The public gets what the public wants.

An AI revolution…but today is about the story beneath the headlines.

We’re finance punks here at Fat Tail Daily — we like presenting the investment tunes you love before they sign the big record deal.

So here’s the financial equivalent of seeing Radiohead in an Oxford basement playing to a crowd of 10.

Right now, everyone’s chasing trillion-dollar AI valuations and tech giants.

For me, this is like listening to the latest Taylor Swift album or something even more bland.

But while more money flows to Silicon Valley, it’s also quietly flowing to the rocks beneath our feet.

Mining stocks absolutely crushed the Nasdaq in 2025, with the MSCI World Metals & Mining Index surging over 40% while the Nasdaq managed a measly 20%:

Source: Mining.com

This isn’t luck.

It’s the start of something massive.

A sleeper hit in the making…

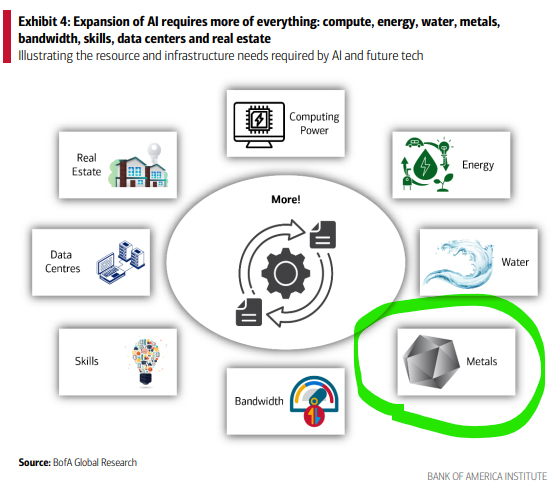

Bank of America recently released a very intriguing report.

AI expansion requires ‘more of everything’ — compute, energy, water, metals, bandwidth, real estate, and data centres:

Source: Bank of America Global Research

What we’re watching isn’t just a tech revolution.

It’s a materials revolution disguised as software.

Consider Microsoft’s US$500 million Chicago data centre, which used 2,177 tonnes of copper — that’s 27 tonnes per megawatt of applied power.

Multiply that across thousands of new facilities planned globally, and you’re staring at unprecedented copper demand.

The natural gas requirements are equally insane. Analysts project that AI data centres will drive an additional 3.3 billion cubic feet per day of global demand by 2030.

Meanwhile, uranium’s heating up as tech giants invest in small modular reactors.

They need reliable power 24/7.

Famous rock producers will crank out the hits

There’s no magic wand that creates AI data centres.

Every server rack, cooling system, and backup power unit requires materials pulled from the ground.

The ~US$1 trillion in U.S. AI infrastructure investment projected by 2029 will demand enormous quantities of copper, lithium, rare earth elements, and other critical materials.

China has already recognised this trend, allowing copper reserves to reach multi-year peaks as it positions for the AI-driven commodity surge.

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

Meanwhile, Western investors remain largely focused on the software layer.

So while investors chase expensive tech stocks, the real play might be underground.

Mining companies are experiencing explosive margin expansion as commodity prices rise faster than production costs, creating a leveraged play on the AI infrastructure buildout.

Companies are pulling tomorrow’s technology out of the dirt today.

The AI revolution runs on algorithms, sure.

But more importantly, it runs on rocks.

These guys are going to be big: The coming $15 billion battery world tour

Yes, I’m going to say it again: lithium.

Here’s where the lithium story gets seriously interesting.

The global data centre lithium-ion battery market reached US$5.92 billion in 2025 and is projected to explode to US$15.67 billion by 2033. That’s 12.94% compound annual growth.

Why the massive surge?

AI systems can’t tolerate power disruptions, and even a millisecond outage can corrupt AI training processes and waste millions in computing resources.

This creates unprecedented demand for reliable battery energy storage systems.

Data centres now require sophisticated backup solutions that can run for hours, not minutes.

Lithium-ion batteries provide instant response times and high-power density essential for mission-critical AI applications.

And that creates one hell of an investment opportunity for those paying attention to the picks and shovels rather than the end product.

Want in on three lithium companies positioned to benefit from the data centre battery boom? (Among a whole host of other tech forces)

I encourage you to dig a bit deeper.

Regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

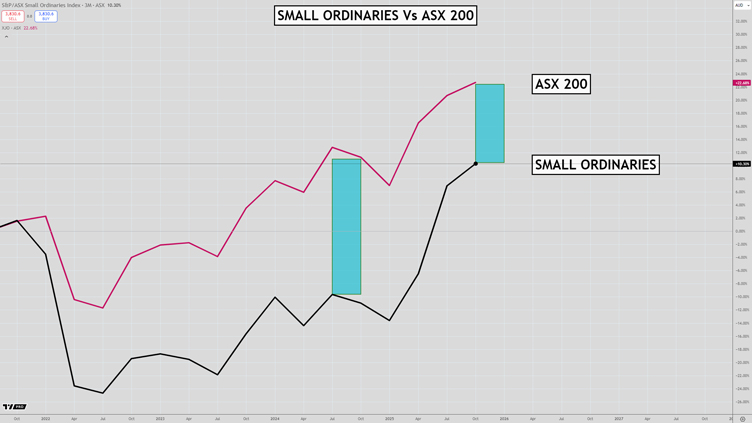

Murray’s Chart of the Day – Small Caps Comeback

Source: TradingView

As the bull market gathers steam we are finally seeing a return to form for smaller companies.

The last couple of years has seen a distinct underperformance by smaller companies since the huge correction in 2022 knocked the stuffing out of the speculative sector.

The first rectangle shown in the chart above shows how badly small caps were performing compared to the ASX 200 in mid-2024.

But the last few months has seen an impressive recovery in the small cap sector as animal spirits have returned.

We needed to see smaller companies participating in the rally before we could become confident that the bull market has legs.

Now that small caps are firing and have broken out above the high reached in 2021, the next target is the all-time high set in 2007. That is just 10% higher than current levels.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

Comments