In today’s Money Morning…what this valuation tells you…the world of DeFi…the takeaway…and more…

One of the first valuation models you learn as an investment analyst is called ‘comparative analysis’.

It’s a pretty easy concept to get your head around…

You simply take a bunch of companies in the same industry and measure them up against each other.

Earnings ratios, debt ratios, asset ratios, user growth…that sort of thing.

By doing this, you get a quick insight into the financial health of each company.

And by comparing them against each other, you can see which look the best value for money in each sector.

It also allows you to adjust your thinking depending on the specific industry you’re looking at.

For example, a stock trading on a price–to–earnings (PE) ratio — the number of years it takes for current earnings to recoup the price you pay on a stock — of 15 might be cheap in one industry but expensive in another.

And in a fast-growth industry like tech, PE ratios, book values, and the like mightn’t even make any sense at all.

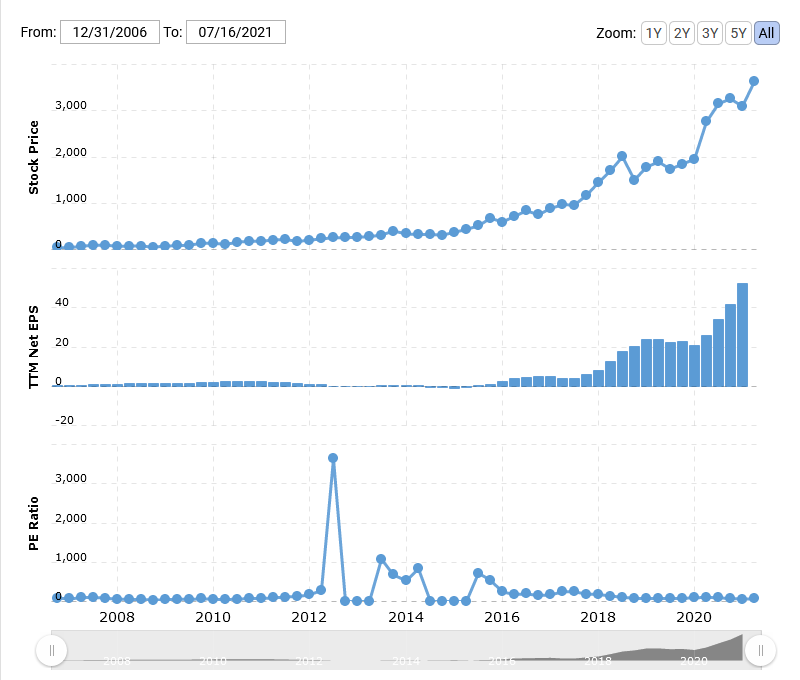

For example, check out Amazon’s PE ratio over time as it rode the internet boom to become one of the most valuable companies in the world:

|

|

|

Source: Mactotrends |

Even today, it trades at a lofty 69 times earnings and has consistently been above 100 times a lot of its history.

Expensive by Buffett standards (which is probably why he missed the boat on it), but because it continued to grow at a blistering pace, it rewarded those who paid up.

And I know a lot of analysts who’ve incorrectly called it a bubble all the way up!!!

I’ve said this before, but the fact is most investors are very bad at spotting exponential growth, so they don’t value high-growth companies correctly.

This brings me to a huge opportunity for you today…

What this valuation tells you

Our value clue came in a story out of the UK late last week…

UK neobank success Revolut just raised US$800 million.

This raise values the company at US$33 billion, and it makes it the most valuable fintech firm in UK history.

For comparison, that’s roughly half the value of our ANZ bank.

Not bad going for an app-based bank that only launched in 2015!

And this current valuation figure is already six times higher than a previous raise valuation in early 2020.

That’s exponential, alright!

And it’s part of a trend I’ve been banging on about for a few years now.

That’s the story of how the big banks in Australia are at extreme risk of being disrupted by smaller, nimbler, tech-focused competitors.

That trend isn’t going to stop.

As my colleague Ryan Clarkson-Ledward wrote on Friday, Apple has plans for a ‘buy now, pay later’ option for their huge user base, which threatens our (pretty much only) home-grown fintech success story Afterpay Ltd [ASX:APT].

PayPal is looking to do something there too.

The point is, the amount of competition coming into financial services is only going to heat up.

Now here’s the thing…

Revolut has 15 million customers and offers a suite of banking products, including deposit accounts, insurance, stock investments, and even crypto trading tools.

Like most fast-growth venture capital plays, profits don’t matter yet.

Over the 2020 calendar year, they made a loss of US$231 million against an income of US$358 million.

But I think Revolut itself could be disrupted soon.

And comparatively speaking, there’s a far better opportunity for you in fintech right now…

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

The world of DeFi

The bigger opportunity, in my opinion, lives in the world of decentralised finance.

Or ‘DeFi’ for short.

DeFi projects are built on blockchain technology and don’t even have shareholders.

They have token holders who govern a project using a new type of entity called a DAO (decentralised autonomous organisations).

Each token holder has the right to vote on the direction the project takes.

I won’t go deep into that concept today, but it’s an amazing innovation in the world of business, and is the first major challenge to the corporation structure since the formation of the Dutch East India Company in 1602 — the world’s first IPO.

Instead, I want to show the comparative value that’s accruing to token holders in the world of DeFi right now.

It blows the Revolut numbers out of the water.

Consider a project called Uniswap [UNI], which is a leading decentralised cryptocurrency exchange.

Here are some numbers (all in US$):

|

In my eyes, these numbers blow Revolut’s out of the water.

The killer figure being the super low price-to-sales (P/S) ratio of just 16.63 times. That is, the fees generated by the protocol are just 16.63 times the current price of a UNI token.

For a leading project in a high-growth industry, this seems super low to me. I mean, Revolut isn’t even making money, and it’s four times the value!

Decentralised lender AAVE trades on a similar 16.12 P/S ratio.

And there are numerous other examples I could give you showing how projects in DeFi are severely undervalued compared to their fintech peers.

Especially when you look at the insane growth of the Defi industry as a whole.

As research firm Messari reported recently:

‘While the roughly 30% decline in TVL over the past two months looks bad, the year-over-year growth from $2.02 billion to $110 billion represents an increase of 5,500% for the sector as a whole.’

Of course, it’s not quite an apples-versus-apples comparison.

Crypto projects aren’t the same as equity investments and come with different risks to contend with.

Technology risks, competition risks, regulatory risks and more…

But on the flip side, that means a lot of room to run as more certainty comes into the industry, which I believe it will over the next 12–24 months.

The convenience and cost-effectiveness of DeFi are too good to fail, in my opinion…

The takeaway

DAOs using blockchain technology opens up opportunities to ordinary investors that are usually the reserve of venture capitalists.

Namely, the world of DeFi.

That, of course, comes with big risks, but it also comes with extreme opportunities.

If, like me, this is the space you want to play in, there’s no more exciting industry to follow.

And I think comparative analysis shows a lot of value here compared to more traditional fintech valuations.

But even if you don’t agree with me on this, you need to understand that this world of DeFi is coming.

And the next wave of fintech innovation could see the end of some major blue chip players in the financial industry.

Can you afford to ignore that?

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.