New Zealand’s national carrier Air NZ [ASX:AIZ] has downgraded its earnings guidance this morning. The airline is now saying it will be around the bottom of its NZ$180–230 million range, blaming lower domestic travel.

Shares of Air NZ are down by 1.64% this morning, trading at 60 cents per share.

It’s been a challenging second half of the year for the airline. Air NZ noted in September that high fuel costs, rising competition and inflationary pressures were difficult to navigate with the weaker NZ dollar.

Air NZ has also faced engine issues due to defects in its Pratt & Whitney engines, which the airline expects to affect schedules until 2025.

Can the airline overcome these problems and regain shareholder confidence?

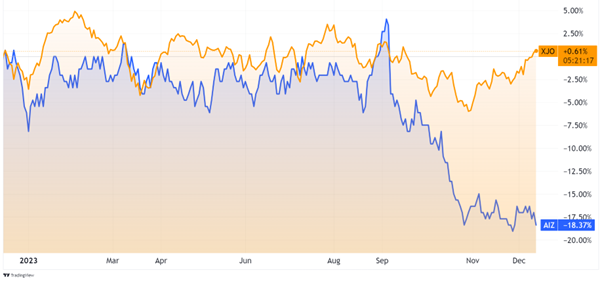

Source: TradingView

Air NZ faces turbulence

After the share price spiked in late August, it’s been all downhill for the airline, with the share price falling 21.5% in under two months.

The big fall came after the airline outlined the scale of the issue with its engines. Since the first advisory was published on 11 September, the number of affected engines has grown to approximately 3,000.

That’s over 90% of these engines presently in service across various airlines, 16 of which are within Air NZ’s fleet.

Air NZ said the issue is expected to last until 2025, with the airline suspending service on two international routes to ensure it can serve the remainder of its schedules.

The airline said it expected a ‘nominal’financial impact from the increased inspections from the issue.

International travel booking, particularly to North America, is reportedly still solid for the airline, while Asia and Pacific Island travel remain unchanged.

Domestic travel has, however, remained soft. The airline noted in its update today that:

‘Early signs of softness in domestic travel, particularly corporate and government travel, have continued, with late booking activity remaining weaker compared to the prior year.’

In a bid to regain domestic demand, it has said it will partner with Elon Musk’s Starlink to provide free internet on its flights.

A trial will begin in late 2024, with a planned rollout in its domestic fleet in 2025.

The company also expects 2H24 to be ‘increasingly challenging’ and will not issue full-year guidance.

Outlook for Air NZ

Things aren’t all that rosy for the 2023 Airline of the year. Inflationary costs and a tough economic environment are clearly impacting consumer travel decisions and the company’s earnings.

Air NZ is not the only airline that has seen the challenges of higher fuel costs alongside debt servicing and operating costs which have been hit by inflation.

Similar drops have been seen industry-wide, with many larger carriers share prices tracking similar patterns.

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

Thankfully, jet fuel costs have eased from their September highs thanks to falling crude prices.

The next concern for Air NZ is a macroeconomic one. With headwinds likely to remain in 2024 and the NZ economy struggling, domestic travel may take some time to return.

For now, it appears international travel is remaining robust. However, competition is also heating up.

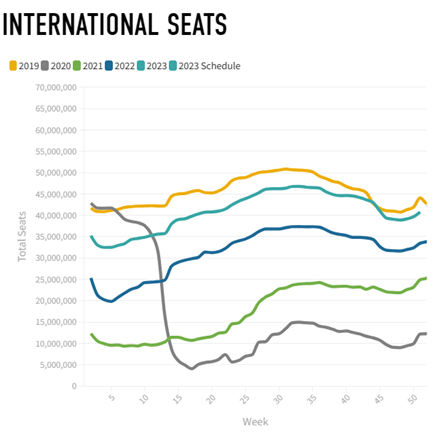

Source: OAG Travel

Air NZ is facing increasing competition within its Asian routes from a growing pool of national carriers that are focusing on pricing.

Air NZ’s service will struggle to compete in this space, as its premium offering gives it little room to cost cut.

The airline will instead rely heavily on its savvy marketing team and headline-catching products, such as cabin beds and free internet. Though, it’s unlikely that this is enough to sway Kiwis to get back into the air.

For investors, airlines may be worth keeping on a watchlist to gauge consumer confidence but are probably best avoided until clearer skies.

Another tech miracle?

If you’re looking for other stories to consider, look no further than the incredible moves of Bitcoin [BTC].

The asset class many had claimed dead has now pulled a return of 145% for the past 12 months. That makes it the best-performing asset class this year.

Compare that to the ASX 200’s +0.59%, and you can see why more people are taking notice.

With a recent 7.7% drop in Bitcoin this could make the perfect time to consider the crypto for anyone who thinks they’ve missed the boat.

Our exponential investor and tech specialist, Ryan Dinse, has been a long-time cryptocurrency investor and isn’t surprised by its movements at all.

In fact, he mapped out these movements. What is next on his timeline?

Could Bitcoin go to US$1 million? Sound ridiculous, too good to be true?

Watch his video here to see how the market looks coming out of this crypto winter and where it could be headed next.

Regards,

Charlie Ormond

For Fat Tail Daily

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…