It’s an intriguing question.

Our reliance on FAMGA products is potentially reaching a tipping point.

I woke up this morning to discover that my Microsoft Teams application wasn’t working.

In fact, the entire Office 365 suite was down. No email, no way to contact my work colleagues.

We sort of just assume it will work every time.

I talked to my buddies that also use Teams and Office 365 at their work and they were experiencing the same problem.

A classic ‘computer says no’ situation.

Which got me thinking, gee whiz, we are really a bit too reliant on these big companies.

The fallout from this error in the Microsoft ether could be $10s of millions in productivity down the drain.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Only one scenario points to a tech stock sell-off

Yesterday, Ryan Dinse shared with you this chart:

|

|

|

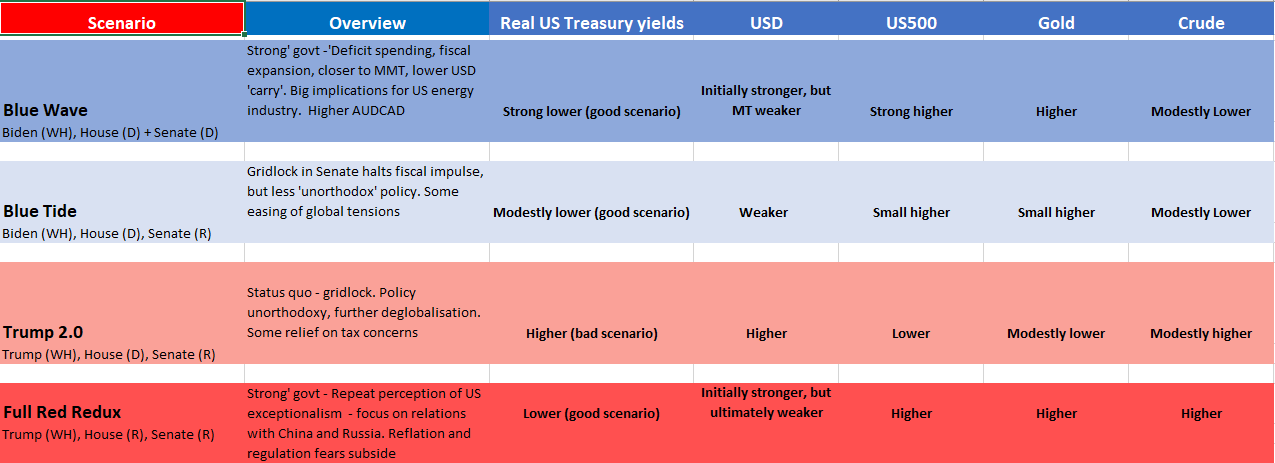

Source: Twitter @ChrisWeston_PS |

It shows the various scenarios that could play out after the election for bonds, the USD, the top 500 stocks, gold, and oil.

The column I’m interested in is the middle column.

According to the chart, if Trump wins, and the division in Congress remains the same, the S&P 500 [SPX] will shed a bit.

We know the gains on the S&P 500 so far are largely accumulating in the hands of the tech giants.

