In today’s Money Weekend…it’s crazy to think — but watch this part of the market closely…gold’s prospects post Jackson Hole could be one for the medium-term…and more…

All eyes are on Jackson Hole, as the Federal Open Market Committee (FOMC) is due to meet virtually.

Meanwhile in Australia, Wesfarmers Ltd [ASX:WES] just returned its best results in more than a decade.

Oh, and the vaccine rollout is accelerating and a big chunk of the population is still in lockdown.

There’s a lot to digest at the moment for Aussie investors, and you’d be forgiven for being confused by it all at this stage.

A wild week for markets, while locked-down Aussies get exasperated at their plight.

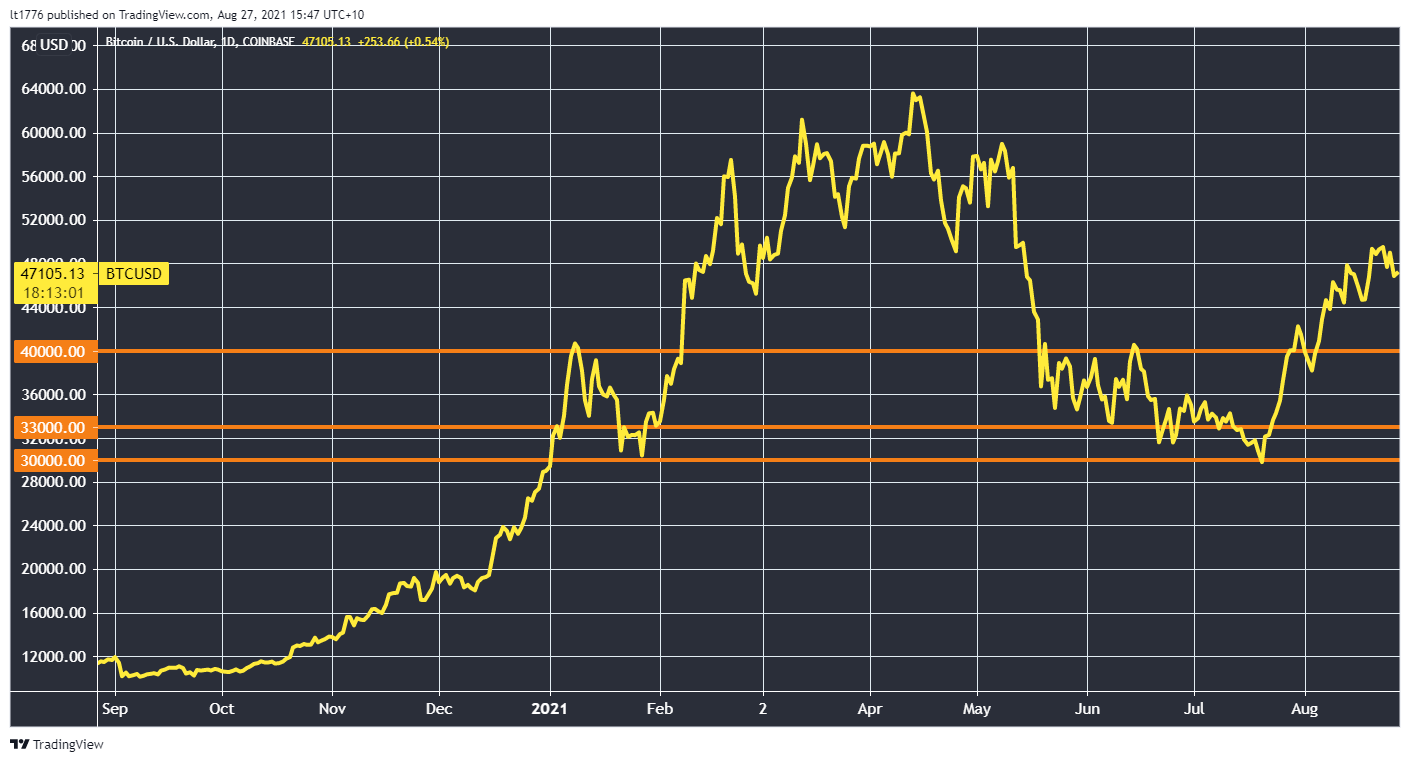

I’d also note that crypto is popping once again — just take a look at the Bitcoin [BTC] chart below:

