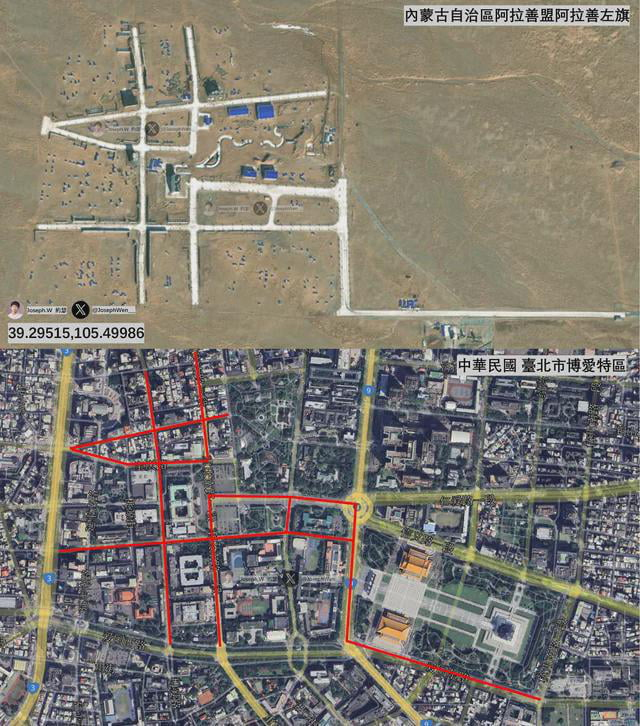

In March last year, a Taiwanese analyst shared satellite imagery of a mysterious Chinese military facility in Inner Mongolia — deep within China’s remote deserts.

A network of seemingly aimless roads winds through the site, but upon closer inspection, it mirrors the exact layout of central Taipei.

That includes crude replicas of the presidential palace, the foreign ministry, the national concert hall, and more.

Source: Joseph Wen — X.com

Sceptical? Here are the coordinates. Zoom in and you’ll see the fake buildings clear as day.

It seems China has created its own training grounds to practise a lightning-fast decapitation strike targeting Taiwan’s leadership.

The revelation is a stark reminder of Beijing’s intentions in Taiwan and the risks to our peace and stability.

Recent oil price discussions received comments from readers balking at the idea of lower oil prices, highlighting geopolitical risks.

A conflict with Iran or Russia is the scenario thrown about that would push oil back up.

But there’s another major risk that people seem to have forgotten about, and this week, Australia’s intelligence community made sure we’re paying attention.

Grey-Zone Warfare

This week, Australia’s intelligence chief warned of growing activity in what’s known as the ‘grey zone,’ the murky area between peace and open war.

‘These methods exploit our openness and restraint,’ said Andrew Shearer, Director-General of the Office of National Intelligence. ‘They seek to undermine our resilience and ultimately to break our resolve.’

The comments came as a classified US military intelligence report recently did the rounds in our media.

According to the report, China continues to build up its invasion fleet via dual-use commercial ferries and landing docks like the ones below.

Source: ABC

Meanwhile, Beijing’s recent September military parade showcased its latest drone and hypersonic nuclear missile systems.

The message was clear. China’s military capabilities and strategic intent are advancing in step. And we’re not out of their gaze.

As a former professional sailor, I’ve heard firsthand how China’s growing naval presence impacts our region.

Mates of mine have had to abort Tasman Sea crossings due to live-fire drills by China. A stark reminder of how the situation is devolving.

This week, a US committee accused the Chinese Navy of trying to intimidate Australia with these exercises.

The message from Washington? Australia is on the frontline of Chinese aggression.

A Grey Swan, Not a Black Swan

To be clear, a war with China remains a low-probability scenario. But probability and impact are different beasts entirely.

At Fat Tail Investment Research, we investigate potential ‘grey swan’ events. The scenarios that aren’t completely unexpected but would be historic if they occurred.

By understanding the unlikely, you can help protect yourself from its full force — or in some cases, gain from it.

With all the talk of AI bubbles recently, folks have forgotten the risks China poses here.

While a debt bubble collapse is the obvious ‘pin’ that pops economic bubbles, a sharp pin looms on China’s mainland.

The invasion of Taiwan fits this definition perfectly.

Housing almost all advanced semiconductor production through the company TSMC, an invasion or blockade of Taiwan would be the beginning of the end.

This week, the US Congress heard proposals for a new Pacific defence pact involving America, Australia, Japan and the Philippines.

Questions were raised about whether Canberra could be relied upon to support the US in the event of a Taiwan Strait conflict.

That’s not just a policy question. It’s a portfolio question.

What Would It Actually Look Like?

Any Chinese invasion would require the largest amphibious assault in history, dwarfing the D-Day landings.

But Beijing has options short of full invasion: a naval blockade, cyber warfare crippling critical infrastructure, or a lightning decapitation strike targeting Taiwan’s leadership.

Remember those mock buildings in Inner Mongolia? They’re not for show.

The economic fallout would be immediate and severe. Taiwan produces over 60% of the world’s semiconductors and over 90% of the most advanced chips.

Apple, Nvidia, and AMD all depend on Taiwan Semiconductor Manufacturing Company (TSMC), and our stock markets increasingly depend on them.

A conflict would instantly choke global supply chains already strained by AI’s expansion.

The chip shortage during COVID would look trivial by comparison.

Market Implications

Here’s where it gets uncomfortable for Australian investors.

The concentration risk in global markets has never been higher. Apple, Microsoft, and Nvidia now account for roughly 17.5% of the entire US stock market.

All three are critically dependent on Taiwanese manufacturing.

A crisis there would trigger tech sell-offs that would bleed into all economies, and Aussie super funds would feel the hit.

Beyond tech, Australia’s the quarry for China’s industrial machine, but we’re also a treaty ally of the United States.

That tension, largely academic until now, would become all too real.

So what’s an investor to do?

First, understand your exposure, then look to diversify.

Diversification isn’t just about different stocks; it’s about different geographies and different supply chains.

Second, consider defensive positions. Energy, commodities, and defence stocks typically perform during crises.

Meanwhile, Gold remains the ultimate safe haven when trouble hits.

Third, don’t panic. Grey swans are still swans — rare, not inevitable.

The goal isn’t to liquidate everything and hide in a bunker. It’s to ensure that you’re not caught completely exposed if the unlikely happens.

As I mentioned last week, the US is pushing for stronger supply chains with Australia in critical minerals.

That’s not charity, it’s a strategic hedge against China. Smart investors should be thinking the same way.

If you want to learn more about Australia’s role as a strategic cornerstone, go here.

Remember, ignoring grey swans doesn’t make them less likely. It just makes you less prepared when they land.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments