In today’s Money Morning…Ford ventures into EVs…they aren’t the only US company with big EV plans…a big win for lithium…and more…

Back in the 1960s, Ford was struggling to sell cars.

For one, they had lost a bundle from the Edsel line, which had been a complete flop.

And then, they were losing market share to rivals like GM and Chrysler.

Some of the top executives at Ford thought the solution for the company’s woes was a sports car. They believed that winning a few car races would help increase the company’s appeal…and drive sales.

You see, the new generation of car buyers at the time, the baby boomers, had money. They bought houses, TVs, appliances, and they wanted to drive something more exciting than a family car.

At the time, Ferrari wasn’t doing that well either financially.

But it had a great reputation in racing and dominated the 24 Hours of Le Mans — a race that tested vehicles’ endurance and reliability.

So since Ford didn’t have any race cars, and they weren’t planning to build one any time soon either, they decided to buy Ferrari.

But at the last minute, the founder, Enzo Ferrari, decided not to sell after finding a clause in the contract that would give Ford control of his motorsport program.

And then Ferrari sold to Fiat…

Angry at the whole ordeal, Henry Ford II decided to build a sports car, a ‘Ferrari killer’ that would beat them at their own game: the 24 Hours of Le Mans.

Anyway, you’ve probably seen the movie Ford v Ferrari. This would spark one of the greatest auto rivalries of all time, one that would end up in the creation of Ford’s GT40 program and in Ford beating Ferrari in 1966.

Over the years, we’ve seen plenty of rivalries between carmakers. And, not sure if you’ve noticed, but there’s even one going on right now.

One that has to do with gaining market share in electric vehicles (EVs).

This week Jim Farley, Ford’s CEO, tweeted that they are planning to make 600,000 EVs per year by the end of 2023. That’s double the amount Ford was targeting before.

And this is without counting new EV sites like Blue Oval City, a 3,600 acre auto production complex in Tennessee powered by renewable energy where they’ll be producing electric trucks and batteries.

As Farley tweeted:

‘We’re approaching it like we did building ventilators & PPE for covid. Whatever it takes, find a way. And it’s working.

‘We aim to become the 2nd biggest EV producer within the next couple years. Then as the huge investments we’re making in EV and battery manufacturing come onstream and we rapidly expand our EV lineup, our ambition is for Ford to become the biggest EV maker in the world.’

Of course, they aren’t the only US company with big EV plans.

GM also has great ambitions in the sector. In October, they said they were looking to beat Tesla and become the US’s EV market leader. They are targeting one million EV annual sales by 2025 and to capture 12% of the global EV market share by 2026.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Tesla is still at the top when it comes to EVs, but it’s been losing US market share as other carmakers try to catch up.

In the second quarter of 2021, its US market share fell from 79.5% in the second quarter of 2020 to 66.3%. And this is happening even as total new EV sales grew 117.4% year-on-year.

So expect this EV race to heat up as the trend gathers speed.

For one, the technology is getting cheaper. Costs for rechargeable lithium-ion batteries have dropped by 97% in the last 30 years.

And also, governments and policy are getting behind it.

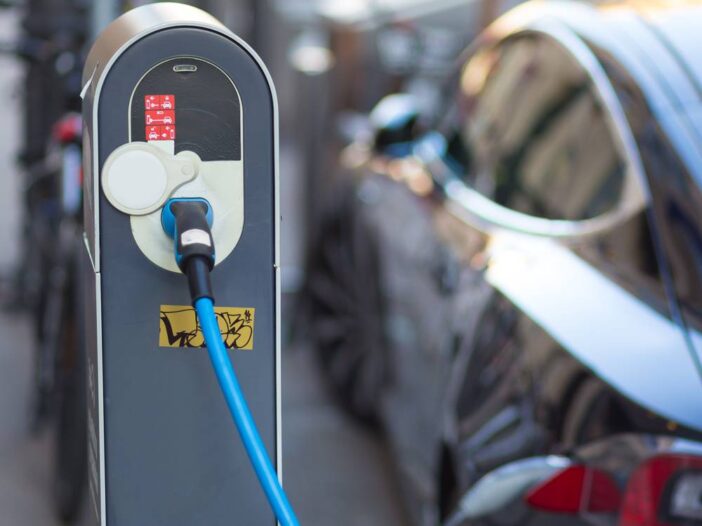

The US recently passed Joe Biden’s new infrastructure bill which includes US$7.5 billion to create an EV charging infrastructure and Biden wants to make 50% of all new US vehicles sales electric by 2030.

Who will win this EV race? I have no idea, but what’s clear is that all of this will need plenty of materials, like lithium.

As I’ve written before, lithium companies are already embroiled in their own lithium wars, which is already resulting in a frenzy for lithium.

And that could only ramp up as demand strips supply.

During the UN Climate Conference in Glasgow this month, 30 countries and six automakers, including Ford and GM, agreed to work towards phasing out sales of new gasoline and diesel vehicles by 2040.

By Benchmark Mineral Intelligence calculations, this would mean an increase of over 30 times the current annual EV battery demand…and an increase of lithium.

How much? Well, they expect we would need over seven million tonnes of lithium (LCE) a year, or 17 times this year’s lithium chemical production.

‘Right now, lithium demand is growing at three times the speed of lithium supply. That’s a big problem that needs to be solved,’ said Simon Moores, CEO at BMI.

So with demand soaring and not enough production, this is all adding up to a big win for lithium…

Until next week,

|

Selva Freigedo,

For Money Morning

PS: Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.