|

|

| Source: Tradingview.com |

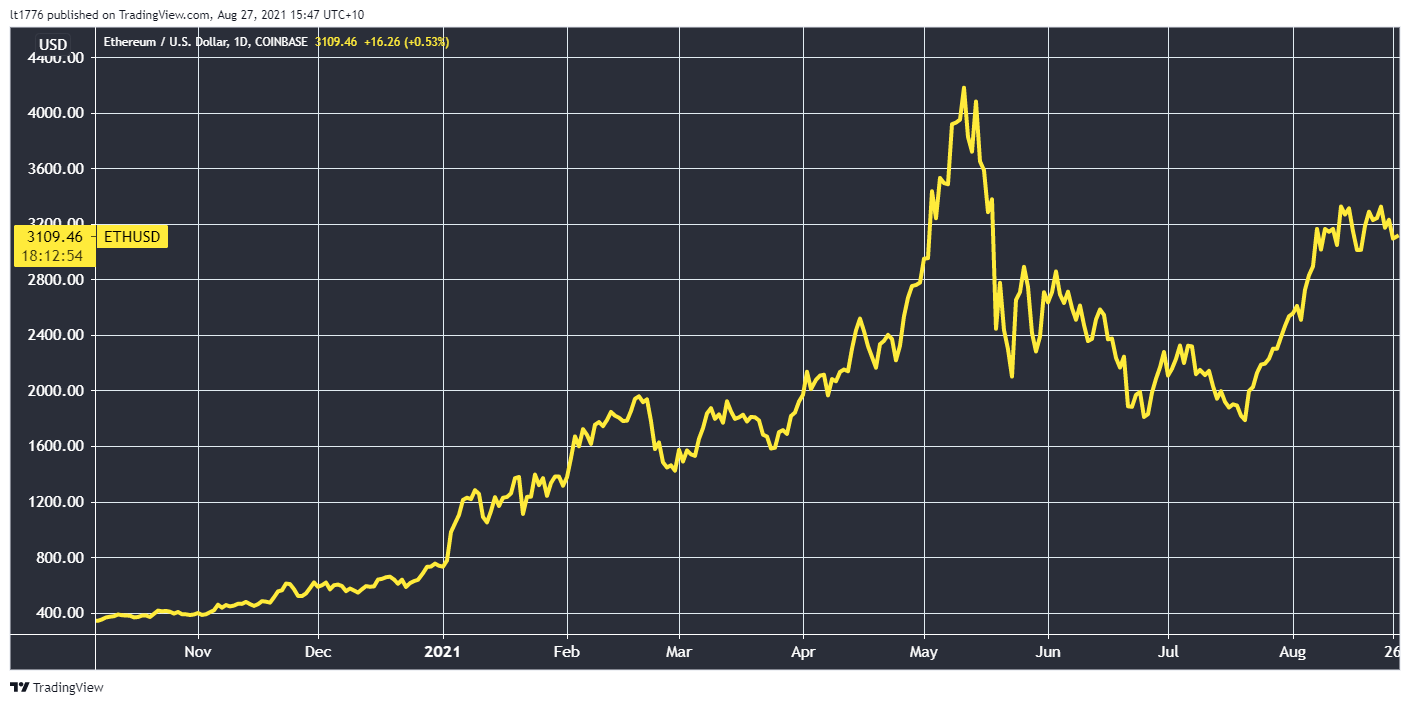

There’s also the Ethereum [ETH] chart, and I’ve also noted some wild moves on more speculative coins as well:

|

|

| Source: Tradingview.com |

What does it all add up to?

Well, you’ve heard the old saying from Ryan Dinse before — ‘markets climb a wall of worry.’

At this stage, my view is that we’re about to see a renewed speculative frenzy.

It’s crazy to think — but watch this part of the market closely

Bears may be howling from the sidelines. The Fed’s in a game of cat and mouse with markets — one I think it always loses.

Will the Fed taper (slow down the QE)? Will they hint at higher rates?

I’m going to once again go out on a limb, and say there are three scenarios (in order of likelihood):

- Cautious fluff of no substance comes from the meeting

- Taper language triggering a small correction

- Hint at higher rates sooner, triggering a larger correction

My money’s on the first scenario. However, in all three, the market still goes up after.

Maybe it’s crazy to think. You can point to valuations, you can point to weak economic data (in some places), you can worry about inflation.

This hasn’t phased the market before, so it’s hard to see it phasing it again.

At this stage, the crypto move might be a leading indicator of speculative sentiment.

As anecdotal evidence, a high net-worth friend of mine who watches the markets and forums like a hawk and has their ear to the ground in a few places, said this to me:

‘I’m not scared of a taper — it means the economy is growing…the investing newbies seem to be out in force.’

Sounds about right.

This isn’t a squeezing blood from the stone market — I maintain that there’s a heap of cash on the sidelines.

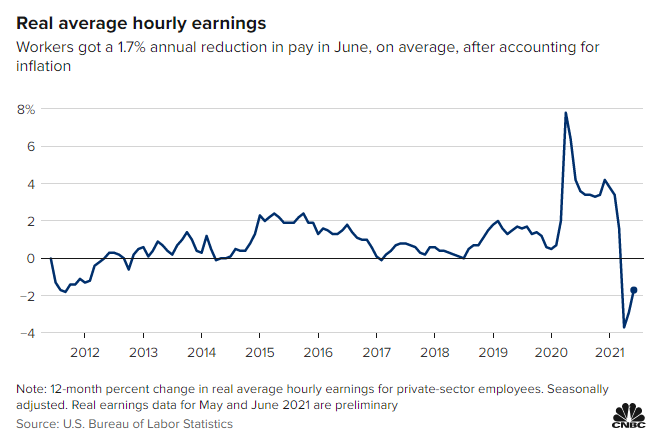

For instance, you’ve got the real average hourly earnings reversing trend in the US:

|

|

| Source: CNBC |

Yes, US workers got a clip on their purchasing power.

That being said, the Fed will probably read that as a positive signal.

Hence the scenario likelihood rankings from Jackson Hole before.

Which means that small-caps could stand to benefit from continuing accommodative monetary policy.

For more on small-caps, be sure to check out Australian Small-Cap Investigator’s latest presentation here.

While the next part of the market that could benefit in the medium-term is this one.

Gold’s prospects post Jackson Hole could be one for the medium-term

You’ve heard about gold as an inflation hedge before.

There’s also this to consider about the producers of the shiny stuff.

In a recent Money Morning Podcast with Shae Russell, I made the following points…

- First leg for gold stocks could be down to a value pivot or correction where existing profits and high-cash balances — there’s some great margins available

- The real story though/second leg is what happens if inflation defies expectations to the upside — well then, barring an ‘all equities down crisis’, gold stocks could see a renaissance

For more on ASX-listed gold stocks, be sure to check out Brian Chu’s latest compelling presentation right here.

That’s the medium-term covered.

Whatever happens at Jackson Hole, it is important to be nimble at the moment.

Set stop-losses if you are worried about a market X factor crushing your portfolio.

But also avoid getting caught up in the hysteria about the sky falling for markets.

I’d say we’re about two-thirds up the wall of worry at this stage and those with steady hands and discipline should thrive for the near-to-medium future.

The Fed isn’t dumb enough to implode the whole gravy train market structure…yet.

Stay safe, and have a great weekend.

Regards,

|

Lachlann Tierney,

For Money Weekend

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here