The a2 Milk Company Ltd [ASX:A2M] updated investors on its new strategy following disruptions faced during the pandemic.

‘Unprecedented change’ in the China infant formula market over the last 12 months led a2 Milk to alter its growth strategy, setting a medium-term goal of hitting NZ$2 billion in sales.

a2 Milk Company Ltd [ASX:A2M] share price is currently trading for $6.09 a share, down 11%.

A2M’s revised strategy

a2 Milk noted its new strategy aims to rebuild the company into an exciting, innovative, and sustainable growth company.

Capturing China’s IMF market is a key strategic priority.

a2 Milk aims to gain more control over its Chinese Label (CL) and English Label (EL) distribution to get closer to the final consumer.

A2M will also continue investing in brand name recognition, digital markets, and e-commerce.

As well, the dairy stock is focusing on product innovation, which should expand its product portfolio.

A2M additionally noted it will seek to realise market potential in the US.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

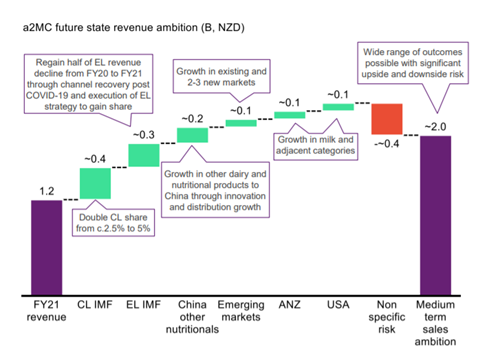

A2M’s NZ$2 billion sales ambition

A2M is setting a medium-term target of growing sales to NZ$2 billion.

This sales target is higher than FY21 sales of NZ$1.2 billion and FY20 pre-COVID sales of NZ$1.73 billion.

Due to ‘unexpected market conditions, investment and innovation’, EBITDA margins would likely be in the ‘teens’ in the medium term.

The new target is lower than the pre-COVID EBITDA margin of 31.7%.

a2 Milk’s Managing Director and CEO, David Bortolussi, commented:

‘The China infant milk formula market has experienced unprecedented change over the past 12 months which has required us to adapt our growth strategy.

‘Our ambition is to rebuild the a2 Milk Company into an exciting, innovative and sustainable growth company.

‘We will innovate and expand our infant milk formula product portfolio to appeal to a broader set of consumers and to maximize our distribution potential.

‘Outside our core business, we are considering opportunities for adjacent category growth in China, ANZ and the USA as well as assessing opportunities in new emerging markets.’

What does the future hold for A2M?

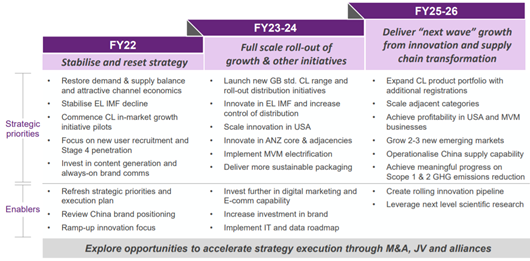

A2M said today its strategy is designed to ‘drive growth across multiple horizons.’

FY22 will focus on stabilising and prioritising the restoration of demand and supply balance.

FY23–24 will be dedicated towards a full-scale rollout of growth initiatives, while FY25–26 will focus on delivering ‘next wave’ growth from innovation and supply chain transformation.

As we’ve discussed earlier, A2M went from being the best-performing stock globally over a decade, to one of the worst-performing stocks on the ASX in 2021.

That kind of turnaround could make one uneasy about entering the stock market — doubly so with inflation fears swirling around.

However, I do think I have a revealing resource for you.

It’s a great report on technical analysis from our trading veteran Murray Dawes. There, Murray unveils his unique strategy to deal with market turbulence.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here