The Andromeda Metals Ltd [ASX:ADN] today executed a binding agreement to form the Eyre Kaolin Project Joint Venture close to its Great White Kaolin project in South Australia.

At time of writing, Andromeda share price was up 9.7%, trading at 17 cents a share.

Andromeda said it can earn up to 80% interest in the new joint venture through sole funding expenditure of $2.75 million over six years.

Andromeda’s kaolin joint venture

ADN today announced it signed a binding heads of agreement with private firm Peninsula Exploration.

Together, the parties will form the Eyre Kaolin Project Joint Venture (EKJV) in South Australia.

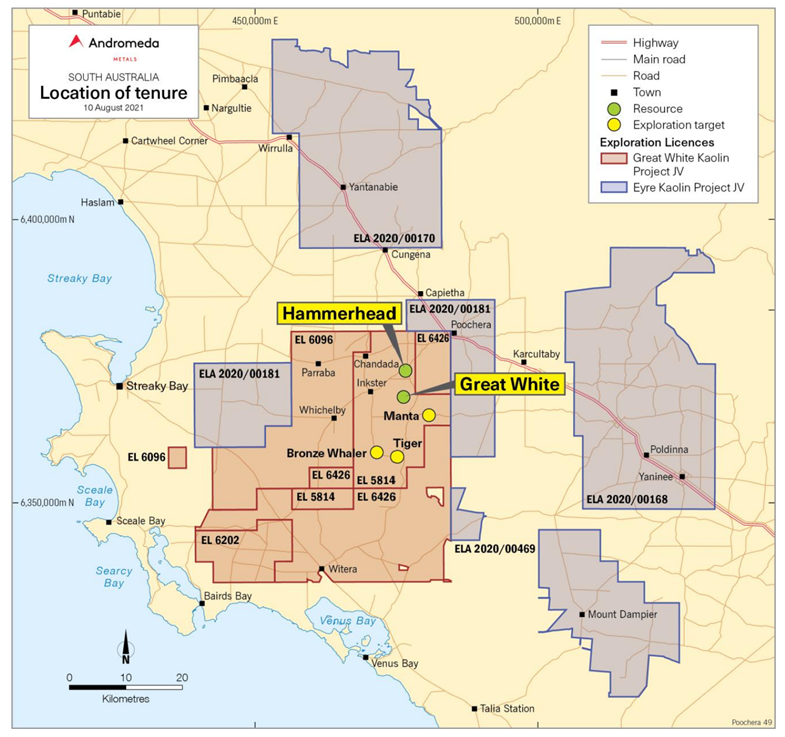

Here’s a map showing the venture’s tenements:

Andromeda’s venture partner Peninsula holds title to four exploration licence applications covering 2,799 square kilometres across the Eyre Peninsula.

Likely informing ADN’s decision to enter the venture is the fact Peninsula’s licence applications are close to tenements comprising Andromeda’s Great White Kaolin project.

Like I mentioned earlier, Andromeda thinks it can earn up to 80% interest in the EKJV through its sole funding of $2.75 million over six years from EKJV’s commencement.

Why did Andromeda choose to partner with Peninsula?

The company said geological reviews indicated the ground helped by Peninsula contained halloysite kaolin targets ‘similar to those found at numerous places across the Great White.’

ADN cited existing data suggesting Peninsula’s tenement package has the potential to host halloysite with properties sought by Andromeda.

What are the joint venture terms?

The most important agreement terms appear to be these:

Under what the parties call Stage 1 expenditure obligations, Andromeda will pay $750,00 (exclusive of tenement rents) within three years of commencement.

This payment will earn Andromeda a 51% interest in EKJV.

That’s the Stage 1 commitment.

Under Stage 2, Andromeda can elect to sole fund a further $2 million over another three years if it meets its Stage 1 obligations.

This will grant ADN a further 29% interest, potentially taking its overall stake in the venture to 80%.

Finally, if Stage 2 is successful, Peninsula holds the option to convert its remaining 20% interest into a 1.5% net profit royalty following a decision to mine.

What’s halloysite-kaolin?

Our earlier coverage of Andromeda mentioned that halloysite is a rare derivative of kaolin where the mineral occurs as nanotubes.

Currently, halloysite-kaolin’s main applications are in ceramics, where it’s used to manufacture high-quality porcelain.

But Andromeda also notes that halloysite-kaolin is an attractive feed material for producing high-purity alumina (HPA).

And HPA is an important component of lithium-ion batteries.

ADN share price outlook

Is today’s joint venture a good deal for Andromeda?

The market seemed to think so, bidding up ADN shares in early trade.

Bullish investors may point out Andromeda is securing about 2,800 square kilometres of additional prospective land near its key Great White project for an initial payment to Peninsula of $20,000, with a further $140,000 payment to be spent within 12 months of the EKJV commencing.

That seems prudent, especially if the deal ends up preventing any halloysite miners from moving close to Andromeda’s flagship Great White halloysite project.

Finally, bulls may argue that it’s always a good sign when a resource company expands its resource footprint.

Andromeda itself today said the joint venture ‘more than doubles its holding of tenements on the western Eyre Peninsula in this highly regarded region that is prospective for the discovery of world class halloysite-kaolin deposits.’

One worry investors may have is whether Andromeda can absorb the $2.75 million required to secure an 80% interest in the joint venture.

Its most recent quarterly revealed the company had $4.99 million in cash after total outgoings of $1.90 million.

Of course, the arrangement with Peninsula stretches over six years, giving Andromeda time to stagger the payments.

But investors will likely wonder if a capital raise will be in the offing soon.

Andromeda’s gains over the last year reflect the recent commodities resurgence, with lithium stocks leading the way.

But commodities like halloysite-kaolin are also starting to receive more attention.

And since halloysite-kaolin is part of the supply chain for HPA — a key ingredient in lithium-ion batteries — it may yet play a bigger role in the coming renewables revolution.

That’s why I recommend reading our free report on the future of renewables, where energy expert Selva Freigedo discusses three ways you can capitalise on the $95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here