The Anson Resources Ltd [ASX:ASN] share price is up as the lithium stock ends the quarter with $8.4 million in cash.

Anson also announced positive final results from test work conducted by Novonix Ltd [ASX:NVX] using samples from Anson’s high-purity lithium products.

ASN shares are currently trading for 11 cents a share, a jump of 12%.

Both Anson and Novonix are riding strong momentum recently associated with the hot ASX lithium sector.

ASN is up 275% over the last 12 months while NVX shares are up 585% in the same period.

What did Anson get up to in the September quarter?

In important news coming out of Anson’s Paradox Lithium-Bromine Project in Utah, an updated Stage 1 preliminary economic assessment (PEA) delivered ‘lower lithium carbonate and sodium bromide operating cost estimates’ while accounting for ESG concerns.

Anson also managed to stake an additional 228 placer claims, which it considers highly prospective for lithium-rich brines.

These staked claims have increased ASN’s project footprint by 18 square kilometres, or 20%, to 114 square kilometres.

Always important for mining firms, Anson also secured approval to drill two lithium-bromine production wells located on the Little Utah State claims.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Anson to use DLE methods

The quarter also saw ASN conduct a review of its project to incorporate an alternative direct lithium extraction (DLE) process.

Initial results from this DLE process were used in the updated PEA. Anson reported the DLE process it trialled achieved a recovery of up to 91.5% without chemical washing and pre-treatment of brine.

The rise in the lithium recovery rate led ASN to increase the estimated production tonnes of LCE in Stage 1 of the project to 2,674tpa, ‘contributing to an overall improvement in project economics.’

If DLE sounds familiar, it is because it formed part of the critique levied against hot lithium stock Vulcan Energy Resources Ltd [ASX:VUL] by short-seller J Capital.

In VUL’s case, the short report from J Capital alleged Vulcan was ‘coy’ about key information regarding its direct lithium extraction methods.

JCap acknowledged DLE is a technology companies ‘around the world are feverishly working on’.

As for Anson, it reported in August:

‘Anson has successfully conducted test work at a third-party laboratory using an alternate Direct Lithium Extraction (“DLE”) technology that has improved the estimated lithium recovery rate in the first stage of the extraction process to 91.5%, an increase of over 10% from the previous test work results (see ASX Announcement 14 November 2018). DLE technologies use physical or chemical selective processes to remove lithium from brines while leaving other components in the brine.

‘The initial benchtop test work was carried out in February 2021 on 50 litres of previously extracted Clastic Zone 31 brine from the Long Canyon No. 2 well. Upon confirmation that the process worked, Anson repeated the testing on a small-scale pilot plant test using 4,000 litres of freshly extracted brine from Clastic Zone 31 of the Long Canyon No. 2 well (see Figure 1). The average head grade for the 4,000 litres brine was tested to be 200ppm Li.’

Regardless of the substance of J Capital’s report on VUL, it has highlighted that new lithium developers are, more than ever, battling each other not just on ore and grade, but tech as well.

I think we will be hearing more about DLE — and lithium developers’ patented DLE methods — in the years ahead.

Anson receives more test results from Novonix

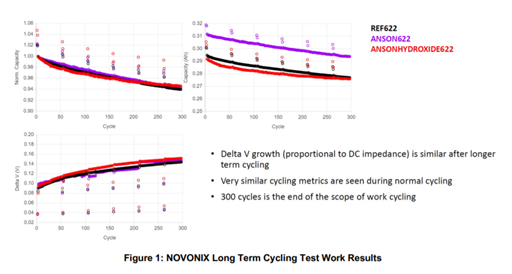

Anson today also received positive final results concerning long-term cycling test work carried out by NVX for the production of NMC622-based lithium-ion battery test cells using samples of Anson’s lithium products.

The test work was conducted at 40 degrees Celsius over three months as the batteries were cycled 300 times.

Anson said its lithium carbonate produced ‘slightly better performance than the existing commercial products in the long-term test work.’

ASN’s lithium hydroxide, in turn, demonstrated ‘similar performance to existing commercial products in long-term cycle experiments.’

Anson will now promote these test results when shopping around for potential off-take partners.

If you want extra information on evaluating and comparing lithium miners, I suggest reading our recent lithium guide.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here