The Afterpay Ltd [ASX:APT] share price will likely face scrutiny this month as the company faces a US class action and UBS forecasts declining growth in Australia.

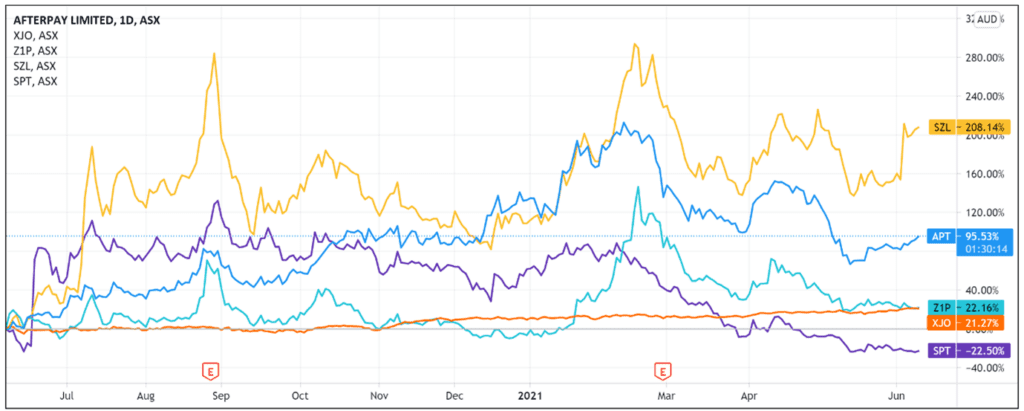

Afterpay Ltd [ASX:APT] shares were up 1.6% at the time of writing, as the ASX’s largest buy now, pay later (BNPL) provider continues to trend up after falling to $84.50 mid-May.

Despite modest gains of 5% this month, the Afterpay share price is still down 15% year-to-date.

‘Without merit’

Yesterday, the Australian Financial Review revealed that two law firms lodged a class action complaint against Afterpay in the US Northern District Court of California.

The class action claims Afterpay’s marketing is misleading over fees consumers can incur with their banks.

Crucially, the claim seeks ‘an injunction on behalf of the general public to prevent Afterpay from continuing to engage in its illegal practices as described herein.’

The AFR reported that the crux of the claim is that the BNPL’s growth in the US concealed the ‘hidden scourge [of] hundreds of thousands of overdraft and NSF (insufficient funds) Fees its already-struggling users have to pay for using the service.’

The lawsuit further alleges that the fintech ‘misrepresents (and omits facts about) the true nature, benefits, and risks of its service, functioning of which means that users are at extreme and undisclosed risk of expensive bank fees when using Afterpay.’

The class action alleges that:

‘In its rush to tout itself as convenient, simple, automatic, and free, Afterpay does not disclose that overdraft and NSF fees are a likely and devastating consequence of the use of its service. No reasonable consumer would run this risk.’

While Afterpay does tell its customers it can charge late fees of up to 25% of a product’s purchase price, the plaintiff’s lawyers allege that Afterpay offers no further warning about banks charging overdraft and insufficient funds fees.

As the Sydney Morning Herald’s Elizabeth Knight reported, APT thinks this is not its problem ‘because it tells its customers that they need to have sufficient funds in their accounts to meet the instalment payments.’

The Weekend Australian reported that the BNPL fintech shrugged off the US class action, labelling it ‘without merit’.

An Afterpay spokeswoman further elaborated:

‘If served, the claim will be vigorously defended. The allegations relate to fees charged by a consumer’s banking institution — not Afterpay.

‘Our terms and conditions state that individuals must have sufficient funds in their account to meet their repayments. We also remind our customers regularly to ensure they have sufficient funds.’

The spokeswoman also noted if an Afterpay customer missed a repayment, their account was suspended until the payment was made.

This isn’t the first time Afterpay has been involved in a legal dispute in California.

In March 2020, the company’s US subsidiary reached a settlement with the state’s Department of Business Oversight.

The BDO concluded Afterpay engaged in the business of a finance lender without obtaining a required license. A similar settlement was reached with Sezzle Inc [ASX:SZL] earlier in the year, highlighting the sector’s regulatory teething issues.

The US is fast becoming Afterpay’s most promising market, so legal challenges threatening its operations in the lucrative jurisdiction isn’t exactly welcome news.

The market, however, isn’t much phased at the moment, with Afterpay’s share price closing higher yesterday and is up today.

Afterpay growth: Can it be sustained?

Latest research from investment bank UBS suggests APT’s growth rates in Australia could fall ‘significantly’ this year as the market matures and reaches saturation.

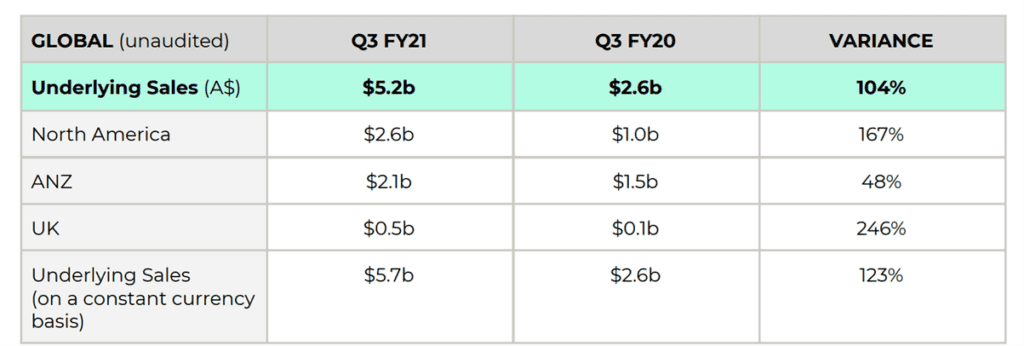

As we reported earlier this year, Afterpay’s underlying sales in Australia and New Zealand lagged growth rates in the US and UK but were still up 48% in Q3 FY21.

Importantly, APT’s North American customer base grew by 112% since 31 March 2020, whereas the Australian and New Zealand customer base only grew by 9%.

UBS reported that Afterpay’s share of total payments volume in Australia dipped to 1.04% from 1.19% over the three months ending 31 March.

UBS reiterated its sell rating on the stock, citing rising competition, tougher regulatory environment, questions about growth plan execution, and a stretched market valuation.

UBS analyst Tom Beadle thinks there is ‘increasing evidence of Afterpay’s maturity in Australia, which could result in a significant drop in its rate of growth towards the end of [calendar] 2021.’

APT Share Price ASX outlook

The potential class action underscores the oft-repeated warning about the BNPL sector — regulation.

Those more bearish on BNPL stocks frequently cite concerns regarding regulation and how it could tighten margins in a sector not yet known for its profitability.

Britain already announced in February that BNPL providers would be regulated by the Financial Conduct Authority.

And after conducting a deep dive into the sector, analysts at Jefferies concluded that while scope for growth remains, regulatory risks should not be underestimated.

Other analysts, however, highlight Afterpay’s dominance of local app store downloads, with a 66% market share in Australia.

Afterpay remains top dog in the BNPL app store in the US too, by the number of aggregate ratings, but the company has slower momentum than its peers.

Afterpay’s volatile year showcases that making investment decisions in the shadow of COVID-19 is no easy feat.

It’s important to gather the right information, sift the credible investment ideas from the incredible, and invest wisely.

And while that can be challenging, our Editorial Director Greg Canavan is excited about the opportunities the current environment presents.

We’re not talking about crypto, small-cap, or more fintech plays.

We’re talking about ideas that could

If you’re interested, then click here.

Regards,

Lachlann Tierney,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.