In a solid feat of exploration and resource growth, Astral Resources [ASX:AAR] has achieved yet another resource upgrade at its flagship Mandilla Gold Project in WA.

After aggressive six months of in-fill drilling, the mineral resource estimate (MRE) of the Mandilla Gold Project has been increased by 22% in total contained ounces — its fifth resource upgrade in 26 months.

This brings the total Indicated Resources of the Mandilla Project to 37Mt at 1.1g/t Au for 1.27Moz of contained gold.

Investors were excited by the prospect, with the share price up by 5.38% today, trading at 7.9 cents per share.

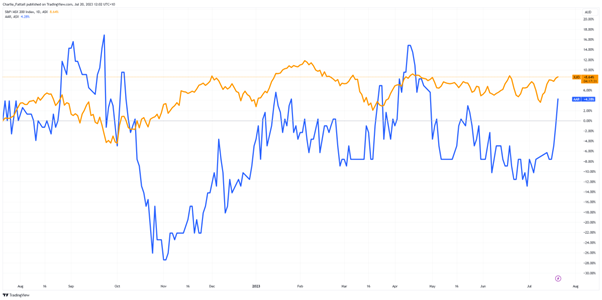

It’s been a relatively quiet year for Astral Resources, formally known as Anglo Australian Resources. The company changed its name in early May 2022 and has seen share prices move sideways as gold prices fell from their peak in March 2022 to their lowest point in November 2022.

Since the slow and steady climb out of that trough by gold, the company has seen its share price increase by only 4.28% in the past 12 months, underperforming other junior explorers.

But with gold prices recovering and the potential of the mine expanding, what’s next for the AAR?

Source: TradingView

Over the one million milestone

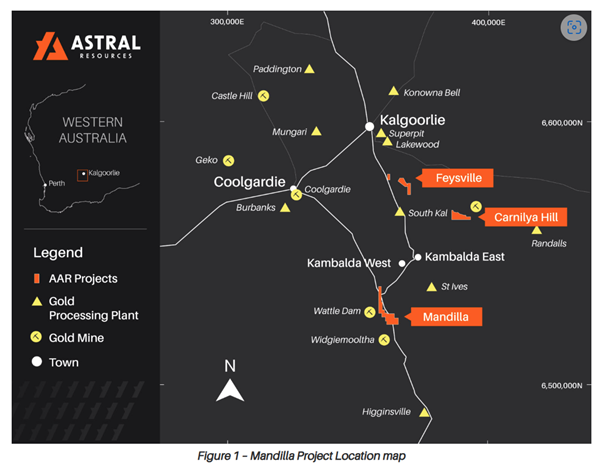

Astral Resources announced a 22% increase in total contained ounces and a 69% increase in indicated resources at its Mandilla Gold Project, 70 kilometres south of Kalgoorlie in WA.

According to the updated mineral resource estimate (MRE), the Mandilla Gold Project now boasts 1.265Moz of contained gold, up 22% from the previous estimate of 1.03Moz reported six months ago.

This marks the fifth MRE for the Mandilla Gold Project in the past 26 months, reflecting Astral’s ability to continuously grow its mineral resources, primarily through an infill drill program.

The Theia deposit, a flagship asset for Astral Resources, has surpassed the milestone of one million ounces of resources within a single $2,500 pit shell, providing a positive outlook for the project’s development.

Source: Astral Resources

AAR also posted impressive gains at the Hestia site of the project, mainly through an extensional drill program, resulting in a 583% increase in Inferred Resources.

This brings the company’s total MRE for the Mandilla Project to:

- Indicated MR of 21Mt at 1.1g/t Au for 694Koz

- Infrerred MR of 17Mt at 1.1g/t Au for 571Koz

Including its nearby Feysville Project, the company’s total gold MR stands at:

- 40Mt at 1.1g/t Au for 1.38Moz of contained gold

The company added 231,000 ounces of gold to the Mandilla MRE at an impressively low discovery cost of $18 per ounce.

With the updated MRE in hand, Astral Resources plans to incorporate the data into a scoping study, which is currently in progress and set to be delivered in the first half of 2024.

This study will provide insights into the feasibility of mining operations and the potential for future production.

Astral Resources’ Managing Director, Marc Ducler, expressed his delight at the outcome, saying:

‘This is another amazing performance by our exploration team and an exceptional result for shareholders…

‘The 2024 financial year is shaping up as a transformational year for Astral, as we begin our transition from junior explorer to mine developer. We expect to be able to continue delivering Resource growth at our gold projects while simultaneously advancing our technical studies through the 2024 financial year’

Astral resources outlook

The company’s considerable growth in the Mandilla MRE is a positive sign for investors. As they advance into the mining study phases, eyes are on Astral Resources to see how their scoping study unfolds.

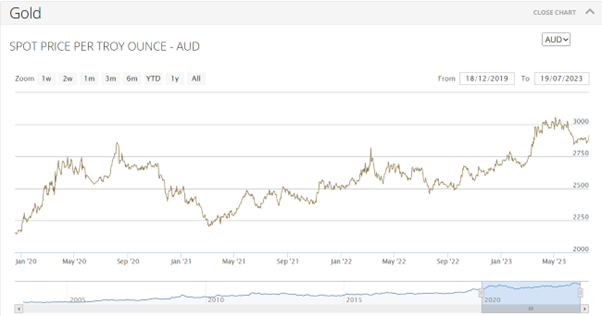

The long-term outlook for gold is bullish and could provide the company with some positive upside and a more explicit mandate to build a standalone mine in the area.

Source: ABC Bullion

With the discovery of additional ounces at a low cost, Astral Resources exhibits the potential for further growth of the MRE as they expand beyond infill drilling towards other hopeful sites.

The updated resource estimate also gives Astral Resources a stronger platform to secure funding for project development.

With a short capital runway, the company may look to raise funds based on these results, which could provide an entry for investors looking towards long-term gold price action.

Overall, Astral Resources’ positive outlook in the Eastern Goldfields region makes it an intriguing player to watch in the WA landscape.

Junior gold explorers are benefiting from increasing gold prices. With a longer-term outlook for gold and an uncertain macro outlook, can investors also gain?

Investing in gold to secure your future

In today’s economy, financial pressures are mounting, and uncertainties loom large.

Safeguarding and growing your wealth has never been more crucial.

However, navigating this landscape becomes daunting, especially with increasing interest rates, soaring energy bills, and the high cost of living.

But here’s the key: don’t let these emotions keep you from seizing potentially rewarding opportunities.

During times like these, smart investors make their move, positioning themselves for success.

But moves in a risky stock market may not always bear fruit.

That’s why we think an intelligent play today might be buying gold.

An asset that usually holds its value in uncertain times and can even grow when markets fall.

In our newest guide by Brian Chu, gold expert and esteemed editor of Gold Stock Pro, we will show you how.

With Brian’s invaluable insights, this comprehensive report serves as your roadmap to financial prosperity.

Learn how to navigate the intricate gold market, make informed decisions, and fortify your wealth against uncertainties.

Now is the time to embrace this golden opportunity.

Click here to access Brian’s latest gold report and embark on your journey towards financial resilience.

Regards,

Fat Tail Commodities

Comments