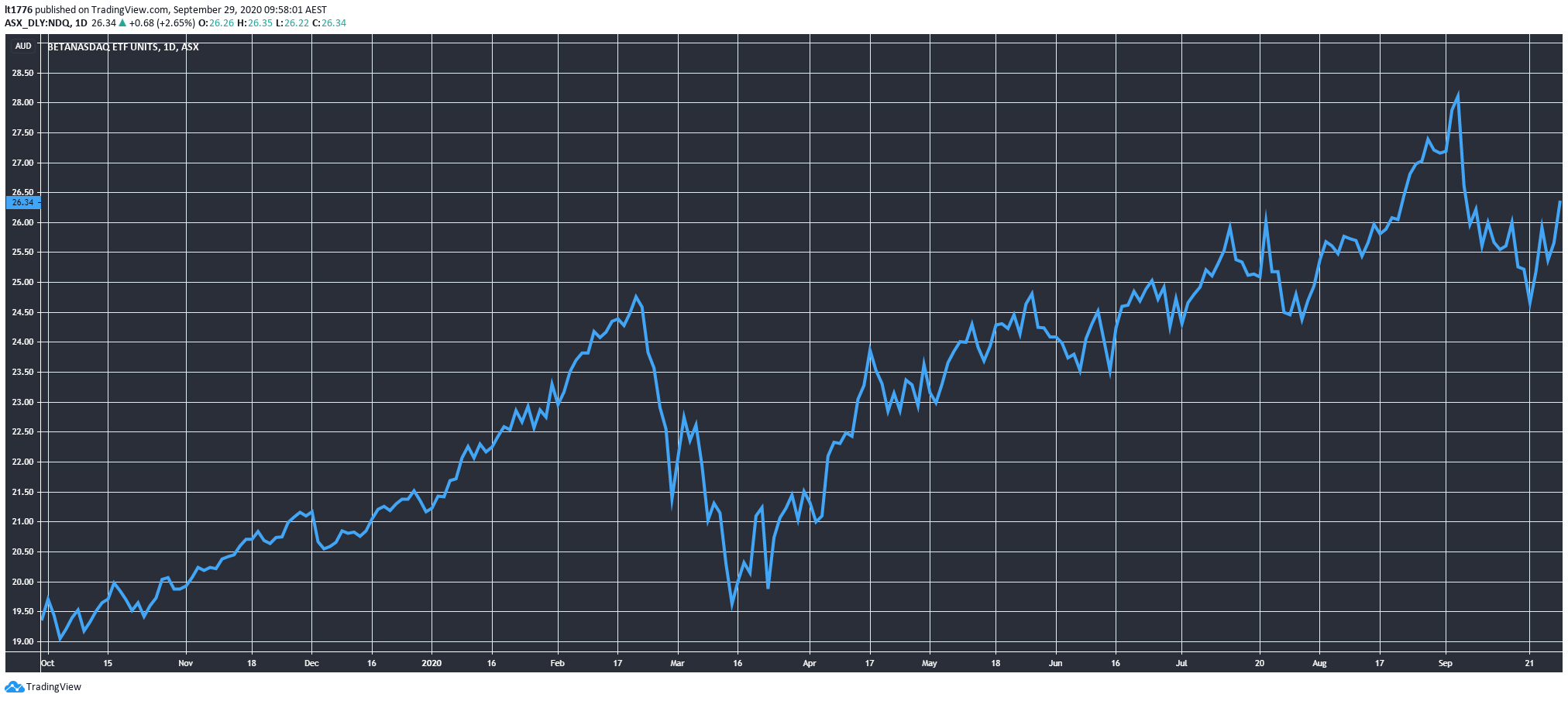

So, let’s take a look at how the BetaShares NASDAQ 100 ETF [ASX:NDQ] is doing.

It sold off a bit, but is now punching higher again:

|

|

|

Source: Tradingview.com |

I think some pre-election jitters came into the picture amid the sell-off.

But what to make of the recent spike on the tail-end of the right side of the chart?

It could be that the market is pricing in a Biden win, which if we refer to the scenario chart, will result in a ‘small higher’ or ‘strong higher’ for SPX.

So what are the bookies saying?

Sportsbet is paying around $1.75 for a Biden win, at time of writing.

That sounds about right.

If you read the headlines in the major outlets, it would appear as if Biden is headed towards a landslide.

They got it wrong last time though — really wrong.

So, the current odds reflect how misleading the polls were proven to be last time around.

Big tech generally support Biden because of his status quo agenda

Having lived near San Francisco and spent a fair bit of time in the city, the people I know in the tech scene are very much behind Biden.

Some would think that he is even too moderate by San Francisco standards.

And Elizabeth Warren and Bernie Sanders were pushed out — the candidates that were in my book, most likely to push for investigations or pressure on big tech’s business practices.

So, Biden is largely a status quo politician on policy relating to big tech’s place in society.

Which brings me to a final point.

How do you invest in what comes after big tech?

Crypto, small tech, synthetic biology, AI into healthcare

These are some of the types of things I spend the most time on.

I advocate for every investor to own at least some crypto.

I’d also recommend that you look at smaller tech companies with potentially breakthrough products.

What follows is not a recommendation, simply an example of the potential out there.

Small-caps are potentially riskier too, by the way, because they are so volatile.

