The a2 Milk Company Ltd [ASX:A2M] is set to face a class action lawsuit led by Slater and Gordon on behalf of unhappy shareholders.

The class action, filed in the Supreme Court of Victoria, alleges A2M engaged in misleading or deceptive conduct in breach of the Corporations Act.

The market was quick to react to the development with the A2M share price tumbling 6% at the time of writing.

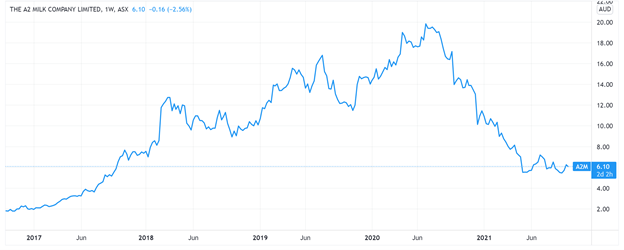

The class action heaps more pressure on a stock already reeling from multiple guidance downgrades and pandemic-impacted sales. The last 12 months have seen A2M drop 55%.

a2 Milk to defend class action

a2 Milk’s update to the market today was brief.

In three curt paragraphs, the dairy stock said it will ‘vigorously defend the proceedings’ brought by Slater and Gordon.

These proceedings are said to be brought on behalf of shareholders who acquired an interest in A2M’s fully paid ordinary shares on the ASX or the NZSX between 19 August 2020 and 9 May 2021.

For details on the class action, we have to consult Slater and Gordon itself.

Slater and Gordon make the case

On its site, the law firm lays out the synopsis of its legal claim.

Slater and Gordon alleges a2 Milk engaged in misleading or deceptive conduct in breach of the Corporations Act when releasing four guidance downgrades during FY21.

Specifically, the law firm asserts that by no later than 19 August 2020, ‘A2 was or ought to have been aware that the FY21 Guidance and subsequent representations did not adequately take account of a number of factors which would impact the company’s financial performance.’

Slater and Gordon elaborated on two of these factors.

First, A2M’s attempts to boost sales by pushing English label infant nutrition stock through cross-border e-commerce channels and the accompanying price discounting ‘would necessarily negatively impact its sales in the daigou/reseller channel.’

And second, A2M’s cross-border e-commerce sales would be impeded by the disruption to the daigou/reseller channel.

Slater and Gordon considers that eligible shareholders may have claims against A2M in relation to losses incurred following A2M’s market updates to the ASX and NZX on:

- ‘28 September 2020, when a2 announced that it expected FY21 group revenue of $1.80bn to $1.90bn and a group Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) margin of 31%;

- ‘18 December 2020, when a2 announced that it expected FY21 group revenue of $1.40bn to $1.55bn and a group EBITDA margin of 26% to 29%;

- ‘25 February 2021, when a2 announced that it expected FY21 group revenue in the order of $1.40bn and a group EBITDA margin of 24% to 26% (excluding MVM transaction costs); and

- ‘10 May 2021, when a2 announced that it expected FY21 group revenue in the order of $1.2bn to $1.25bn and a group EBITDA margin of 11% to 12% (excluding MVM transaction costs).’

What happens from here?

A2M responded to the impending class action by saying:

‘The Company considers that it has at all times complied with its disclosure obligations, denies any liability and will vigorously defend the proceedings.

‘The Company remains confident in the underlying fundamentals of the business and growth potential.’

As we’ve discussed earlier, A2M went from the best-performing stock globally in a decade to one of the worst-performing stocks on the ASX in 2021.

That kind of turnaround could make one uneasy about entering the stock market — doubly so with inflation fears swirling around.

However, I do think I have a revealing resource for you.

It’s a great report on technical analysis from our trading veteran Murray Dawes. There, Murray unveils his unique strategy to deal with market turbulence.

Worth a read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here