I have some unique connections with copper, let me share some of those experiences…

Back in 2010, I was working for the Australian-owned copper producer, Equinox minerals. That was when I met my wife, a US Peace Corps Volunteer.

She was stationed at a rural village a few kilometres away from our exploration camp in northern Zambia. Zambia has a long history of copper mining dating back to the colonial years when it was part of Rhodesia.

While we arrived from opposite ends of the Earth, we both came from areas with important copper roots.

My wife is from Michigan, a US state that borders Canada to the north.

It holds some of the richest and most ancient copper deposits anywhere in the world.

Typically, copper is locked-up within minerals like chalcopyrite, chalcocite or bornite.

But uniquely, Michigan copper exists in a pure form.

Known as native copper, pure copper boulders the size of cars, once littered Michigan’s northern peninsula. Deep copper veins also strike below the surface.

Miners from all walks of life have tapped this bounty. Some mines date well over a thousand years, presumably extracted by Indigenous Americans.

More recently though, European pioneers used the copper wealth to establish settlements across the state.

Michigan was a major source for America’s copper demand as it grew into the world’s largest economy. It also fed surging demand from the US Civil War.

Let’s flip to the other side of the planet to South Australia, another state with important copper roots.

As a SA local, I’m well aware of the state’s history with this metal and its role in establishing the state’s economy.

Most of us know about Barossa Valley Shiraz and McLaren Vale Cabernet. But that didn’t build the state’s economy. Copper was the economic mainstay in those early days.

According to Geoscience Australia, the first major discovery occurred at Kapunda in 1842.

A bloke by the name Francis Dutton stumbled on a copper bearing rock while searching for lost sheep.

Less than twenty years later, South Australia became known as the ‘Copper Kingdom’ holding the world’s largest copper mines.

If only it was that easy to find deposits now!

One mine in Burra accounted for around 5% of global supply.

Like Michigan, miners from Cornwell, Great Britain, helped establish these early copper mines.

The metal has always fascinated me, from its history to its future role in electrification.

Copper Defies the Odds

At times, though, I’ve questioned whether my role as a geologist dealing with copper mining and exploration has made me a little overzealous in pushing its potential as an investment.

Copper has been a major theme for me ever since I started with Fat Tail back in mid-2022.

But after taking the reins as editor of Fat Tails’ resource publication, Diggers & Drillers, copper has been smacked with strong macro headwinds.

First was the banking crisis in the US.

Silicon Valley Bank, First Republic and Credit Suisse were early casualties as central bankers amped up the war on inflation.

A couple of months later and China was bracing for its ‘Lehman Brothers moment’ following the collapse of its second largest property developer, Evergrande Group.

The house of cards was falling in the global economy. This was no time to be bullish on the world’s most growth-dependent commodity.

Consensus remained strongly in favour of a significant US recession in 2023.

ACTUAL recession began to take place across the UK, Japan, Finland and Ireland.

The reasons to be bearish on copper were diverse and far reaching. Copper SHOULD have collapsed.

Yet, despite all the threats, this resilient metal has held firm.

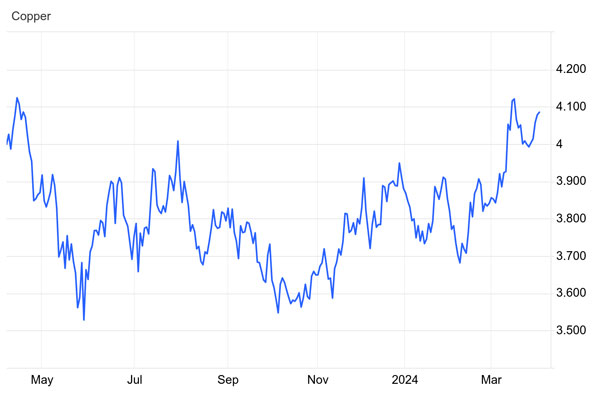

Today, it trades back around the elevated levels from early 2023, above US$4 per pound:

| |

| Source: TradingEconomics |

Now, don’t get me wrong, copper is still far from being a roaring investment theme.

Many stocks tied to this metal are just starting to recover from major lows.

And that’s why you should be taking notice.

A Golden Future for Copper

If you’re a long-term reader, you’d be aware of the reasons why copper has held up…

A lack of global supply kept the price from plunging like other metals such as lithium and nickel.

Like every cycle before it, a lack of capital expenditure on exploration and mine development constricted output.

Concentrate from the world’s largest miners, including Codelco, continues to decline. Late last year, the company reported the lowest output in over a quarter of a century.

It’s a recurring theme.

Government bureaucrats have flattered themselves as those who provide answers to society’s problems. To this end they have flirted with tax subsidies, generous grants and debt instruments to kick-off investment in this important sector.

Ultimately though, addressing supply problems can only come with higher prices.

And that’s your opportunity as an investor… Tapping into the lucrative ‘investment phase.’

Copper prices have begun to emerge from a 12-month slumber, having broken the first major resistance level of $4 per pound.

So, what’s next?

If copper holds here, small-cap equities should rise quickly from multi-year lows.

But the next key zone to watch will be around the top from January 2023, $4.38 per pound, see below:

| |

| Source: ProRealTime |

As you might recall, copper surged (briefly) early last year as China reopened from its two-year Covid-lockdown. However, that spike was short lived.

A break here and prices could move quickly… Perhaps testing all-time highs around $4.90 per pound.

With momentum building and stocks starting to stir, right now is an excellent time to start to consider building a position.

You can find some opportunities here in my resources investment newsletter.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments