The AMA Group Ltd [ASX:AMA] share price is on pause today after it flagged a $150 million capital raising to strengthen its balance sheet.

AMA expects the capital injection to offset the disruptions caused by the pandemic.

Disruptions that have seen AMA shares drop 35% over the last 12 months.

AMA set to raise $150 million

The capital raising will have two parts.

First, there will be a $100 million fully underwritten 1 for 2.80 pro rata non-renounceable entitlement offer at 37.5 cents per share, which is the equity offer price.

The offer price reflects a 10.7% discount to AMA’s closing price of 42.0 cents on 3 September 2021.

This will result in approximately 267 million new ordinary shares being issued.

This number represents almost 36% of AMA’s existing issued capital.

And second, the remaining $50 million will be raised via fully underwritten senior unsecured convertible notes due in 2027.

These notes can be converted to AMA ordinary shares.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Why is AMA raising capital?

In simple terms, debt.

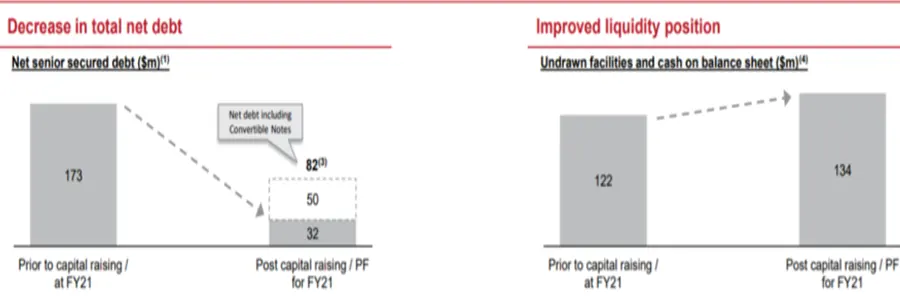

The euphemistic ‘balance sheet flexibility’ made possible by the capital raise is — in blunter parlance — a way to reduce AMA’s debt.

$72.5 million of the raised capital will go to repaying debt facilities.

Liquidity is another major reason for the raise.

AMA will allocate $69.3 million for working capital in supporting the business during a time when travel restrictions weaken demand for repairs.

AMA Group CEO Carl Bizon commented:

‘This Capital Raising will provide us with funding and flexibility as we face the headwinds presented by COVID-19 and give us the firepower to execute our strategy.

‘AMA Group is uniquely positioned to respond as restrictions lift, and I look forward to us realizing the value inherent in the Group.’

AMA restructures debt

AMA also announced it negotiated with its bank to restructure its debt facilities.

Under the new agreement, AMA will have no debt facility maturing before October 2024.

Prior to the restructure, the company had two facilities maturing in October 2022.

Following a permanent repayment of bank debt totalling $72.5 million, AMA’s total bank facility limit will be $182.5 million.

What does the capital raise mean for the AMA Share Price?

AMA admitted today it will likely continue to feel the impact of COVID-19 in 1H22.

The company anticipates pandemic-related restrictions to cut kilometers travelled, directly affecting vehicle repair volumes.

To illustrate this point, AMA noted that as of this month, the NSW Drive and Non-Drive business units were operating at 70% and 60% unutilised capacity, respectively.

31 sites were either hibernated or under partial stand down.

While the acceleration of Australia’s vaccination efforts may suggest to some the worst of the pandemic is behind us, AMA’s struggles with depressed demand reveal this may not be true for all sectors.

Now, if you are interested in stocks that are less impacted by the pandemic — in fact, stocks primed to leverage emerging trends — then I suggest reading the latest report by our market analyst, Murray Dawes.

It’s a great read from one of the most astute small-cap analysts out there.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here