Argosy Minerals [ASX:AGY] shares rose 6% after an update on its Rincon Lithium Project operations in Argentina.

AGY, the lithium developer, bucked the wider market sell-off, rising on a day when the ASX 200 slid as much as 1.2% on Thursday.

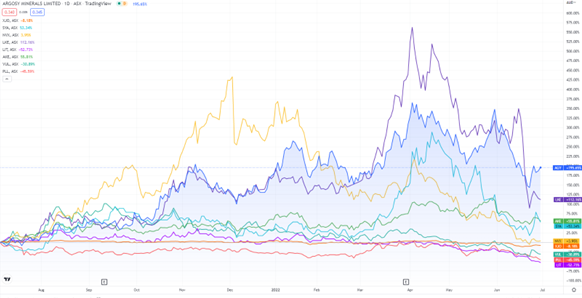

While AGY shares are up a strong 250% in the past 12 months, the lithium stock has not been immune to the lithium sector correction, down 20% in the past month.

Source: Tradingview.com

Argosy’s Rincon Lithium Project update

This Thursday morning, Argosy revealed that 90% of total development works at its Argentina-based Rincon Lithium Project are now complete.

Argosy said it is now one step closer to operating a project capable of producing 2,000 tonnes a year of lithium carbonate.

The operation has now passed its design and engineering phase, 94% of its construction and 42% commissioning.

AGY is targeting the first production of battery-quality lithium carbonate during Q3 CY22.

In terms of budget, Argosy said things were on track.

So far, the operation has involved the installation of equipment and auxiliary systems, an office and laboratory, and expanded accommodation and recruitment.

Production testing and plant commissioning are the next hurdles, and once construction is complete, the eagerly awaited 2,000 tonnes of lithium a year can officially begin.

Source: AGY

AGY share price outlook

Argosy’s Managing Director Jerko Zuvela commented on the project’s progress:

‘The Company’s Puna operations team are getting closer to completing construction works and progressing with plant commissioning works, and then commencing lithium carbonate production operations.

‘The lithium market remains very positive and lithium carbonate prices are forecast to continue around record highs during 2022 and 2023, resulting in very robust upcoming product sales revenues.

‘The Company is very excited with our progress to become the next commercial scale lithium carbonate production operation, transforming into a cashflow generator, and progressing toward the next stage 12,000tpa scale operations.’

Now, the fact that we are headed towards a renewable-energy future means we’re going to need plenty of battery tech materials: lithium, copper, nickel, cobalt, graphite.

And our industry expert Callum Newman believes the rush to secure battery materials isn’t over yet.

He thinks there are ASX stocks flying under the radar who could be the next ‘chosen ones’ — stocks tipped by Tesla to be their battery materials supply partners.

To find out more, read Callum’s latest battery materials report, ‘Elon’s Chosen One’, here.

Regards,

Kiryll Prakapenka,

For Money Morning