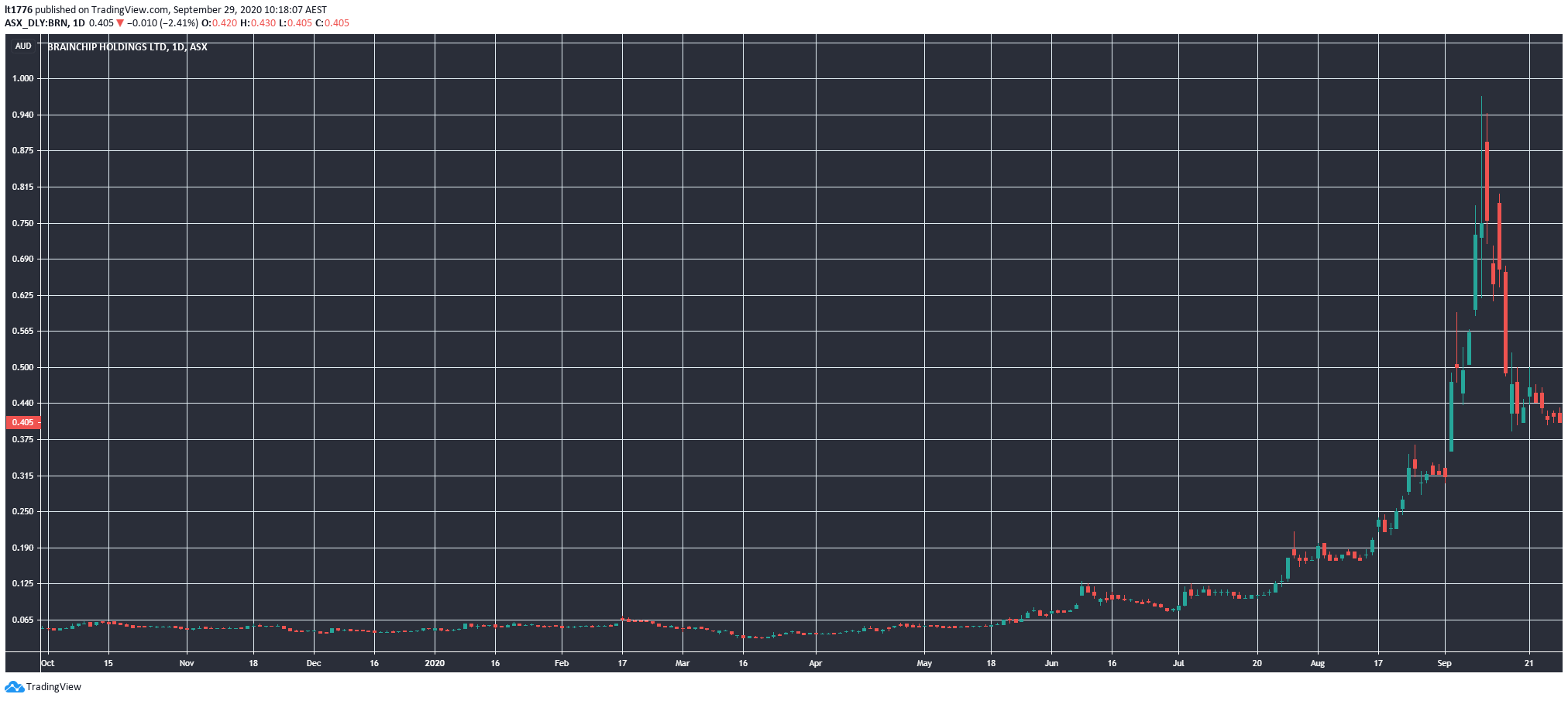

For instance, check out the chart for edge computing/AI on chip maker BrainChip Holdings Ltd [ASX:BRN]:

|

|

|

Source: Tradingview.com |

The BRN share price spiked on a deal involving none other than NASA.

That just goes to show you how much explosive potential is out there for smaller tech companies.

From what I’ve seen, the market is lapping up these types of small-cap tech stocks at the moment.

Synthetic biology is the wave of the future too.

We are talking about putting computers to work in biotech and drug discovery.

It’s a big theme in our Exponential Stock Investor portfolio.

Finally, did you know Google is quickly reframing itself as a health company?

AI into healthcare is another way to potentially capitalise on big tech’s search for the next growth corridor for their business.

It’s a little bit scary to think about.

Imagine if Microsoft managed your health records and they went down, like their Office 365 program did today.

So, whatever comes after this election, be prepared to see these FAMGA companies continue to dominate our lives.

Their acquisition targets are the most interesting though, to be sure.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.