‘Sleep, baby, sleep

‘Angels watch over you’

Jimmie Rodgers

‘You’re going to go to the hospital’, said the doctor.

‘But I don’t want to go to the hospital.’

‘Why not?’

‘I might catch something.’

‘You’ve already got something. You need to stay for at least 24 hours so we can keep an eye on you.’

‘What if I just keep an eye on myself?’

Eventually, age and treachery triumphed over the doctor’s youth and skill. We went home.

And there, we spent last week in bed. We lay in a near-coma from some form of flu. Drifting in and out of wakefulness…an angel hovered at the end of the bed. Were its wings brushing against our flushed cheeks? Or was it the HVAC system merely warming the room?

The angel was actually a Latin American painting of an ‘armed saint’, a very fine young man in a luxurious outfit, holding a muzzle-loading rifle. And he had wings.

In our tormented state, we saw something new. It seemed to us that there was also another face, hidden in the folds of his 17th century finery, much more sinister. We hadn’t noticed it when we were feeling well. But weak, and sick, trembling with cold or bathed in sweat, the devils and demons show up.

And now we are back in the office. A little shaky, at least we are able to walk, talk, read the headlines, and act like a normal person.

And what gives? Angel or devil…living or dead? Here, we attempt to make sense of a pandemonium of conflicting data.

Last week, The New York Times was on the story: ‘Wages climbed 5.1 percent, a still-rapid pace as Fed awaits slowdown’:

‘Average hourly earnings picked up by 5.1 percent in the year through June, moderating slightly from 5.3 percent in the year through May. Economists in a Bloomberg survey had expected a slightly bigger cool-down, to 5 percent.’

This news item could be easily filed under ‘Economy Improving’ or ‘Why the Fed Won’t Pause’.

But wait. Here’s Charlie Bilello with the other side of the story:

‘November was the 20th consecutive month in which the rate of inflation outpaced the growth of hourly wages, a decline in the prosperity for the American worker.’

See? Wages up at a ‘rapid’ pace. And workers get poorer.

It’s like that with almost every detail. Each fact needs to be turned over, like a warped board. On the other underside are the worms and bugs.

The unemployment rate is near a record low. But the number of people actually working…along with the number of hours they put in…have never recovered from the COVID Hysteria.

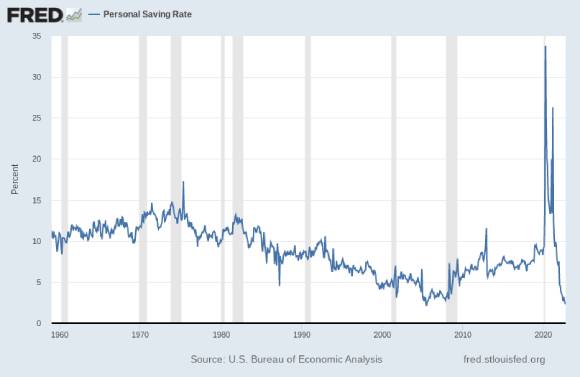

Savings plummet

House prices have been going down for three months. But rising interest rates make them more expensive. For the median family, prices have risen so much that buying a median house would take nearly half its income.

The Fed is still raising rates. But it still lends at 370 basis points below CPI. And the money supply, meanwhile, goes down — the 1.5% drop is the biggest ever recorded in a seven-month period.

October’s personal savings rate was one for the record books too — 2.3% was the second lowest level ever recorded. Consumers were spending; but they are running out of money. And if a recession is coming, it will hit them hard.

|

|

|

Source: US Bureau of Economic Analysis |

With such a confusing mix of facts before them, people could form any opinion they wanted. Investors chose to look on the bright side. The economy is basically healthy, they said to one another. ‘The Fed’s higher rates don’t hurt it. So, let’s get back in the stock market.’

The rally, so far, has brought a 17% gain off the October lows. There have been four previous rallies. Each one ended in new lows. Will this be the same?

We don’t know. But tomorrow, let’s look at the contradictions and ambiguities from a different perspective. In preview, we will see why today’s data is supposed to be confusing.

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia