The share price of mineral explorer Anax Metals Ltd [ASX:ANX] has doubled this morning on the release of drill results from its Whim Creek Copper-Zinc Project in the West Pilbara region of WA.

At the time of writing the share price is up 100% or 4.7 cents, trading at 9.4 cents per share.

Source: Tradingview

Trading in ANX shares only resumed in early November after an extended hiatus after failing to comply with ASX-listing rules.

Despite the suspension, ANX shares have returned over 1,000% over the past 12 months.

Is copper the gold of 2021?

It was Australia’s gold stocks that took centre stage last year, rallying alongside rocketing gold price has COVID-19 gripped the global economy.

And while the outlook for gold is still healthy, the demand for base metals like copper and zinc has been steadily climbing.

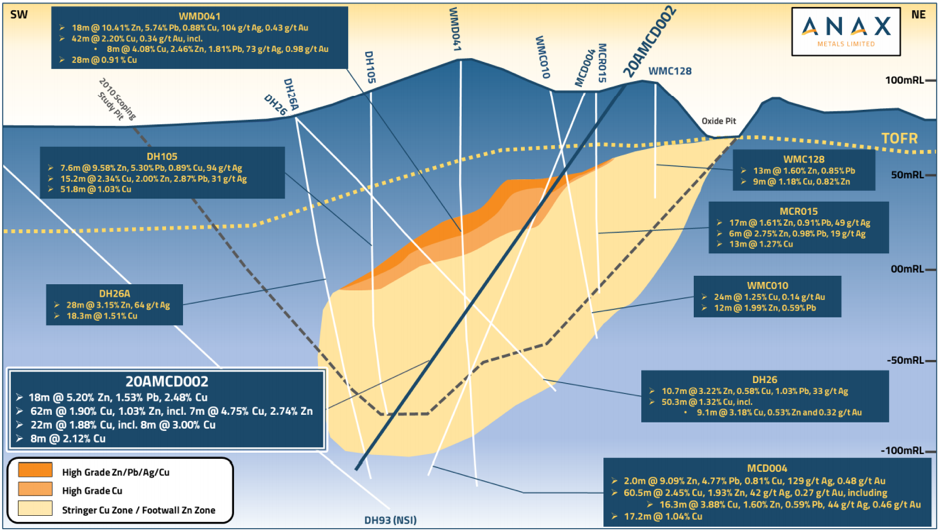

ANX announced the results from its November 2020 drill campaign at its Whim Creek Copper-Zinc Project today.

Metallurgical drilling had intersected visible near-surface matrix, semi-massive to massive sulphide copper (Cu), lead (Pb) and zinc (Zn) mineralisation at the Mons Cupri deposit.

Highlights include substantial zones of near-surface high-grade mineralisation:

- 11m at 5.01% Zn, 5.22% Pb and 0.87% Cu from 32m

- 42m at 2.34% Cu from 43m including 11m at 4.37% Cu from 43m

- 18m at 5.20% Zn, 2.48% Cu and 1.53% Pb from 60m including 3m at 10.34% Zn, 3.15% Pb and 2.55% Cu

Source: ANAX Metals

Due to tools used to test for mineralisation of the base metals, ANX say they cannot provide accurate analyses for gold and silver in the drill holes.

However, analyses of bulk composites prepared for ore sorting test work did return significant gold (up to 2.08 g/t Au) and silver grades (up to 89 g/t Ag).

What does this mean moving forward?

Essentially, a massive or semi-massive sulphide, also known as volcanic massive sulphide (VMS), are major sources of Cu and Zn and contain significant quantities other valuable elements.

And as the name suggests, they are big.

ANX say ore sorting test work is currently in progress and is likely to be completed towards the end of February.

Feasibility study activities are currently in progress, with further details expect to be released shortly.

VMS systems thought to host some of the most significant deposits of copper in the world.

The Kidd Creek mine in Canada is the deepest (1000m-plus) base metal mine in the world and the largest VMS deposit in the world.

Meaning ANX could be sitting on a very extensive system.

If you’re interested in knowing more about the factors that influence gold stocks, check out our gold expert Shae Russell’s latest report. In it she breaks down what Australia becoming the new gold ‘epicentre’ means for gold and your Aussie gold stocks. Click here to download the free report.

Kind regards,

Lachlann Tierney

For The Daily Reckoning Australia