If we break down commodity markets to their simplest form, we have supply and demand… You could liken this to the Yin and Yang of the commodity world.

Equal measures of each result in a balanced market. Displace one, and the market loses harmony. Volatility rises, and prices rise or fall.

Neither is more important than the other; supply and demand play a vital role in a balanced commodity market.

But the key point is this… Most investors focus exclusively on DEMAND.

Demand controls the narrative in the commodity world—the yang, if you like.

However, supply is equally important yet often overlooked.

In mining, supply is primarily dictated by geology, engineering, investment and politics. Each component can affect the overall output for a particular commodity.

Regarding the latter, imagine a commodity concentrated in a geopolitical hotspot; political instability can destabilise a market by causing mine closures.

Regarding geology or engineering, declining grades or poor mine planning can impact an operation’s output. This is worsened by a lack of investment in finding new reserves to replace depleting assets.

Recognising the important role SUPPLY plays in a balanced market can put you ahead of most investors.

Last year, I wrote extensively about the potential supply squeeze forming in the copper market based on all the factors above.

A prolonged period of declining output at the world’s largest copper mines, lack of exploration to drive new development and geopolitical instability.

All these factors offered the perfect melt-up for higher copper prices.

The copper squeeze

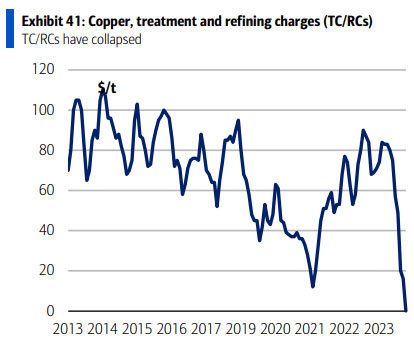

In late 2023, the copper squeeze had begun. The world’s largest copper refiners began to cut fees to compete for the limited supply of concentrate in the market.

A sign that the market was falling into deficit due to years of underinvestment in exploration, mine development, and geopolitical tensions.

| |

| Source: Woodmac, Bloomberg, BofA Global Research |

So, what was the consequence?

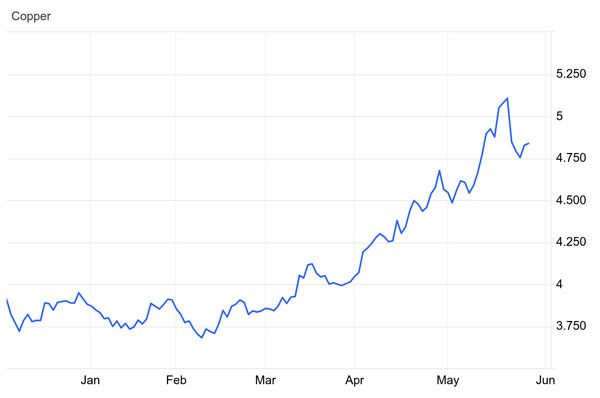

Copper prices surged from around US$3.70 per pound late last year to over US$5.00 late last month.

| |

| Source: TradingEconomics |

Yet, as you’ve probably noticed over the last several weeks, the copper SUPPLY story has become rather mainstream.

How far could this market go?

Who knows. Given it takes upward of 15 years to put new mines into operation, the supply problem is a long-term challenge.

Don’t expect copper’s supply problem to be fixed with a brief spike above US$5 per pound… Miners will need sustained higher prices to warrant investment in new developments.

That’s why the current copper correction should not be viewed as a major concern for longer-term investors. Resolving these supply problems will take years to correct.

But what’s the lesson from copper’s moves in 2024?

As an investor, you should pay attention to potential supply squeezes, not just copper but any commodity.

So, which commodity could be the next big winner from a potential supply squeeze?

One that hasn’t been picked up by mainstream outlets?

The answer… OIL.

Supply problems emerge from the failure

to find new reserves

Over time, near-surface deposits deplete. That pushes geologists further into the Earth’s crust to find new deposits.

Exploration and extraction are both becoming more difficult and expensive as mines become deeper.

It’s similar to oil and gas… As onshore and nearshore basins deplete, explorers must seek new reserves in deeper unexplored basins.

