Three lithium competitors were announcing their news on the ASX earlier on Thursday with Anson Resources [ASX:ASN], Allkem [ASX:AKE] and Vulcan Energy Resources [ASX:VUL] all making different moves on the charts.

For ASN, the focus was on site works at its Paradox Lithium Project, updating on activities and expectations for expansions, approvals and JORC Mineral Resources speculation.

Likewise, Allkem wished to provide an update to it shareholders on drilling at the James Bay project in Québec, Canada.

Meanwhile, VUL halted on the ASX today as it prepares for a fully underwritten single-tranche placement to raise $109 million.

ASN improved its share price today by 3% to a worth of 18 cents, while AKE was mostly flat as it was barely up a half percent to the worth of $12 at the time of writing, and VUL was halted for the launch of its capital raising.

Source: TradingView

Anson’s drilling at Paradox underway

Anson Resources this morning said it has commenced site works at the Mineral Canyon and Sunburst wells as it prepares for the Western Strategy mineral resource drilling program at the Paradox Lithium Project in Utah, US.

All government appraisals have now been granted for the project, and drilling will begin once site works finish.

ASN believes this will increase the existing JORC Mineral Resource at Paradox, supporting future expansions of the group’s proposed lithium carbonate plant, and potentially boosting the 1.04 million tonnes of lithium carbonate equivalent and 5.27 million tonnes of bromine on site.

Adding to the group’s expansion strategy, the explorer plans drilling at the Green River Lithium Project, 50 kilometres to Paradox’s north-west.

Source: ASN

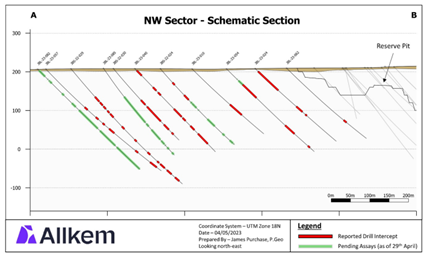

Allkem’s James Bay drilling

Allkem also posted a project update earlier this morning, sharing the latest for its resource definition drilling program at the James Bay Project in Québec, Canada.

AKE said it has discovered additional spodumene-bearing pegmatites directly northwest of the initial discoveries.

It highlighted incepting resources that included ‘125m at 1.70 Li2O from 68m in drill hole JBL-23-048, and 72m at 1.89% Li2O from 11m in drill hole JBL-23-024’. Of those results, the true thickness is estimated to be between 60% and 80% of downhole thickness.

Allkem finished its 2022-2023 winter drilling program last month, which consisted of infill and delineation, exploration, and systematic step-out.

A total of 130 drill holes were completed between the end of November 2022 and mid-April 2023, totalling 29,164 metres and approximately 6,700 assays.

Once results of the final assays are received, Allkem intends to update the James Bay MRE incorporating all new drilling results.

Source: AKE

Vulcan seeks $109 million

Vulcan launched a fully underwritten single-tranche placement to raise $109 million through the issue of 21.4 million shares at $5.10 each.

This represents a 17.2% discount to its last trading price which was $6.16 apiece.

The miner states that the funds raised will be put towards developing its integrated renewable energy and lithium project execution strategy, as well as general working capital and corporate needs.

Vulcan will remain halted in trade during the launch of the placement and said that it will be allotting the new shares on 12 May.

Quotation and trading will begin with the new shares on 15 May.

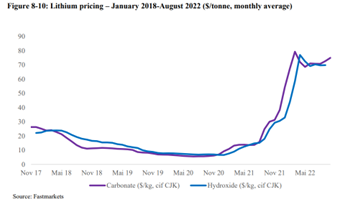

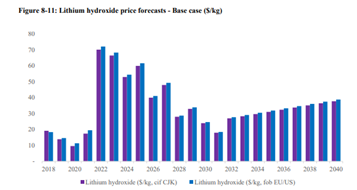

Vulcan also shared Fastmarkets predictions for LHM prices, which are narrowing in demand between Asia, Europe and the US, as nickel-rich battery chemistries are expected to increase in Asia and gain on market share:

Source: VUL

Australia’s drilling boom

There’s a ‘new golden age’ for junior explorers, and for investors who get in early.

Aussie mining is expected to hit a multi-year boom which is expected to benefit every metal on the periodic table.

Many small caps are primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

Click here to hear from James about six ASX mining stocks that are heading to top the charts.

Regards,

Fat Tail Commodities

Comments