Sayona Mining [ASX:SYA] announced the results from 57 drill holes in its latest exploration campaign at its North American Lithium (NAL) operations in Quebec, Canada.

The 14,350 meters of samples ‘significantly’ increase the potential for a resource upgrade at the site, according to CEO James Brown.

Shares are up by 9% on the news, trading at 7.9 cents per share.

The brownfield NAL operations is owned in partnership with Aussie mining junior Piedmont Lithium [ASX:PLL], which holds a 25% stake, to SYA’s 75%.

The NAL site is currently North America’s single largest source of hard rock lithium.

Sayona purchased the flagship operation in August 2021 and marked its first shipments of spodumene lithium concentrate in August 2023.

It’s been a tough year for the company, which has been mired by controversy within its management.

This came to a head with the resignation of former CEO Brett Lynch and changes to the board.

Shares in the company hit their lowest point in two years yesterday, down -65% for the past 12 months and approximately 80% from their April 2022 peak.

The company is currently the second-most shorted stock on the ASX, with 15% of its stock shorted. Only beaten by fellow lithium miners Pilbara Minerals [ASX:PLS].

What sparked the leadership reshuffle, and can Sayona recover from its current headaches?

Source: TradingView

North American dreams, leadership nightmares

Sayona’s latest results are one part of the newest drilling campaign.

Assay results for an additional 152 holes at the NAL deposit are still pending. Combined with today’s results, they have the potential to increase the underlying resource by a healthy margin.

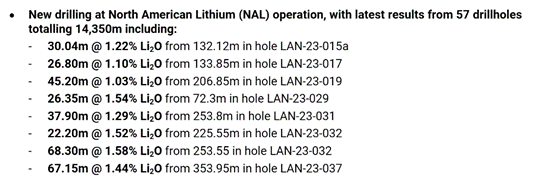

Highlights from the latest results include:

Source: SYA Results 2/11/23

Sayona’s Interim CEO, James Brown, celebrated the drilling, saying:

‘These results are hugely significant for NAL, showing the potential for a resource upgrade at North America’s single largest source of hard rock lithium production.’

The exploration of the northwest site also set out to convert some of the inferred resources to measured and indicated resources.

This would help the company as it tries to find its stride in the production phase at the site, which began production in March this year.

The NAL site is still seeing its operations ramp up but hit a quarterly production record of 31,486 dry metric tonnes.

SYA also marked the first shipments of spodumene from NAL this quarter, helping it pull in $96 million in revenue.

This helped the company improve its cash balance by 10% quarter-over-quarter to $233 million.

Unfortunately, the company also failed production targets, mining 224,420 wet metric tonnes, down -1% from its previous quarter.

The company has been struggling to regain momentum since its poor pre-feasibility study in early 2022.

This was nothing new to veterans of the stock, who’ve been at odds with management.

This grumble turned into outrage when the company granted 10 million shares to Managing Director Brett Lynch and other heads.

Following shareholder backlash, the company vowed to revamp its corporate governance.

Mr Lynch then resigned by James Brown replaced him as interim CEO.

Thankfully, a more positive Definitive Feasibility Study this April helped ease some concerns.

The newer study doubled the pre-tax net present value to an estimated $2.2 billion.

Still, by then, much of the damage had been done.

Outlook for Sayona Mining

In its simplest terms, there is a reason for the company holding so much short pressure.

As one shareholder described the company, ‘they are like an F1 car driven by a blind person’.

Their projects have great potential, but the company has failed to convince investors that they are the best operators.

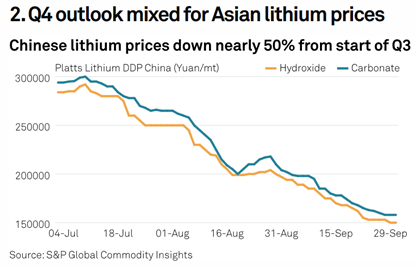

Adding to the list of concerns with the company is the falling prices of lithium.

This is largely from falling EV demand seen in mainland China.

September saw an 11% slump in new EV purchases in China as macroeconomic headwinds meant households cut back spending.

The problem is worsened by an excess inventory of battery materials held by manufacturers in the region.

For many, what is usually a restocking period has gone quiet as Chinese manufacturers put off lithium purchases.

Source: S&P Global Commodity Insights

With lithium carbonate prices this low, even SYA’s conservative estimates for their mine operations seem well off now.

Some back-of-the-envelope calculations show their definitive study estimating the average price of lithium at approximately US$43,000. It currently sits at around US$22,345.

This could take anywhere between US$270−365 million off their revenue estimates and hinder any expansion to the operations.

The company released FY24 guidance of between 160−180,000 dry metric tonnes of spodumene and will aim to continue to ramp up production.

But until lithium prices improve, SYA is unlikely to move out of its short selling pressure anytime soon.

Playing the ‘lithium comeback’

If you like to move in the opposite direction than the herd, this moment could be one to pick up companies like this for pennies on the dollar.

If you think lithium prices are going to return and leave you behind again, then it pays to be a little contrarian.

Editor Ryan Dinse has produced a free report with ideas in the lithium space that he thinks you could time well while things are looking weaker.

Click here to see how you can access his free report.

Thanks for reading, and I hope you’re enjoying the new website.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments