The shares of future tech metals explorer Andromeda Metals Ltd [ASX:ADN] has skyrocketed over the past 10 days.

And that momentum looks to continue today with the ADN share price currently up 11.69% at the time of writing, trading at 8.6 cents per share.

ADN currently holds 19 exploration licences located in South Australia, Queensland and Western Australia.

The explorer’s focus is high-quality halloysite-kaolin and high-purity alumina.

Two materials that could have lots of applications in the future.

Source: Tradingview

What’s with the Andromeda Share Price?

Since the beginning of the month, the ADN share price has been on a strong upwards trajectory.

On 3 September, ADN released a statement along with an interview with their managing director detailing a marketing services agreement and their maiden probable ore reserve for the Great White Deposit.

Interestingly, the market took a couple of days to react to this information, which might be explained by the unique format ADN used to make this announcement.

Regardless, Andromeda said it had engaged specialist commodity service provider to support the company with the implementation of its Asian marketing strategy.

Approximately 10 tonnes of commercially-refined material sourced from ADN has now been produced in Japan.

Which is now available for distribution to identified potential customers for final factory-scale trials.

Managing director James Marsh also said the Great White Deposit’s maiden probable ore reserve had come in at 12.5Mt of bright white kaolinised granite containing 52% material.

A result that supports the 26-year mine life at 500,000tpa.

A pleasing outcome for any prospective miner.

Days later ADN announced drilling results from its Hammerhead Prospect, which is located 5kms to the north of the Great White Deposit.

Results confirmed zones of high-grade (up to 20%-plus) halloysite-kaolin over an area of 2.4kms by 0.5kms.

Andromeda said we can expect a maiden mineral resource ‘shortly’.

From paper and ceramics to batteries and super capacitors

You would be forgiven if you had never heard of kaolin before.

Despite being of little renown, it’s used in a wide variety of common items.

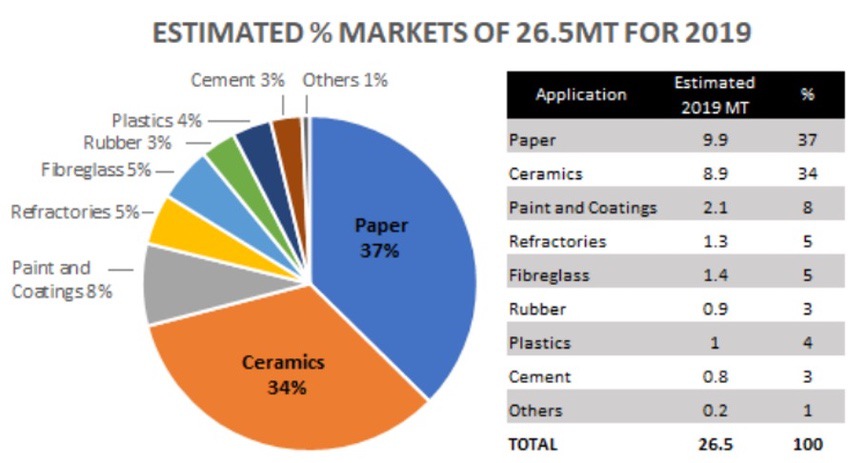

See for yourself:

Source: Andromeda Metals

But what could have investors so excited is the future potential of the material.

The Great White Project hosts what is called halloysite-kaolin.

Halloysite is a rare derivative of kaolin where the mineral occurs as nanotubes.

It is now in short supply due to the exhaustion of existing global reserves and the closing of environmentally damaging mines in China.

Currently Halloysite’s main applications are in ceramics, where it is used in the manufacture of high-quality porcelain by adding whiteness.

But its future applications are in nanotechnology.

And according to ADN, they are set to become the largest supplier of halloysite-kaolin and nanotechnology materials in the world.

Which isn’t hard to believe since they already own one of the world’s largest resources of halloysite-kaolin.

This is just some of the areas Great White Project halloysite is being tested in: hydrogen storage and transport, batteries and super-capacitors, water purification, carbon dioxide capture/storage and conversion to fuels, medical delivery of drugs and anti-bacterial properties, and polymers and coatings.

Money Morning and the subscription only service Exponential Stock Investor (ESI) are following the emerging resources story closely. In fact, it’s the latest theme in our ESI portfolio. For a great in-depth explanation of how a commodities ‘Supercell’ could drive companies like Andromeda to exponential heights in the next two years, go here. It’s the story no one is talking about (yet) and Australia’s next mining boom could be just around the corner for fast-acting investors. View the report here.

Kind regards,

Lachlann Tierney

Money Morning

Comments