increase is driven primarily by the Group’s decision to take greater control of its supply chain as a response to the continued global supply chain pressures, including freight capacity shortages.’

And while sales rose, so, too, did expenses.

Take CCX’s cash flow statement.

While customer receipts rose from $126 million to $197 million, payments to suppliers and employees rose from $104 million to $213 million.

Life360 plummets 30%

City Chic was not the only stock suffering from a sharp sell-off.

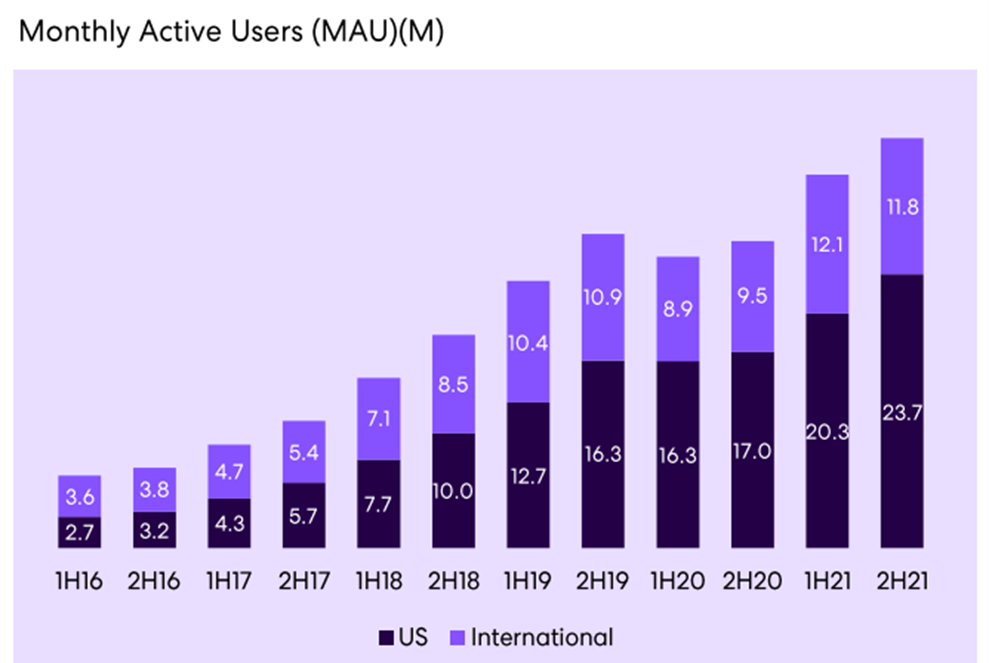

Family safety tech stock Life360 fell more than 30% on Thursday following the release of its full-year results.

360’s FY21 revenue rose 40% to US$112.6 million but statutory EBITDA loss widened to US$31.4 million.

Life360’s underlying EBITDA was also negative — even after excluding stock-based compensation, acquisition costs, and fair value revaluations.

Underlying EBITDA loss totalled US$13.1 million, up on a US$7 million loss on the prior corresponding period.

Life360 attributed the growing losses to investment in growth initiatives.

Source: Life360

Life360’s growing revenue came at a steep cost.

Growth in operating expenses outpaced growth in revenue, with operating expenses jumping 49% to US$121.3 million.

Sales and marketing made up 52% of 360’s gross profit.

Now, the big swings today suggest the market is becoming more volatile as it grapples with geopolitical tension and inflationary pressures.

The future is murkier…and the risks higher.

But that doesn’t mean we can’t take a stab at analysing what trends are set to shape the markets in the years ahead.

We’ve recently published a research report on nine investment trends we think are worth watching in 2022 and beyond.

To read the report, click here.

Regards,

Kiryll Prakapenka,

For Money Morning