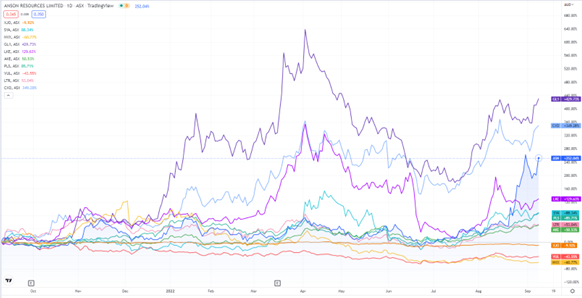

Australian lithium developer Anson Resources [ASX:ASN] rose as much as 40% on Thursday following ‘outstanding economics’ for its Paradox Project DFS.

The release of the DFS caps off a big month for the lithium stock, with ASN shares rising more than 200% in the past four weeks alone.

Over the past 12 months, ASN shares are up 370%.

Source: tradingview.com

Anson Resources DFS: ‘outstanding economics’

On Thursday, Anson Resources announced the completion of its Definitive Feasibility Study (DFS) for ‘Phase 1’ of its Paradox Lithium Project in Utah, US.

Anson said the DFS confirmed Paradox’s ‘advanced potential to become a major supplier of high purity, battery grade Lithium Carbonate’.

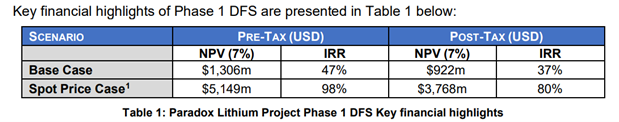

The key financial DFS estimates are captured below:

Source: ASN

‘Phase 1’ DFS suggests Paradox is capable of delivering a ‘low-cost operation with revenues of US$5,080 million forecast over 23 years of operations.’

That’s about US$221 million in revenue when annualised.

The revenue is expected to come from annual production of up to 13,074 tonnes of high purity lithium carbonate over an initial 10 years of project life.

The project is then expected to produce ‘at lower commercial levels’ if no further wells were to be brought online.

The project’s post-tax net present value (with a 7% discount rate) is estimated at US$922 million, with a post-commissioning payback period of two years.

Economics for ‘Phase 1’ of the project have been based on an existing Indicated Mineral Resource of 239,000 tonnes. However, DFS Economics could be updated based on future Mineral Resource upgrades.

Anson DFS key assumptions

Here are some key assumptions underpinning the projections:

- C1 operating costs of US$4,368 per tonne of LCE

- Long-term price assumption of US$19,000 per tonne of battery grade lithium carbonate

- Recovery rates of 91.5% using direct lithium extraction

- Annual EBITDA margin of 69%

On the topic of yearly production, Anson elaborated that its production output will shrink as it cycles mining zones:

‘Production of up to 13,074 tonnes per annum of lithium carbonate during years 1 to 10 from extracting brine from Clastic Zone 31 and the Mississippian formation, before progressing to Clastic Zones 19 and 29 during years 11 to 17, followed by Clastic Zones 17 and 33 during years 18 to 23 when production volumes are estimated at 7,723 tonnes per annum and 4,186 tonnes per annum, respectively.’

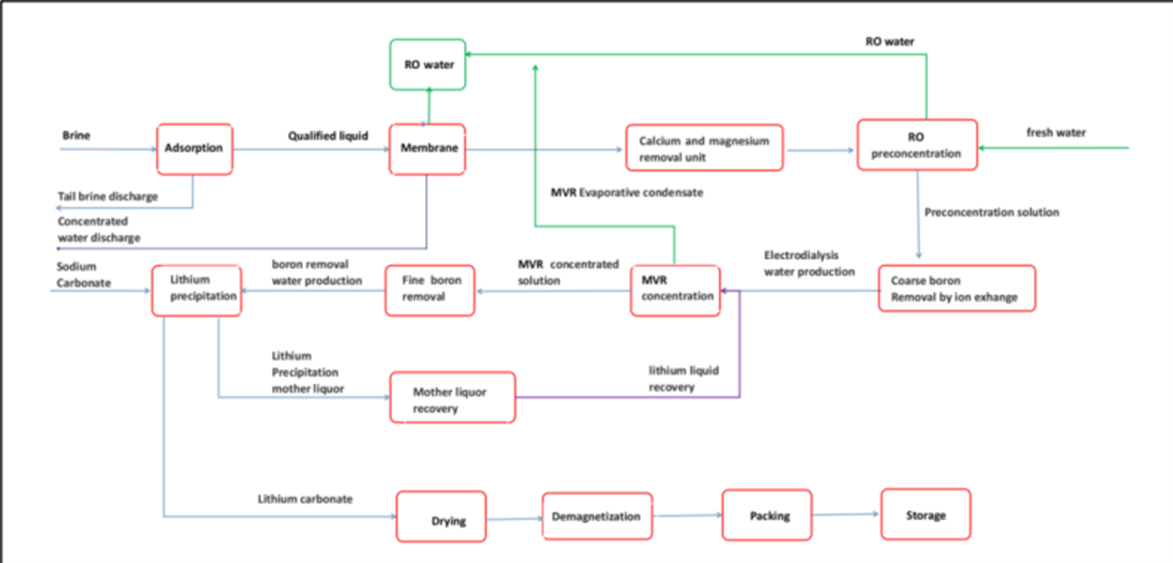

Anson also provided a detailed diagram of its planned DLE process.

DLE has been a contentious topic of late, with short-seller J Capital sceptical about the developing technology in its recent critical report on Lake Resources [ASX:LKE] — a lithium developer also using DLE.

Source: Anson Resources

Anson said its technology partner’s lithium plant would be used for its DLE technology.

What the DFS means for ASN

Anson said it is confident it can begin high purity lithium carbonate production in 2025.

As production moves closer, Anson needs to start considering further partnerships and offtake deals to ensure its product manifests profit.

Anson’s Executive Chairman, Mr Bruce Richardson, stated:

‘We are very excited to deliver the Paradox Lithium Project Phase 1 DFS to market. The DFS confirms the technical and financial viability of a major new source of high purity Lithium Carbonate available for the rapidly growing US market.

‘The Project delivers industry leading ESG credentials based on direct lithium extraction utilising Sunresin technology using lower energy and water consumption, and with spent brine being reinjected back into the Paradox.

‘Significantly, there remains material upside beyond the DFS announced today based on future Mineral Resource upgrades associated with the recently completed drilling campaign at Cane Creek and the future Western Expansion drilling campaign, as well as incorporating Bromine production into stage 2.’

Lithium stands strong

In 2021, lithium stocks were dominating the ASX — eight out of the top 10 performing stocks were lithium stocks.

But a correction, this year has seen many lithium stocks trade well down on their 52-week highs, with Anson Resources a rare exception.

It seems the easy money has been made in a hot sector.

But the lithium theme is still strong, boosted by secular tailwinds.

So, are there any overlooked ASX lithium stocks out there?

Yes, according to a recent research report from Money Morning.

In fact, the free report has outlined three Aussie lithium stocks that have been severely overlooked.

Regards,

Kiryll Prakapenka,

For, Money Morning