From BNPL to energy, we examine the trending ASX news on Tuesday, 23 November 2021.

The benchmark S&P/ASX 200 [ASX:XJO] is inching higher on Tuesday morning, propelled by a rebounding iron ore price which pushed the big miners Fortescue Metals Group Ltd [ASX:FMG] and Rio Tinto Ltd [ASX:RIO] higher.

Mining giant BHP Group Ltd [ASX:BHP] is also up in morning trade as it edges closer to completing its deal with Woodside Petroleum Ltd [ASX:WPL].

ASX BNPL: IOU shares down on quarterly update

The IOUpay Ltd [ASX:IOU] share price is down almost 5% in late morning trade as the BNPL stock provided a mid-December quarterly update.

IOU’s operational update contained information current to 14 November 2021. Let’s get into the numbers:

- Total transaction value between 1 October and 14 November was $3,189,092

- Net transaction revenue was $306,616

- 2,613 merchants onboarded, up 13% since 30 September

- 28,370 consumer downloads of myIOU, up 67% since 30 September

- 8,201 consumer activated accounts, up 71% since 30 September

- Income margin was 9.6%

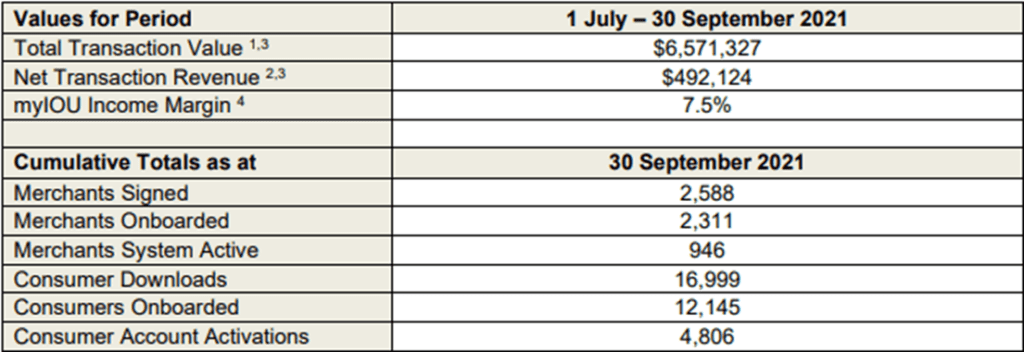

For reference, here were the key metrics for IOU’s September quarter:

As IOU mainly operates in Malaysia and Indonesia, its metrics are impacted by the countries’ COVID-19 response.

Regarding this, IOUpay said the Malaysian economy is now opening up, increasing its merchant acquisition.

IOU said its business development staff were more active in the first half of the December quarter, ramping up in-person marketing and merchant engagement.

At its most recent completed quarter (September), IOU had $39.5 million in cash and call deposits on operating cash outflows of $7.7 million.

For more research on fintechs, check out our free report on the emerging industry set to discomfit the big banks.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Life360 shares halted on acquisition news

Life360 Inc [ASX:360] — a communications and safety app used by families — is set to acquire 100% of Tile for US$170 million.

The deal will also include a further US$35 million in retention awards for Tile employees.

In total, the acquisition is set to cost about US$205 million.

Life360 described Tile as a global leader in location services, helping customers pinpoint millions of items daily.

As Life360 explained:

‘The combination of Life360, the leading family safety platform, and Tile, the market leader in finding things, creates an integrated market leader in location solutions for all life stages, enabling a seamless experience for families that integrates people, pets and things. Life360 will be the only vertically integrated, cross-platform solution of scale in the market and will be well-placed to take advantage of the growing location solutions category.’

As at 30 September 2021, 360 had 33.8 million monthly active users spread across 195 countries.

To fund the acquisition, 360 will undertake an equity raising, involving:

- AU$119.8 million 1-for-15.64 accelerated non-renounceable entitlement offer of new Life360 CDIs

- AU$160.2 million placement of new Life360 CDIs to institutional investors

Life360 also used today’s update to reaffirm its guidance of Annualised Monthly Revenue by December 2021 in the range of US$125–130 million, excluding recent acquisition Jiobit.

Including Jiobit, Life360 expects CY21 revenue in the range of US$109–113 million and an underlying EBITDA loss of US$14–18 million.

Tile will not contribute to Life360’s financial results for CY21 as the acquisition is forecast to close in Q1 CY22.

Life360 also expects to ramp up its investments to turbocharge growth. As a result, the company believes its operating cash outflow will rise in CY22 versus CY21, offset by accelerated revenue.

Life360 shares are up 250% in the last 12 months, demonstrating the potential of the small- to mid-cap sector.

For more research and insight into small-caps, I highly recommend checking out Australian Small-Cap Investigator, a service run by two of our equity gurus — Murray Dawes and Ryan Clarkson-Ledward.

Paradigm share price flat on interim clinical trial data update

Paradigm Biopharmaceuticals Ltd [ASX:PAR] — the clinical stage biopharma stock — updated investors on ‘positive interim data’ from a phase II rare disease trial.

Specifically, PAR reported preliminary data on the pilot study of pentosan polysulfate sodium (PPS) centred on treating mucopolysaccharidosis type I (MPS-I) that Paradigm will present at the 14th International Congress of Inborn Errors of Metabolism in Sydney (ICIEM 2021).

As PAR explained, MPS-I is a rare disease currently without a cure. It is caused by reduced levels or lack of an enzyme responsible for the break down of glycosaminoglycans (GAG).

The disorder afflicts neurological, skeletal, and cardiovascular development.

The interim data came from three patients who are over halfway through their 48-week treatment regime.

PAR said the interim results provide ‘evidence PPS could help address the unmet medical needs of MPS-I patients and supported further studies.’

Paradigm said it’s currently chasing strategic partnerships to advance its current and planned clinical studies evaluating PPS as a treatment.

BHP and Woodside agree to create global energy company

BHP and WPL shares are rising today as the two companies finalise a $40 billion petroleum merger.

The merger will see Woodside acquire BHP’s petroleum assets in return for a 48% stake in the new combined entity.

BHP said the merger will create a global top 10 independent energy company by production and the ‘largest energy company listed on the ASX.’

WPL and BHP expect the newly formed giant to have a high-margin oil portfolio, long-life LNG assets, and the ‘financial resilience to help supply the energy needed for global growth and development over the energy transition.’

The merged Woodside-BHP Petroleum is forecast to have production of 200 million barrels of oil equivalent and reserves of two billion BOE, with a market cap pushing over $41 billion.

The merger is set to result in synergies of more than US$400 million per annum pre-tax.

Sustainable and affordable energy is a huge global issue, especially as the world shifts to greener energy.

For more on the coming energy disruption, I suggest giving this free energy report a read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here