Yesterday I discussed how scarcity is creeping back into the economic equation.

After more than a decade of unfettered growth, it seems people are finally waking up to the idea that we have limited resources. As I pointed out, with copper as an example, commodities are likely to become pricier as the industry is scrambling and failing to meet necessary production output.

We are entering a new era where access to raw materials may be harder to secure than ever before…

But, as grim as that may seem, it isn’t something that investors should feel overwhelmed by. This is especially true for Aussie investors because, unlike a lot of the world, we stand to benefit more than most from this looming scarcity.

In fact, in all likelihood, we appear to be on the cusp of a new mining boom!

The only difference is that this boom isn’t really about demand…

It’s all about supply.

A decade of underinvestment

Now, you may think that this scarcity claim is a bold prediction to make. I know that it certainly goes against the grain of what you’ll often hear from the mainstream.

Nevertheless, it is something that becomes fairly apparent if you actually look at the data.

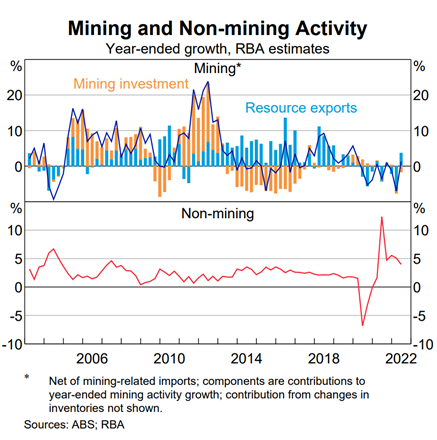

Take this chart from the RBA and ABS, for example:

|

|

| Source: Reserve Bank of Australia |

What you are looking at is a rough breakdown of annual growth in mining and non-mining activity. You can ignore the bottom half of the chart (non-mining) because what we care about, for argument’s sake, is the top half.

More specifically, look at the orange bars in the mining breakdown. As the chart tells you, this represents year-end growth within mining investment as a percentage.

As you can see, from the mid-2000s to around 2012, mining investment was soaring. Apart from a brief blip during the GFC, mining investment was averaging around 10% growth a year and topping out at almost 25% at its peak.

This was, of course, thanks to the ravenous demand from China, particularly for iron ore.

But then, around 2013/14, the boom ended abruptly. Commodity prices began to fall and with it, investment in mining. You can see it for yourself on the chart.

What is fascinating is how exports didn’t really take a hit. Despite the lack of investment, Australia was shipping more resources than ever.

It was only once the pandemic hit that exports really went negative. That is, until the late spike in 2022.

Again, though, the bigger trend to consider here is that mining investment growth has never really recovered.

We have failed to fund new exploration and drilling despite knowing that demand is only going to increase.

We are making these scarce resources even more scarce by undersupplying them…

A different boom, but a boom nonetheless

Logic would suggest that this lack of new investment in mining may be because of weaker commodity prices. Companies aren’t going to invest in new projects if they aren’t profitable.

But that is far from true.

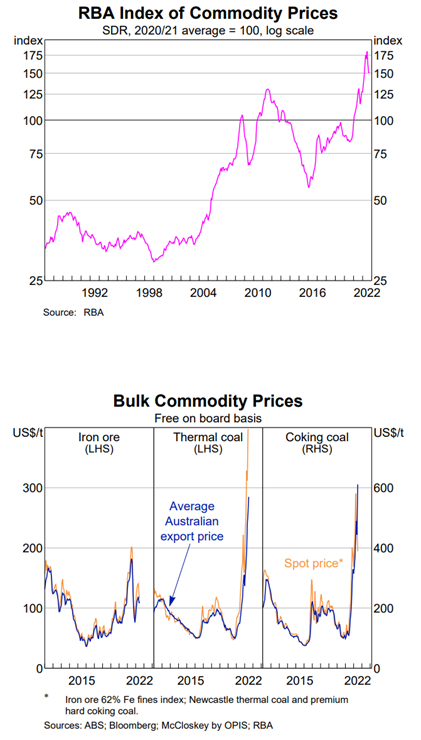

Again, take a look at more data from the RBA and ABS:

|

|

| Source: Reserve Bank of Australia |

The overall index of commodities (the top graph) has been surging in recent years. It seems safe to assume that demand certainly isn’t an issue for miners.

As you can see in the bottom graphs, too, coal prices, in particular, have exploded higher. This is because while global demand for coal is forecast to rise by 0.7% this year, the bigger factor is a cutoff of Russian supply.

What we are currently seeing in coal prices offers a potential glimpse of the kind of scarcity-induced pricing that could come for commodities as a whole — a boom driven by a need for these critical minerals but a severe lack of access to them.

And that is why you, as an investor, should start preparing for this new era.

Because as disruptive as a materials shortage may be, it also presents an opportunity for incredible gains. For proof of that, all you need to do is google the chart for Whitehaven Coal [ASX:WHC].

The next mining boom is coming, and it will be driven by underinvestment and undersupply…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.