Again, this drives up exploration and development costs.

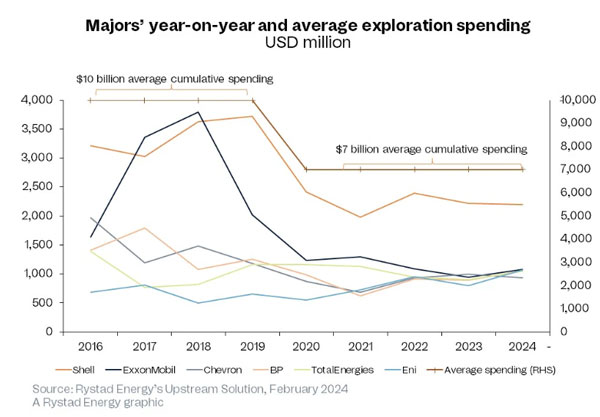

Yet, like mineral exploration over the last several years, investment has declined in oil and gas exploration.

As you can see below, average cumulative spending has fallen from US$10 billion to just US$7 billion over the last eight years.

| |

| Source: Rystad Energy |

So, what’s the consequence of this?

According to IHS Markit, reported oil and gas finds had recently sunk to their lowest level in over 75 years. In other words, discovery rates in the early 2020s were on par with the mid-1940s.

Just to put that in perspective…

Back in the mid-1940s, the global population was around 2.5 billion. Today, it’s 220% higher, with around 8 billion people.

With about 5.5 billion more mouths to feed, plus many more homes to heat and goods to transport, energy needs have grown exponentially.

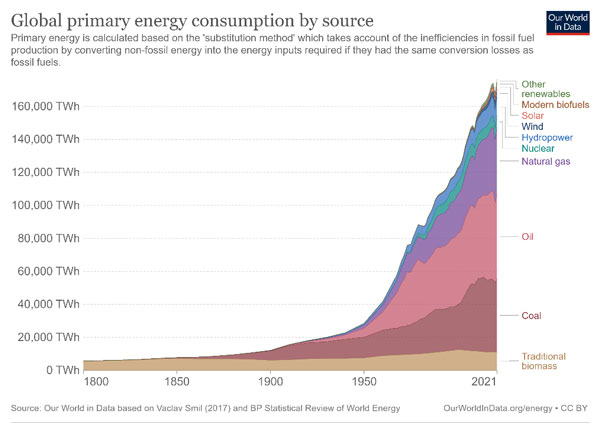

As the graph below shows, in 1946, energy demand stood at 20,000 TWh (terawatt-hours).

| |

| Source: Our World in Data |

By 2021, this has escalated to a staggering 160,000 TWh.

In short, the industry’s discovery rate is similar to 75 years ago, yet energy demand is around eight times higher!

That puts incredible pressure on current reserves and sits at the heart of the looming energy problem.

Rapidly declining oil fields without replacement reserves in sight.

So, why not ramp up exploration now and address the supply squeeze before current reserves deplete?

Well, even if the global economy recognised that we still live in an oil-fuelled economy, thus need to continue finding more oil… these new reserves won’t come fast enough.

It takes at least 7-10 years to bring a new oil field discovery into production.

That’s why the world’s largest oil producer is sounding the alarm on energy security… According to Saudi Aramco’s chief, global spare capacity for oil and gas supplies is now extremely tight, at around 2%.

Suffice it to say, the oil market could be precariously out of balance.

Your ticket to history’s last oil boom

Given the world remains committed to ending fossil fuel reliance, we could be at the cusp of history’s LAST oil and gas boom.

Yet, that doesn’t mean this boom will be any smaller than those from the past.

Oils’ (eventual) demise seems inevitable… But don’t expect oil to leave the global stage quietly.

Despite efforts to transition toward renewables, we remain in an oil-fuelled economy.

Given this major global oversight and the lack of attention to developing new oil fields or exploring for new basins, crude offers a highly favourable SUPPLY dynamic.

If you missed copper’s breakout in 2024, ensure you don’t miss the potential surge in oil prices.

To make it as easy as possible, I’ve just finished putting together a new report, outlining the full opportunity.

You can access it for free here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments