The Appen Ltd’s [ASX:APX] share price surged 12% after announcing a new organisational structure comprising four customer-facing business units.

The organisational shakeup reflects Appen’s evolution from a niche AI data annotation services provider, to a provider of a broad range of AI products and solutions.

Appen’s gains today bucked the overall market trend, with the ASX 200 down 1.6% at time of writing.

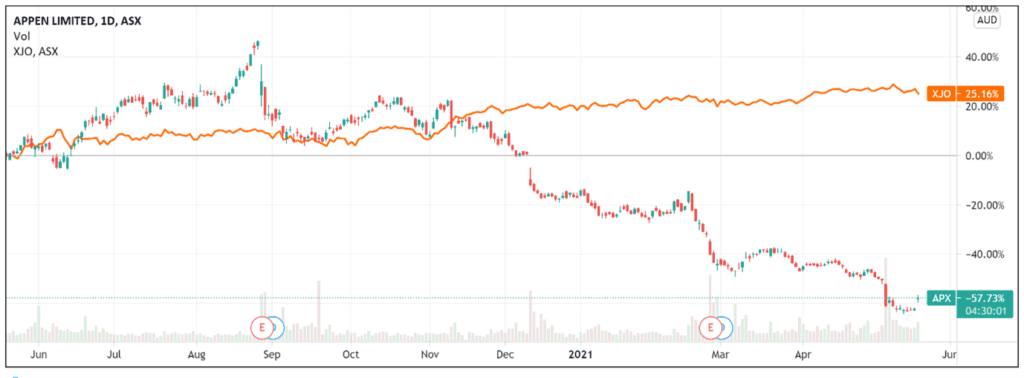

Despite the positive outlier performance, Appen shares still trade 70% lower than their 52-week high of $43.66. Currently, the APX share price sits at $12.64.

Investors will welcome today’s gains after a sustained downward trajectory in recent months.

Year-to-date APX shares are down 45%, and down 55% over the last 12 months.

Appen’s restructure

To align with its product expansion growth strategy, APX will restructure to have four customer-facing business units.

These units will be Global, Enterprise, China, and Government. The units will have the following remits:

- Global: provide data annotation services and products to major US technology customers.

- Enterprise: drive growth outside of Global’s customer base by targeting new customers and new AI use cases.

- China and Government: continue to capture share in these high-growth markets by operating separately under their current leadership.

All four business units will be supported by a further four service units: Product, Engineering, Crowd & HR, and Corporate.

Appen stated that ‘partial benefits’ of its restructure will be realised in the second half of 2021.

The AI company expects annualised gross savings (before investment) of US$15 million from 2022.

Appen attributed these anticipated savings largely to lower labour expenses following short-term restructuring costs related to redundancies.

APX also reported it will change its reporting currency from AUD to USD from the 2021 interim result onwards.

The change better reflects the company’s operations as 90% of Appen’s revenue and assets are in US dollars.

Reporting in US dollars will ‘remove the volatility that occurs when US earnings and assets are translated into Australian dollars.’

What next for Appen Share Price?

APX thinks that the rejigged structure will enable the ‘development of differentiated approaches to sales, customer experience and delivery models.’

The company also anticipates the restructure will optimise how it uses its resources.

Appen thinks this in turn will streamline business processes, reducing ‘delivery and other resource requirements.’

While the market approved of Appen’s new organisational structure judging by Appen’s share price action, some investors may still wonder at the quantitative impact of today’s announced changes.

Barring the US$15 million in forecasted annualised savings, Appen did not divulge any further figures relating to the restructure’s impact.

Should investors consider this largely a cost-cutting exercise or will it also boost revenues?

In any case, these savings, expected to be realised in 2022, will not impact Appen’s guidance for the year ending 31 December 2021, despite flagging ‘partial benefits’ from the restructure will be realised in the second half of 2021.

The company reaffirmed its previous guidance to the market in February, with underlying EBITDA for the year ending 31 December 2021 expected to be US$83–90 million.

Analysing the announcement, Wilsons Research noted Appen did not include profit margin guidance.

The research firm also stated that ‘if Appen is able to move its revenue model from project-based work to committed spend by customers, this would increase revenue visibility and decrease revenue volatility, which is a positive.’

If you are interested in stocks at the forefront of technological advancements, then I recommend reading our free AI stocks report.

It details why the AI boom could accelerate in 2021 and outlines five high-potential stocks to watch. Download your free report now.

Regards,

Lachlann Tierney,

For Money Morning