A quick look at the AD1 Holdings Ltd [ASX:AD1] share price.

The provider of customer branded recruitment platforms recently announced the acquisition of SaaS company Art of Mentoring.

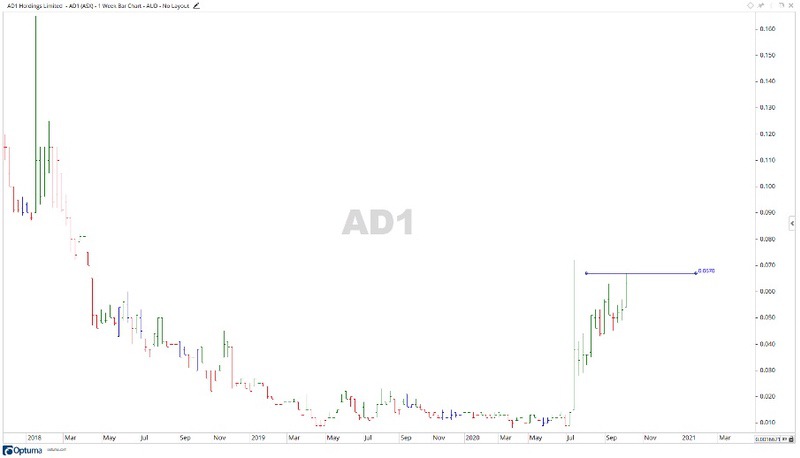

News of the purchase saw the AD1 share price move up 6.35% to trade at $0.067 at the time of writing.

Source: Optuma

What’s Happening at AD1?

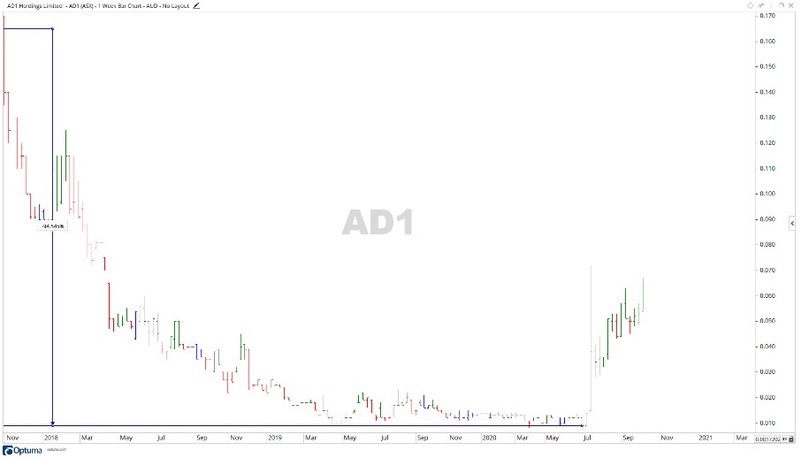

The COVID-19 pandemic hit the AD1 share price particularly hard.

From this year’s January high it fell to a whopping 94.54% low in June.

Source: Optuma

Now with the company taking the right steps and announcing new acquisitions, the recovery is underway.

In recent weeks, AD1 announced a three-year master service agreement with US company Powerclub, a member-owned energy retailer.

This coupled with the new purchase of Art of Mentoring — which is expected to give a recurring revenue stream of $1 million per year — will help build share price momentum.

‘This is an important milestone for the company. We will continue to deliver organic growth and pursue additional strategic acquisition opportunities as they present themselves’, said Prashant Chandra, AD1’s CEO.

Where to from here for AD1?

From the enormous fall into the low of June, the AD1 share price recovered and moved up over 643%. In turn, boosting the market cap of the company back up to $34.53 million.

Source: Optuma

The price fell away after the surge, before recovering well. Should the move up continue, then the level of $0.072 may become the focus.

This is also the most recent high and would be a very good sign of things to come if this were to be broken.

The most recent move up took place on increased volume, indicating buyers may be returning to the market to support the move up.

On the downside, if price were to decline, then the levels of $0.063 and $0.053 may come into play.

Regards

Carl Wittkopp

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments